Extended new crop wheat premium to maize: Grain Market Daily

Wednesday, 29 January 2020

Market commentary

- Global grain and oilseed markets have come under pressure as fears regarding coronavirus continue to bring a bearish sentiment to commodity markets. UK feed wheat futures (May-20) closed at £154.50/t yesterday, down £4.20/t from market highs on 21 January.

- New Crop UK feed wheat futures have also continued to come under pressure. From a peak of £167.80/t on 21 January, UK feed wheat futures (Nov-20) closed at £163.55/t yesterday and have lost further ground this morning.

Extended new crop wheat premium to maize

As the value of wheat and maize diverges, consumers able to swap between wheat, barley and maize will use the most economically efficient grain, be this distillers or animal feed compounders. As substitution of wheat and barley for maize occurs this reduces the demand for domestically grown grains and prevents domestic markets from continuing to price higher.

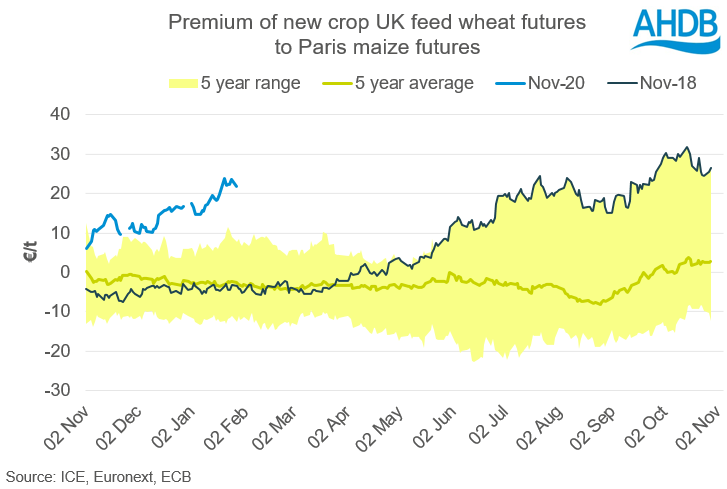

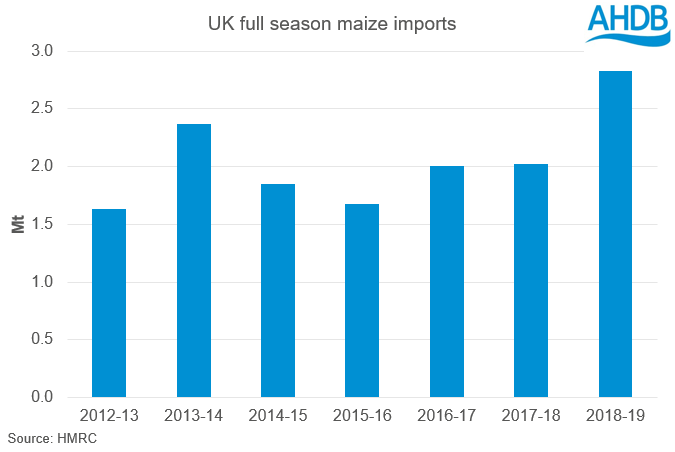

During the 2018/19 season a record volume of maize imported into the UK. UK feed wheat futures (Nov) moved to a premium over Paris maize futures (Nov) as the domestic supply and demand situation for the UK became clear. Wheat futures peaked at a premium of over €30/t relative to Paris maize futures, this set the tone for the remainder of the 2018/19 season with over 2.8Mt of maize imports.

While the majority of the UK’s imports of maize comes from Ukraine, there is a good link between Paris maize futures and that of imported any origin maize, enabling a look forward to next season.

Although the value of new crop grain has recently come under some pressure, the premium to European maize has continued to grow. Reaching a peak of €23.84/t on 21 Jan between Nov-20 UK feed wheat futures and Nov-20 Paris maize, this is the largest premium that new crop wheat has had to new crop maize at this point in time prior to harvest since at least 2012/13.

With the premium of maize having already stretched with a tightening wheat outlook and prospects for a larger EU maize area, domestic consumers already looking at rations and formulations for next season may be able to make the decision to substitute wheat for maize at an earlier point than has previously been the case. With the premium of maize to wheat having extended, this may well reduce the demand for forward purchases and add pressure to new crop domestic markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.