Growth continues for UK beef trade in July

Thursday, 16 September 2021

As of January 2021 data, the way HMRC collects trade data has changed, which will be reflected in the trade statistics. Comparisons between this and historic data should be treated with caution, and may well be subject to future revisions.

Imports

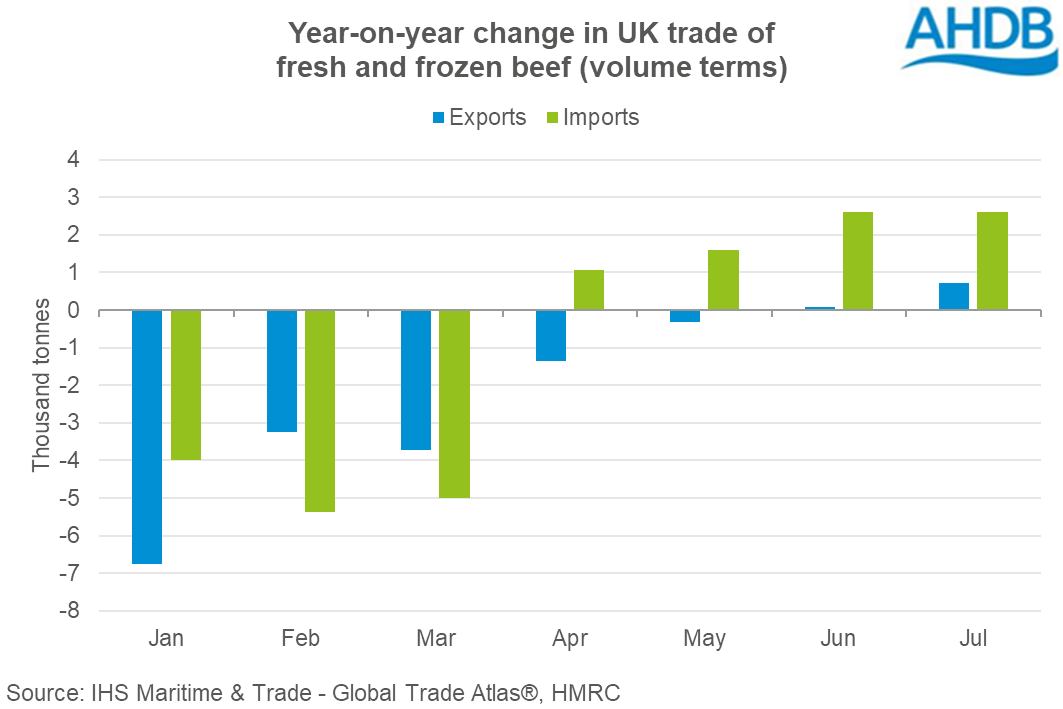

The UK imported 19,800 tonnes of fresh and frozen beef in July, 9% more than June and 15% more compared to the same month a year ago, according to latest HMRC statistics.

In actual terms, the majority of the uplift came from Irish shipments, which grew 9% year-on-year to 15,000 tonnes. Several other smaller suppliers showed higher rates of growth in volumes, including Poland, the Netherlands, Spain and Uruguay. However, in actual terms the volumes were smaller than that from Ireland.

For the year to July (inclusive), 121,200 tonnes of fresh and frozen beef was imported into the UK, 5% less compared to the same period a year ago. A 10% increase in average price meant that the overall value of these shipments increased by 4% to £514 million.

Exports

For beef heading out of the UK, volumes totalled 9,600 tonnes in July, up 2% from June, and up 8% compared to July 2020. Shipments increased the most in actual terms to France, followed by relatively new markets Senegal and Iran. More beef was also sent to Ireland, South Africa, Japan and the US. Reports suggest some UK exporters now find it administratively easier to export first to France, and then ship on from there to other European destinations.

For the year to July (inclusive), the UK exported 54,600 tonnes of fresh and frozen beef, 21% less than the same period a year ago. The average price of these shipments however increased by 6%, bringing their total value to £187 million (-17% year-on-year).

What factors could affect trade going forward?

Beef trade is expected to continue showing some recovery through the second half of the year, as foodservice activity increases in the UK and Europe. However, this activity is expected to remain below pre-pandemic levels, and so total volumes for 2021 are forecast to be lower year-on-year. Significantly lower trade in quarter one of 2021 is expected to weigh on full-year figures. For imports specifically, lower cattle supplies in Ireland could also limit volumes for the rest of 2021, and uncertainty remains over the impact of future changes to import requirements. For exports, lower domestic production could limit volumes available for trade, as could increased interest by UK retailers in stocking home-grown product, if it continues.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.