Impact of China’s import tariffs on EU dairy

Thursday, 15 January 2026

Overview

China has imposed temporary import tariffs on EU cheese and high fat milk and cream (fat content more than 10%) effective as of 23 December 2025.

This follows the first phase of anti-subsidy investigation, which was launched in August 2024. These duties are provisional and are subject to revisions following the conclusion of the investigation on 21 February 2026.

The provisional countervailing duties imposed by the Chinese authorities are structured in three parts:

- The first part covers companies individually selected in the investigation, subject to rates from 21% to 42.7%.

- The second one covers cooperating companies not individually sampled, subject to a 28.6% rate.

- The third part covers other EU companies, subject to the maximum rate of 42.7%.

As a result, the volume of dairy from the EU into China is likely to decline in the coming months.

This comes a few months after China imposed anti-dumping duties on the EU pigmeat imports for a five-year period from September 2025.

The move is aimed at shoring up the domestic market which has been impacted by excessive supply outpacing domestic demand.

China-EU dairy trade

China is one of the largest dairy importers in the world and sources nearly a quarter of its requirements from the EU.

Self-sufficiency is around 70-80% with the rest being imported. It is still heavily reliant on imports for products like infant formula, whole milk powder and protein-based products including whey.

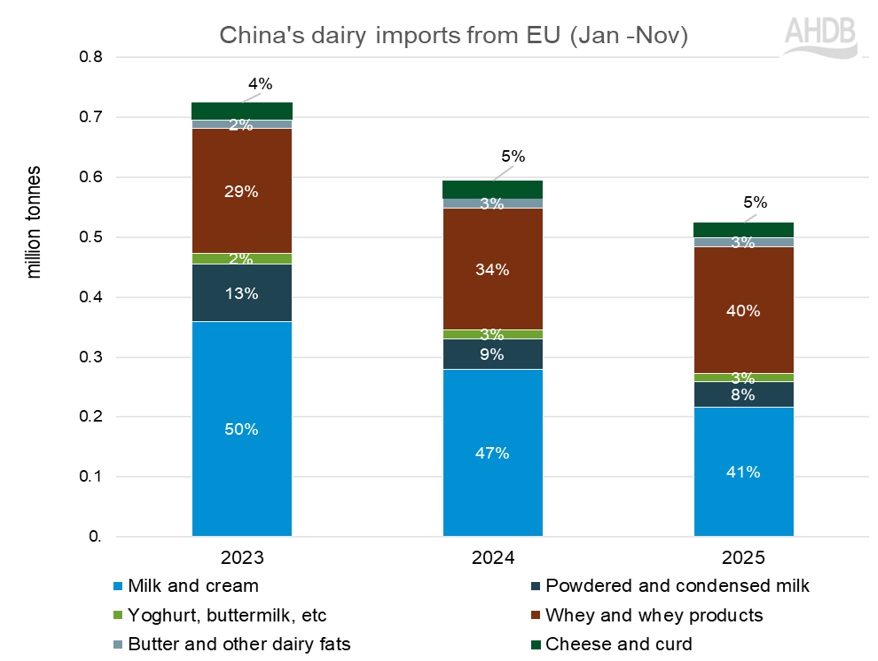

China’s dairy imports from the EU amounted to 524,000 tonnes (January to November 2025) valued at £1.05bn. Cheese imports from the EU constitute 14.5% of the total imports.

Imports from the EU have been declining over the years with less milk and cream and milk powders, and comparatively more whey, and with further tariffs, imports are likely to become expensive in the coming months.

This will incentivise Chinese importers to change their sourcing destinations thereby displacing EU dairy products from China’s shelves.

Chinese government’s policy of boosting domestic production as well as sourcing from other countries weighed on imports from the EU.

China-Other nations dairy trade

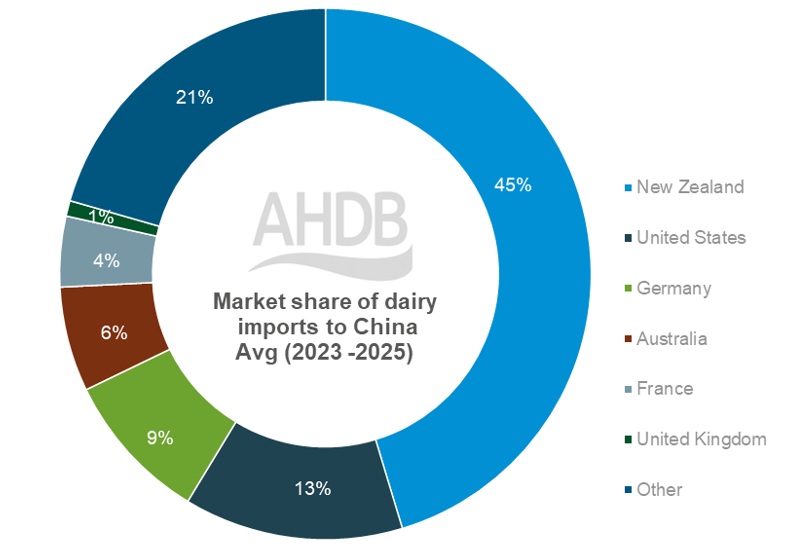

Forty-five per cent of total Chinese dairy imports (based on average of 2023 to 2025, Jan-Nov) comes from New Zealand, 28% comes from the EU, 13% from the USA, 6% from Australia and 21% from other nations.

Only 1% of the total imports currently come from the UK. In the EU, 9% comes from Germany and 4% from France.

Coming to cheese specifically, New Zealand takes the bulk tonnage of 61% followed by the EU at 17%, Australia at 14% and the USA at 5%. In the EU, Italy, Denmark and France are the major contributors.

Under the high fat milk and cream category (040150), China imports 59% of its requirements from New Zealand (2023-2025 average), 34% from the EU and 5% from the UK.

France, Belgium, Ireland and the Netherlands are the major contributors in the EU.

With the tariffs being applied, imports from the EU will become costlier and other major trading partners like New Zealand, Australia and the United States and potentially the UK will gain from the EU’s lost share.

The USA will also have the advantage of producing more competitively priced cheese in greater quantity as new plants have increased production capacity.

The dropping of Chinese retaliatory tariffs on the US in November 2025 could allow them to exploit this opportunity.

EU-Other nations dairy trade

The EU dairy sector has grown by nearly 90% in value during last ten years to £13.6bn in 2025 (January to October) while volumes have grown by 12% during the same period.

The UK is the topmost destination for EU dairy exports followed by the United States and China. The EU-Mercosur deal will boost EU dairy exports in the coming months.

Implications for the British dairy sector

Imposition of provisional tariffs on the EU dairy products will make it costlier for China to import from Europe and will pave the way for other major global exporters like the USA and Oceania.

Currently, US dairy products are very price competitive in the global market. Any additional requirement on cheese could be filled in by the USA as there has been major expansion in cheese facility recently.

On the other hand, EU products previously destined for China could land on the shores of the domestic market instead.

The UK is the most dominant importer of the EU dairy products and more displaced products on the UK market or going to potential third-party export markets like South-east Asia or the Middle East, could pressurise prices further.

Demand remains subdued in global markets amid sluggish economic growth.

This, coupled with excessive supply and recent imposition of tariffs, creates uncertainty on the continent as well as into the British dairy sector affecting trade flows globally.

The industry should be geared up to face the potential headwinds and navigate through uncertain times with resilient practices in the dairy sector.

However, one has to keep in mind that these duties are provisional and could be revised further when the investigation concludes next month.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.