How does dairy beef influence global beef production? Beef market update

Thursday, 11 December 2025

In 2024, dairy beef made up 37% of GB prime cattle supply, with registrations data from BCMS indicating that this proportion will continue to grow in coming years. This article explores how dairy beef production differs in key regions across the globe and how this might change looking forward.

Key points

- USA: Dairy-beef production in the US has grown significantly in recent years, as dairy farmers focus more on a sexed and beef breeding strategy. High beef prices of late continue to support production looking forward.

- New Zealand: Dairy-beef makes up about a quarter of births on the dairy farm, with key challenges around rearing capacity and growth rates limiting expansion.

- Australia: Initiatives aim to expand dairy-beef production from a low base, in order to support beef production and maximise value across the supply chain.

USA

Beef output from the dairy herd has grown significantly in the US over the past five years. Data from the US National Association of Animal Breeders shows that domestic beef semen sales rose by 67% between 2019 and 2024, while dairy semen sales fell by 17%. This is indicative of changing breeding practices on US dairy farms, moving to a sexed and beef breeding strategy.

Studies from California and Pennsylvania show that Angus X calves dominate, accounting for approximately 89% of beef semen sales to dairy farms. This is likely because US producers can achieve a price premium for black-coat animals. Limousin, Simmental, Wagyu and Charolais are also common breed choices for US dairy farmers, according to these researchers.

Improved profitability is a major driver of dairy-beef expansion. Reports suggest that the value of day-old dairy-beef calves has almost doubled in the last year, mirroring the strength across the wider US beef market. For the supply chain, dairy beef is supplementing historically tight supply by adding more cattle with improved carcase quality to the slaughter pool.

Looking forward, growth in the US dairy herd – coupled with a constrained beef herd leaving more feedlot capacity – should continue to underpin expansion in US dairy beef output.

New Zealand

New Zealand’s large dairy herd has traditionally produced replacement heifers and bobby calves (dairy male calves that are sold around a week old). Dairy beef production is growing now in popularity, both to support beef supply and to combat ethical challenges associated with bobby calf production.

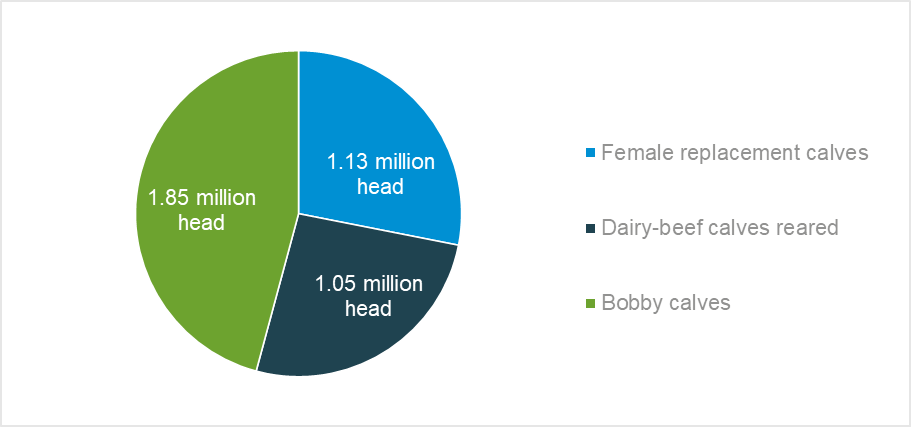

However, analysis from Rabobank suggests that in 2024, only 26% of calves born on the dairy farm were reared as dairy beef, with the largest proportion (46%) sent to processors as bobby calves and the remaining 28% kept as female heifer replacements. So, on the face of it, there is a sizeable opportunity for adding value.

Estimated route for calves born on dairy farms in New Zealand, 2024

Source: RaboResearch 2025

There are several constraints to dairy beef expansion in New Zealand. The predominance of spring-block calving creates a very seasonal system where most calves are born within a 6-8 week window. This concentrates demand for rearing space, facilities and labour into a short period, while leaving capacity underutilised for the rest of the year. In addition, if growth rates are insufficient, spring born calves require two winters to reach finishing weight, increasing feed costs and reducing margins across the supply chain.

Looking forward, improved genetics and closer supply chain integration and collaboration will be key in overcoming these challenges and strengthening New Zealand’s dairy beef sector.

Australia

Dairy-beef is in relatively early stages of development in Australia, with many of the non-replacement animals born to the dairy herd still entering the bobby calf market aged 5-30 days. Yet, Australian producers increasingly recognise the supply and economic potential of producing more beef from the dairy herd.

A key initiative jointly funded by Dairy Australia and Meat and Livestock Australia aims to provide resources to improve welfare and meat quality of surplus calves, engaging with both beef and dairy producers. This will look to address factors such as collaboration in the supply chain, meat quality and rearing practices, all of which are currently key blockers to growth of dairy beef in the region.

Conclusion

Distinct regional differences remain in the development of effective dairy beef supply chains, and the coming years will be instrumental in their progress. Dairy-beef production is set to grow across the globe, helping sustain production volumes as beef supply challenges persist.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.