Irish beef market update and outlook for 2026

Friday, 23 January 2026

Beef production in Ireland fell significantly in 2025 and is forecast to see further falls in 2026. We explore the impacts on Irish farmgate prices, trade and potential implications for the UK beef market.

Key points

- Beef production in Ireland fell by 6% year-on-year in 2025, with lower slaughter numbers in the second half of the year the major driver

- Lower production, combined with demand from key export markets prompted significant price growth throughout 2025

- Looking into 2026, forecasts indicate that high Irish beef prices are set to continue, with production forecasted to fall by a further 4% on the year

Production

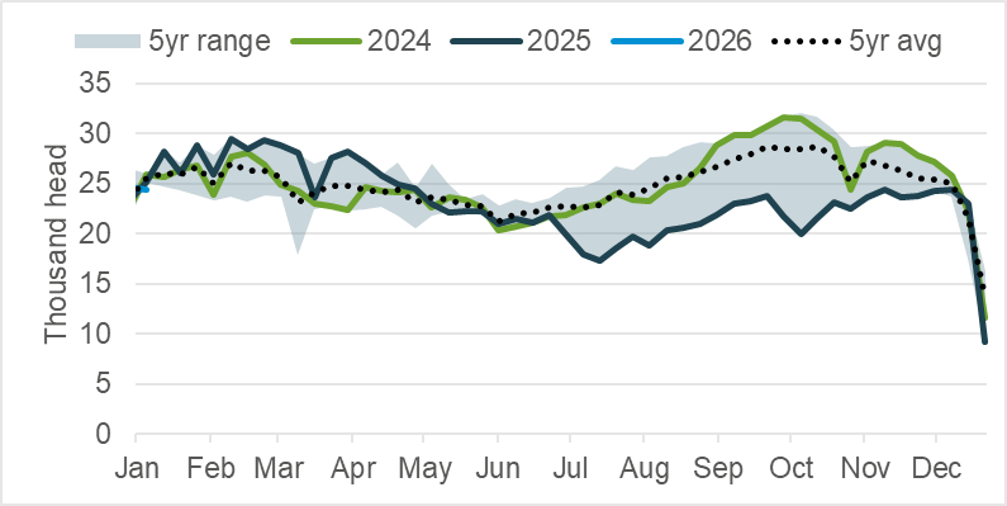

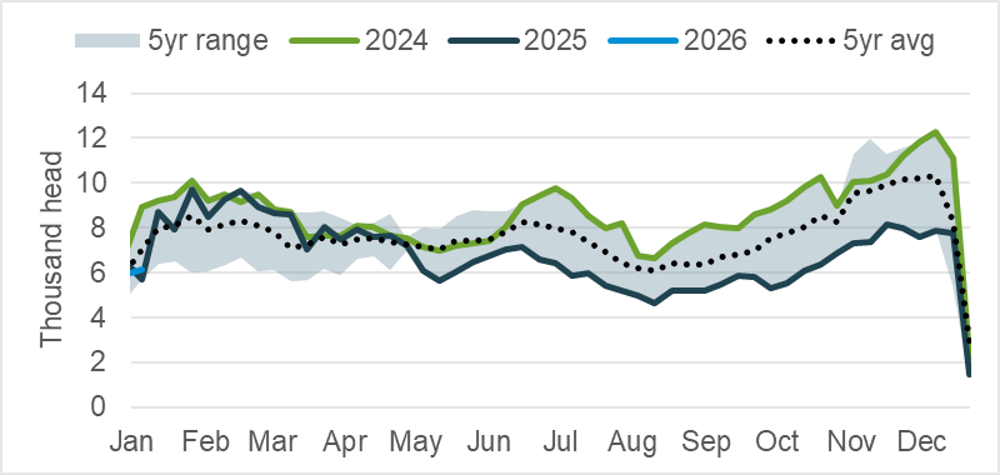

For the full year of 2025, prime cattle slaughter in Ireland totalled 1.21 million head, a fall of 7% year-on-year. Greater falls were seen in cow slaughter, back by 21% annually to total 354,000 head in 2025.

Strong levels of live cattle exports in the preceding years and contracting cow numbers limited cattle available to slaughter in 2025. Numbers were particularly tight in the second half of the year, leading to Irish prime beef production falling by 6% in 2025 in total versus 2024. Meanwhile, carcase weights increased slightly.

