Key trends to watch out for in 2020 for the beef market

Friday, 3 January 2020

2019 has been a very challenging year for the beef sector. Here we look back on some of the key events in the beef industry over the last 12 months, and those that will remain relevant in 2020.

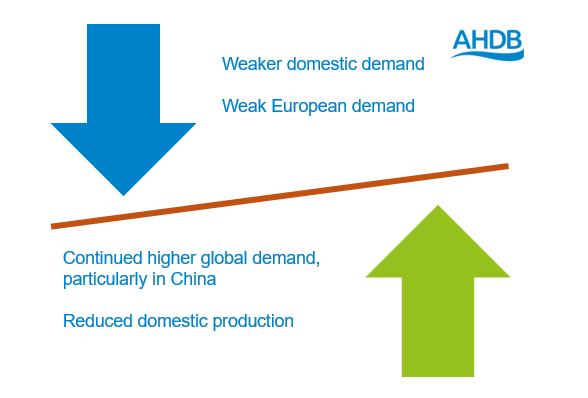

The all prime cattle price started lower than last year and the 5 year average. It remained below 2018 levels all year with the price in the summer dropping to over 40p lower compared with 2018, and, despite climbing above the 5-year average during the second quarter of the year, it has spent the second half of the year well below the 5 year average too.

- Domestic demand for beef has remained subdued, both at retail and foodservice levels with spend in the 52 w/e 1 December down 1.5% to just over £3bn. Volume sales dropped over the same time with volumes down 1.1%, according to Kantar. There has been a large annual drop in volume sales of roasting joints and frying/grilling steak and though there are increases in volumes of other products, such as mince and fresh pre-packed pasties, they’re not enough to balance out the reductions in other products.

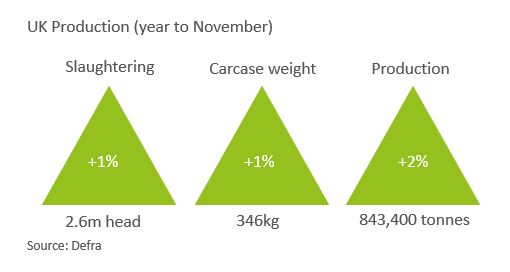

- Despite the subdued demand and lacklustre prices, domestic production of beef and veal to November 2019 was 843,400 tonnes, a 2% (14,800 tonne) increase on 2018 levels. This rise was driven by an increase in heifer slaughtering overall compared to 2018 and an increase in carcase weights. Although the number of animals slaughtered overall was slightly higher, the number of adult cattle slaughtered was down 2%. Conversely, calf slaughtering was up 11%.

- Prime dressed carcase weights up to November, were marginally heavier than in 2018, at 346 kg/head. This is not surprising, as the grass growth in 2019 exceeded that seen in the drought of 2018.

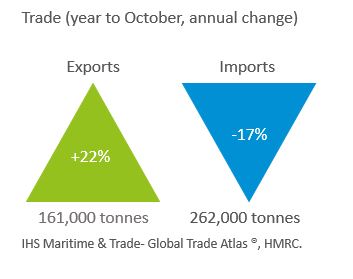

- After both imports and exports increased in 2018, it was expected that, as the pound was weaker, imports could decrease and exports increase during 2019. This proved correct as in the year to October, exports were up 22% to 161,400 tonnes, although not for that reason. Trade volumes in 2019 were driven by oversupply in the UK market. Shipments increased to all major destinations including Ireland (+18%), France (+26%) and the Netherlands (+22%). While export volumes increased, the value has not seen the same level of uplift with the total value up 8% to £480million pounds. Over the same period, (to October) import volumes fell 17% with imports from Ireland, the UK’s largest supplier of beef down 11% to 185,000 tonnes. Shipments were also down from Poland (-8%), the Netherlands (-13%) and Brazil (-56%).

Outlook

Prime slaughter is expected to fall in 2020 by around 3%, production could drop by 4% if carcase weights fall too. Exports are expected to be lower, by 9%, due to this lower production. Although cattle prices are still vulnerable to weak domestic demand, if they do recover, they will attract more imports, predominantly from Ireland. Product availability in Ireland will play an important part, as will Ireland’s exports to countries other than the UK.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: