Export demand fuels Irish cattle market

Tuesday, 14 June 2022

Robust demand from the UK and the EU has supported Irish cattle prices, despite more Irish cattle on the market during the first quarter of 2022.

Beef production

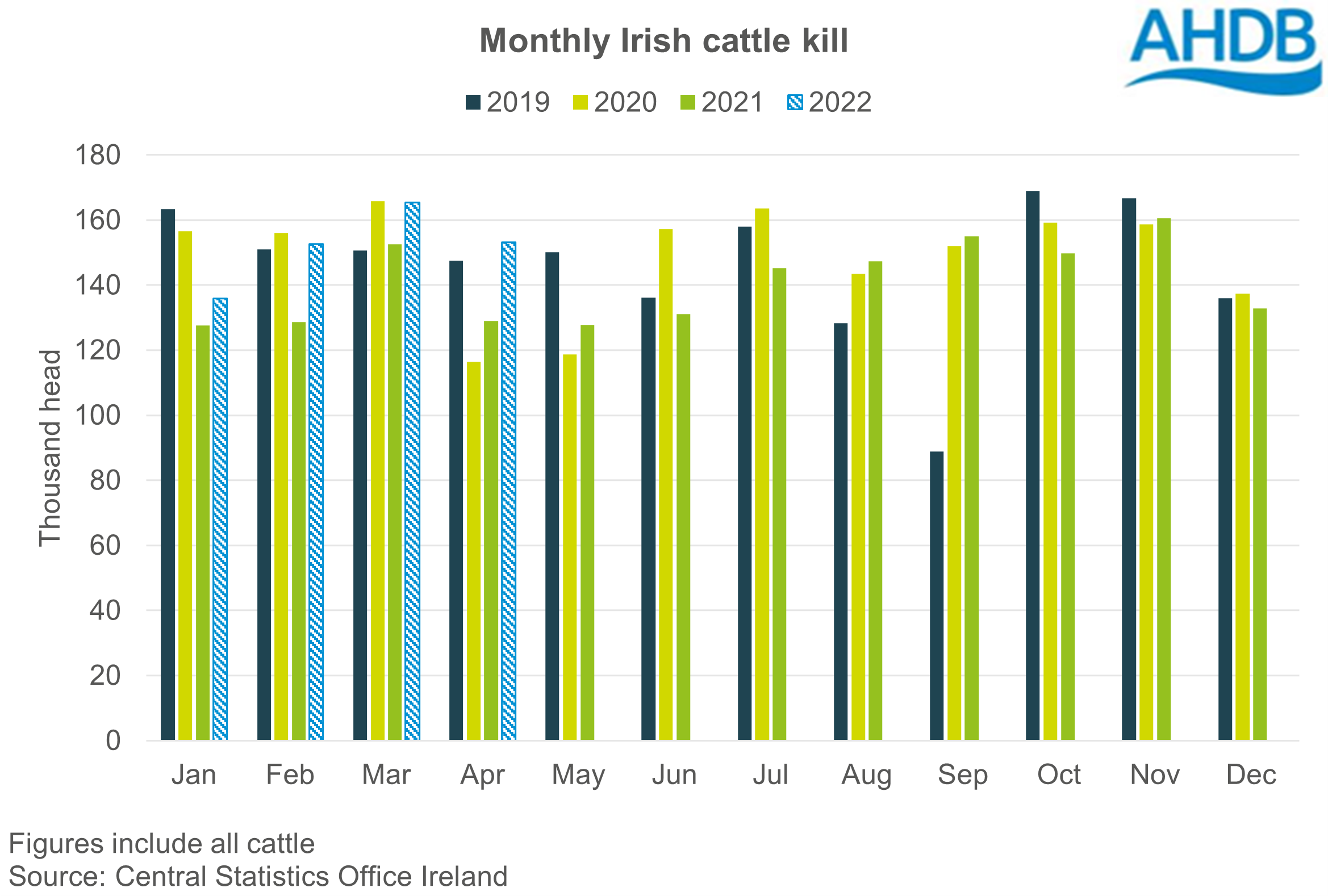

Irish cattle slaughter has been running ahead of 2021 levels during the first four months of 2022, according to data from Central Statistics Office (CSO) Ireland. A total of 607,000 cattle have been processed during that time, 13% more than the same period a year ago.

While slaughter of both prime cattle and cows has increased notably year-on-year, cow kill has been particularly strong. Bord Bia’s forecast for all cattle for 2022 as a whole has been revised upwards from around +65,000 head to around+105,000 head compared to 2021. This would be around 6% above the kill level in 2021.

Prices

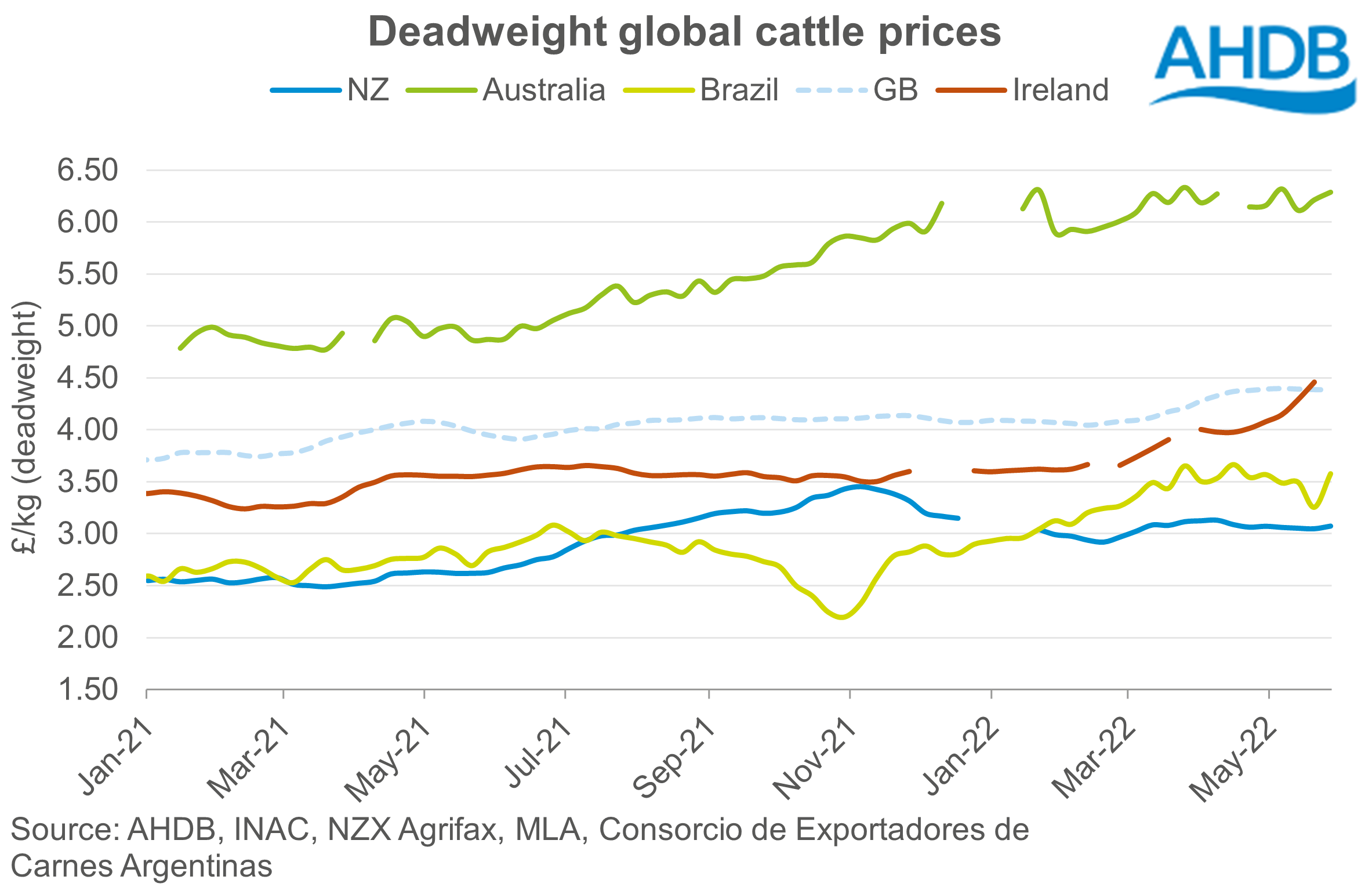

However, at the moment Irish prime cattle numbers are reportedly starting to tighten, causing stronger competition among buyers for available supplies. Indeed, the average Irish R3 steer price as reported by the European Commission moved above the overall average GB steer price in the week ending 28 May, for the first time in many years.

Irish cattle are typically at a discount to British cattle. Ireland is a net exporter and has a need to be price-competitive in both the UK market and continental Europe. Irish prices are reportedly being buoyed by strong market conditions on the continent and in the UK, and robust demand from reopening foodservice sectors in the EU and UK.

