Imports rise 13% as production drops: EU beef market update

Friday, 28 November 2025

Supply tightness on the continent has caused an increase in prices. This article looks into how EU beef production is progressing and the reasons behind this.

Key points

- EU beef production has decreased 4% (169,000t) year-on-year to 4.2Mt so far in 2025 (Jan-Aug)

- For the week beginning 10 November, the average EU R3 grade steer price sat at 650p/kg equivalent, 206p/kg higher than the same period in 2024.

- Total EU beef imports have increased 13% (22,500t) to 195,600t (Jan-Sep), driven by imports from South American countries

Production

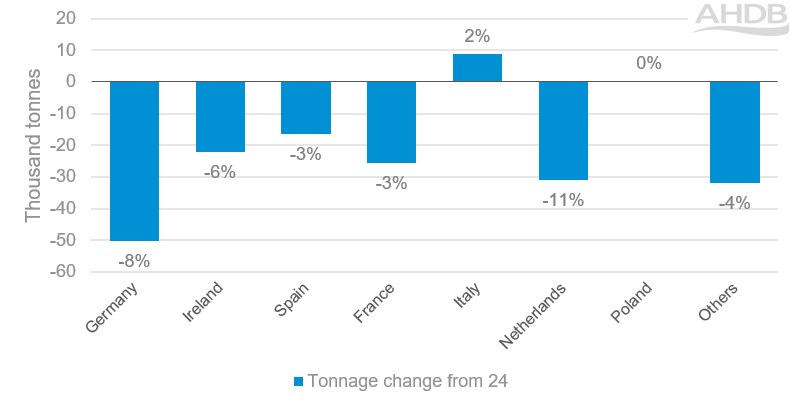

According to data from the European Commission, EU beef production for the year to date (Jan-Aug), decreased by 4% (169,000t) year-on-year to 4.1 million tonnes (Mt). Of the main producing nations, the Netherlands has experienced the steepest decrease of 11% (31,000t) to 255,000t followed by Germany with an 8% (50,000t) decrease to 607,000t. Output from France, the largest EU producer, fell by 3% (26,000t) to 832,000t.

Year-on-year change in beef production of select EU27 countries

Source: European Commission

Over the same period, total EU cattle slaughter fell to 13.9 million head, a decrease of 5% (804,000 head).

Total prime beef production* decreased by approximately 2% to reach an estimated 2.4Mt, this was primarily driven by lower bull slaughter. Bullock slaughter decreased by 1%, while heifer throughput saw minimal change. Total prime slaughter numbers fell to 6.9 million head, a decrease of 3%.

Total EU cow beef production fell to 1.2Mt, a decrease of 5%. Ireland saw a significant (15%) decrease, the largest of the main producing countries. Total cow slaughter numbers decreased by 6% to 3.8 million head.