Irish prime cattle kill, weekly

Source: DAFM

Irish cow kill, weekly

Source: DAFM

Prices

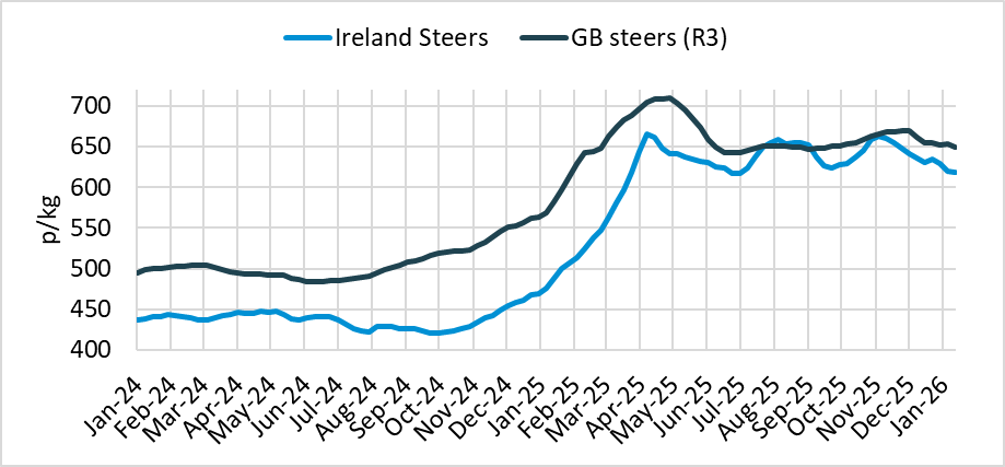

In 2025 Irish beef prices set record highs, with rapid growth in the first few months of the year topping out at an average price of 664p/kg for steers at the beginning of April. Since then, we’ve seen prices fluctuate in the range of £6–6.50/kg, holding at a level around 50% higher than the year prior.

Tight domestic supply and solid demand from export markets underpinned this price growth, with the Irish and GB markets closely linked. The value of fresh/frozen Irish beef exports grew by 20% year-on-year in Jan–Nov 2025 compared to the year before, despite lower volumes of product shipped.

Domestically, as high prices began to be passed on to the consumer, demand for beef softened as customers looked to manage spend, which somewhat stalled price growth at the farmgate. However, demand for manufacturing beef has been supported, as consumers down-trade within the category.

Irish and GB R3 steer price

Source: AHDB, Eurostat

Over the first couple of weeks of 2026, we have seen the price differential widen again slightly, with average GB steer prices sitting 31p/kg above their Irish equivalent in the week beginning 12 January. Irish prices are reportedly steady suggesting demand for available cattle is strong as supplies remain tight.

2026 outlook

Teagasc forecast a 4% annual fall in prime beef production in 2026, continuing the decline seen through 2025. Ongoing tightness in slaughter numbers will drive this decline. Population data from DAFM showed a 3% drop in animals for beef production (beef males and females, and dairy males) aged 12–30 months as of December 2025, a strong indicator of the tightness in the supply pipeline over the coming year.

Irish beef prices are strongly influenced by the demand of their key export markets, the UK and EU, with nearly 90% of production exported. However, domestic supply shocks do also play a part in price development.

Forecasts from Teagasc and Bord Bia anticipate tight supply in export and domestic markets over the coming year to support demand for Irish beef. Teagasc anticipate average Irish finished cattle prices to rise by a further 5% in 2026 and expects the price differential between the UK and Ireland to remain historically narrow.

Irish farmer net margins are expected to improve year-on-year for finishing producers in 2026, while rearers might see a slight annual fall following very high calf prices in 2025. Teagasc forecast that both feed and fuel prices will fall year-on-year, easing key input costs, while cattle prices remain strong, leading to greater net gains.

Implications for the UK

Lower beef production in Ireland will affect exportable volumes in 2026, likely reducing shipments to the UK, as seen in the second half of 2025. While tightness in UK supply is likely to lead to higher import requirements in the year ahead, Ireland's limited cattle numbers may limit their market share somewhat.

Furthermore, strength in beef prices across Ireland and other key global markets is likely to lend support to UK pricing in the coming year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.