Exports

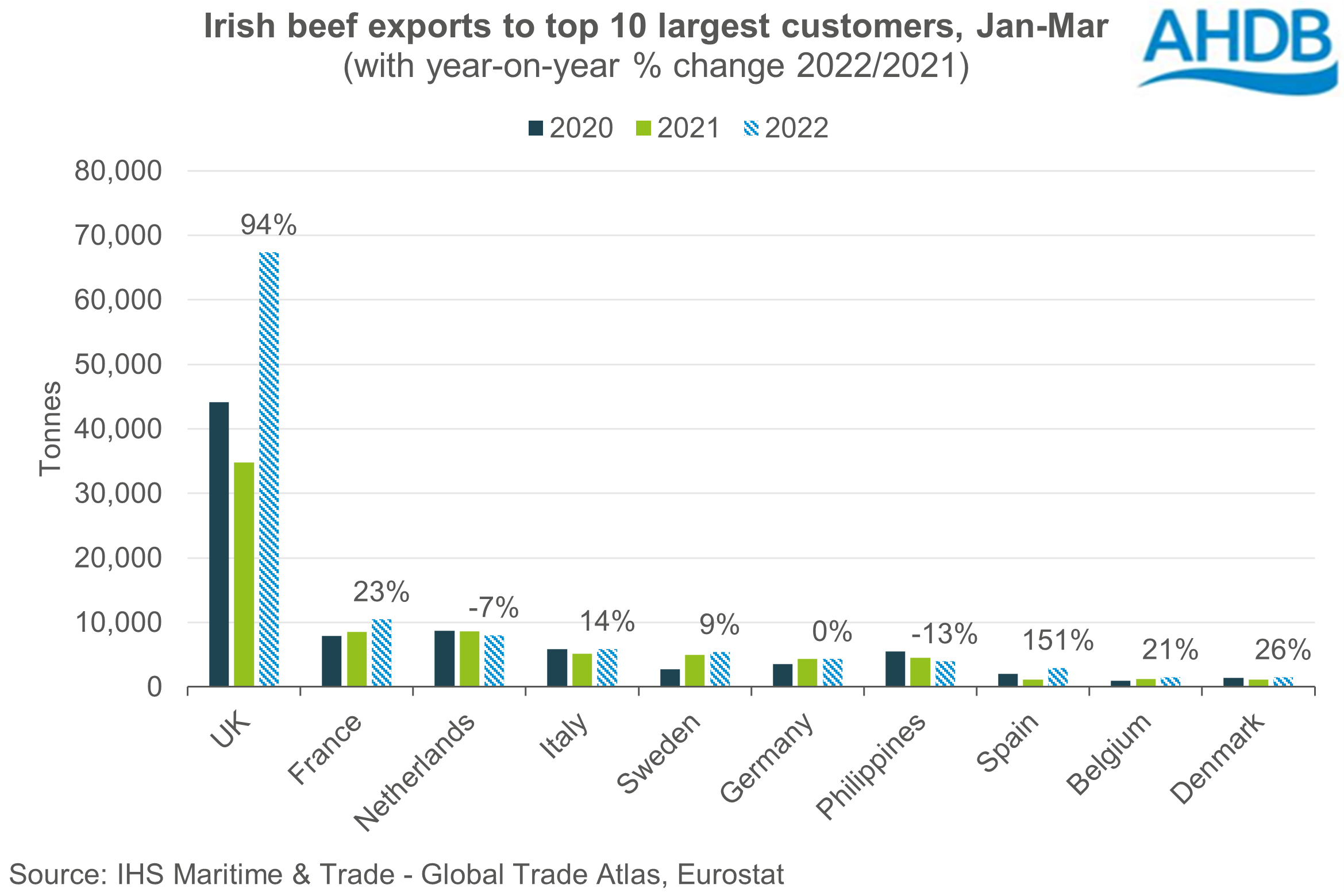

Data from CSO Ireland shows that Irish fresh and frozen beef exports grew by 41% year-on-year for the first quarter of 2022 to 120,000 tonnes. Nearly all the uplift was from increased shipments to the UK, particularly in boneless beef to Northern Ireland.

Ireland also sent more beef to France and Spain, while volumes to Hong Kong fell notably compared to a year ago. Production in the EU has been relatively flat compared to a year ago, but notably lower in key producing nations France and Germany. Meanwhile, demand for beef from the foodservice sector has been increasing.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.