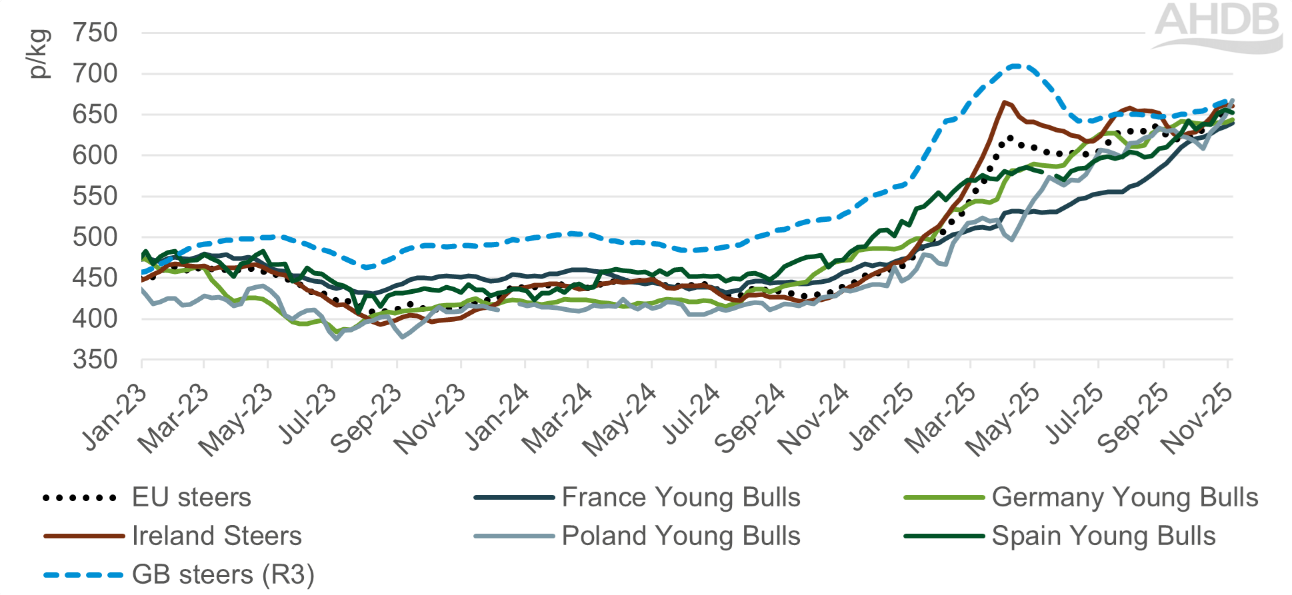

Prices

For the week beginning 10 November, the average EU R3 grade steer price remained stable from the previous week, at 650p/kg equivalent. This is 206p/kg higher than the same period in 2024. These prices reflect the reduced supply picture on the continent generally. European Commission forecasts and cattle census figures point to lower EU beef production in 2026, suggesting continued supply-side support for prices going forward.

The Irish R3 grade steer price averaged 660p/kg equivalent, 8p/kg lower than the equivalent GB price, with the tightness in Irish supply keeping prices buoyed.

Selected EU deadweight prime cattle prices (p/kg)

Source: European Commission, AHDB

The average EU cow price increased by 2p/kg equivalent from the previous week to 536p/kg equivalent. This is the first week to see an increase after 4 weeks of decline.

Trade

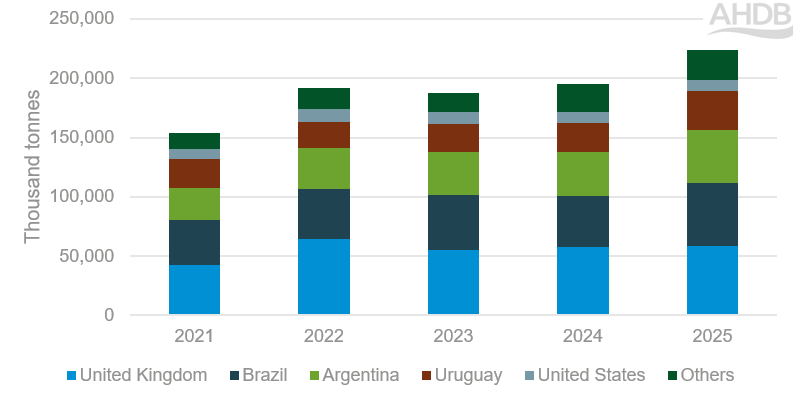

Total EU imports of fresh/frozen beef for the year to date (January – September) increased by 15% (28,500t) year-on-year to 223,900. The UK has remained the top supplier in terms of volume, shipping 69,500t across the period (-1% year-on-year).

The majority of growth in EU beef imports this year have come from South America. Brazil have increased volumes by 26% (11,100t) whilst Argentina and Uruguay increased by 21% (7,700t) and 32% (7,900t) respectively. Brazilian beef exports have maintained a strong pace, reaching record high levels throughout 2025, supported by competitive pricing and strong production levels.

EU27 beef import volumes by supplier country (Jan-Sep) 2021-2025

Source: Eurostat compiled by Trade Data Monitor LLC

For the same nine-month period, total EU exports of fresh/frozen beef have declined by 12% year-on-year (43,400t) to 319,100t, driven by limited production and high pricing. Exports to the UK have decreased by 6% (10,300t) to 149,900t. Exports to Turkey have decreased by 31% (18,300t) to 41,000t.

Offal exports from the EU decreased by 9,500t to 107,800t when compared to the same period in 2024 (January-September), mostly driven by declines into Asian markets including the Philippines, Hong Kong and Japan. Despite this, exports to Cote d’Ivoire, the largest customer in volume terms, increased by 2,400t to 20,800t.

*Excluding Lithuania and Hungary due to incomplete data. Lithuania and Hungary combined have accounted for 1% of EU27 beef production so far in 2025.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.