GB pig prices creep upwards through Q2 – Pork market update

Tuesday, 15 July 2025

Key points

- GB pig prices through Q2 2025 showed gentle recovery from a weaker position earlier in the year

- Resilient demand domestically, strong export performance and recovering EU prices provide underlying support for GB returns

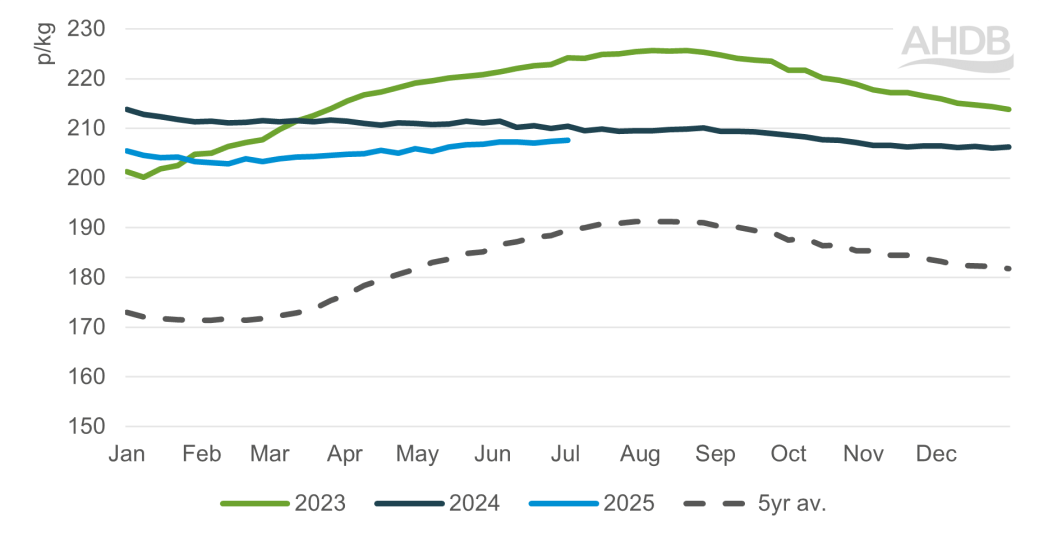

The modest upward movement seen in GB pig prices towards the end of the first quarter continued through the second. Between the week ending 5 April and week ending 5 July, the GB EU-spec SPP rose by 2.79p/kg to average 207.55p/kg.

GB standard deadweight pig price (SPP – EU spec)

Source: AHDB

Market drivers

Resilient retail demand

Domestic consumer demand for pig meat has been robust of late. Kantar data shows that GB retail volume sales for the 12 weeks to 15 June were up 0.8% year-on-year, driven predominantly by added value products.

Pig meat volume sales saw seasonal uptick over the April period, benefitting from Easter purchasing and sunny weather. Volumes have stayed broadly stable since.

The pig meat category is benefitting from shoppers switching out of beef (Kantar), with price likely a key motivator. Over the same period, pig meat has lost smaller volumes to other proteins, namely poultry, but the gains from beef have outweighed this.

EU influence

EU pig prices rebounded in the second quarter from their lowered position, closing the gap to the UK. In the week ending 6 July, the EU grade E reference price was the equivalent of 180.62p/kg, 27p below the UK price. Strength in the EU market has been driven by a combination of factors, including crucially the reinstatement of Germany’s FMD-free status and anticipated release of product.

Demand for pig meat in Europe has been robust generally, helped by good barbeque weather and tighter supplies of poultry and beef, although more recent reports from July suggest that excessively hot weather in some countries is softening demand somewhat (indeed some price reductions have been recorded). EU export has been flowing strongly (volumes up 3% year-on-year for Jan–Apr period), particularly for offal into China. This has drawn on production, with data from the European Commission showing a 1.5% annual increase in output for the Jan–Apr period.

Growth in export

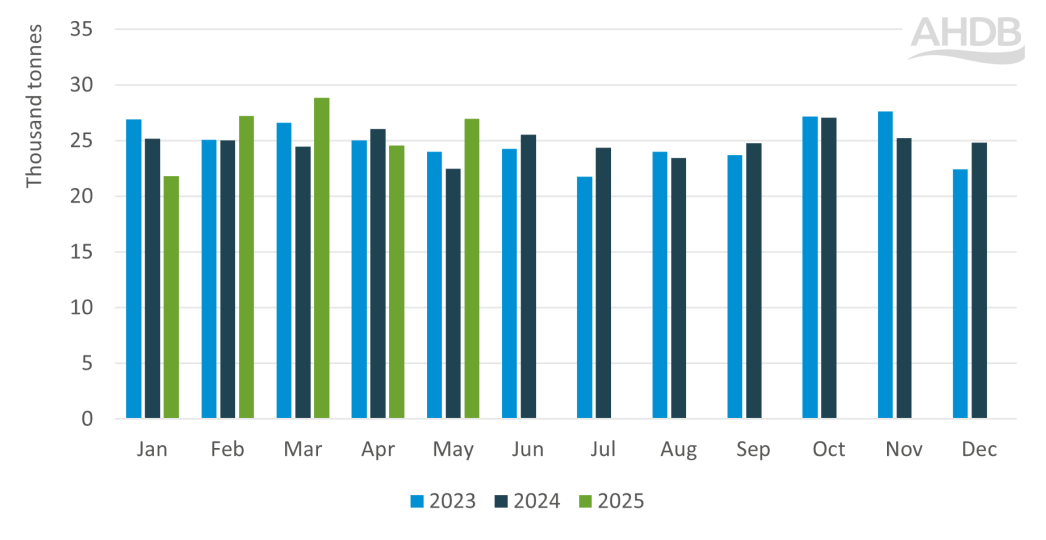

Latest figures show that UK pig meat exports rose strongly in May, up 10% on-the-month and 20% on-the-year to just under 27,000 tonnes. Exports to China drove this increase predominantly, continuing the general upward trend seen over the past year.

Monthly UK exports of pig meat (including offal)

Source: HMRC via TDM LLC

Imports rising

Meanwhile, UK pig meat imports for May were up 9% from April and up 3% on May 2024 at 66,600 tonnes, partly due to recovering German volumes. Despite import growth, our red meat audit data (or “Pork Watch” data) indicated that the proportion of retail facings that were British were broadly stable through May, contributing to market strength. For the year-to-date (Jan–May), pig meat imports were down nearly 3% versus the same period in 2024.

Production growth

Pig meat production through the second quarter of 2025 remained above year-ago levels, but not to the extent seen through quarter one. Q2 production totalled 239,000 tonnes according to Defra figures, up 1.6% year-on-year. Clean pig kill was up by the same rate, totalling just under 2.6 million head for the quarter, while average weights were largely stable year on year at 90.3kg (+300g). However, warmer weather in Q2 has resulted in carcase weights easing compared to Q1 2025. In more recent weeks, weights in the SPP sample have dipped below 90kg, as the UK witnessed record high temperatures at the end of June and the first half of July.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.