- Home

- News

- Lamb market update: Australian lamb production is expected to remain at record levels, what does this mean for the UK?

Lamb market update: Australian lamb production is expected to remain at record levels, what does this mean for the UK?

Thursday, 3 April 2025

Following a period of instability, the Australian lamb market appears to have stabilised. As the worlds biggest exporter of sheep meat, Australian sheep meat prices, production and exports have a significant impact on the global sheep sector. This article examines Australia’s current export position with a specific focus on what this means for the UK.

Key Points

- Australian sheep production is expected to remain strong in the coming years following a year of record production in 2024.

- Australian sheep meat export volumes have been growing steadily following the 2020-2022 flock rebuild, and are anticipated to continue this expansion.

- Australia has under-utilised its sheep meat quota under the UK-Australia Free Trade Agreement (FTA) for the first two years of the agreement. However, the quota allocation is set to increase over time.

Production and prices

After a volitile period in 2023 in which destocking due to adverse weather led to a rapid decline in prices (hitting a low of £2.20/kg in September 2023), the Australian sheep sector has mostly regained stability, and has seen gradually strengthening prices over the last year with the National Trade Lamb Indicator standing at £3.89/kg at the week ending 23 March 2025.

Indeed, Australian sheep slaughter and production reached record levels in 2024, and both are expected to persist at these heights. Meat and Livestock Australia (MLA) forcast production at 879,000 tonnes for 2025 representing only a 0.1% decrease from 2024 levels.

Moreover, production is expected to remain elevated into the future due to productivity improvements in the Australian flock driven by increased incorporation of meat-breed genetics.

These elevated production volumes contrast with many other major sheep producing regions, with the EU, New Zealand, and the UK all experiencing marked declines in flock sizes, positioning Australia well for sheep meat exports on the global field.

Exports

In 2024 Australia broke its export record of lamb and mutton, with 2024 exports reaching 691,000 tonnes (valuing at approximately £2.7 billion). This represented a 15% increase from 2023.

Australian sheepmeat export volumes have been growing steadily following the 2020-2022 flock rebuild, and are anticipated to continue this expansion as Australia takes advantage of the gap left on the global market by New Zealand’s reduced sheep meat production.

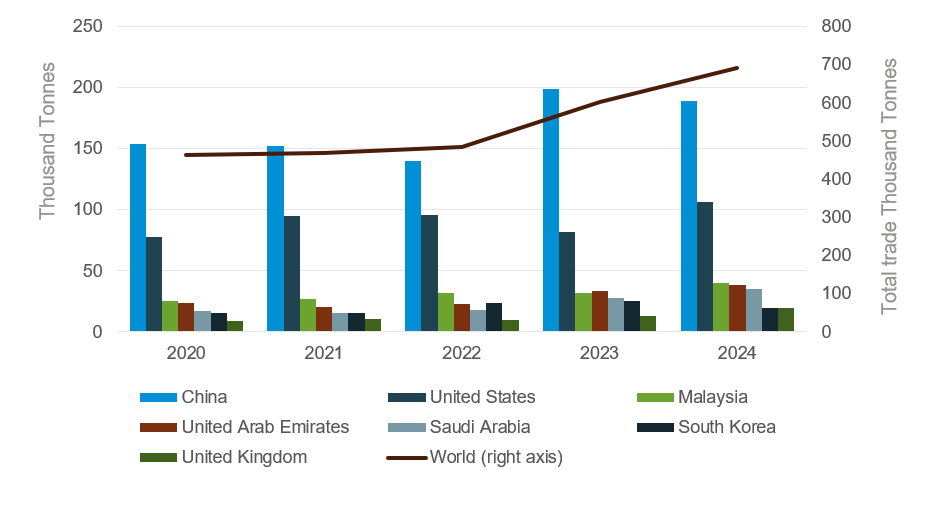

Australian sheep meat exports by destination

Source: TDM LLC

Much like in the beef sector, Australia has attempted to pivot away from a reliance on the Chinese market by pursuing export markets for higher value products elsewhere. China still remained the primary destination of sheep meat exports (in terms of volume), making up 27% of total Australian sheep meat export volumes in 2024. Nevertheless, these volues to China were down 5% on the year, whilst volumes to the United States, Malaysia, and the UAE were up 30%, 27% and 16% respectively.

UK-Australia trade

The UK represents only 0.3% of total Australian sheep meat exports by volume.

Most UK sheep meat demand is met domestically or by imports from New Zealand. However, as global sheep meat production shifts, volumes of Australian exports destined for the UK are increasing, reaching 19,300 tonnes in 2024. This made up 25% of UK sheep meat import volumes and indicated a 6,000 tonne (47%) rise in volumes from 2023.

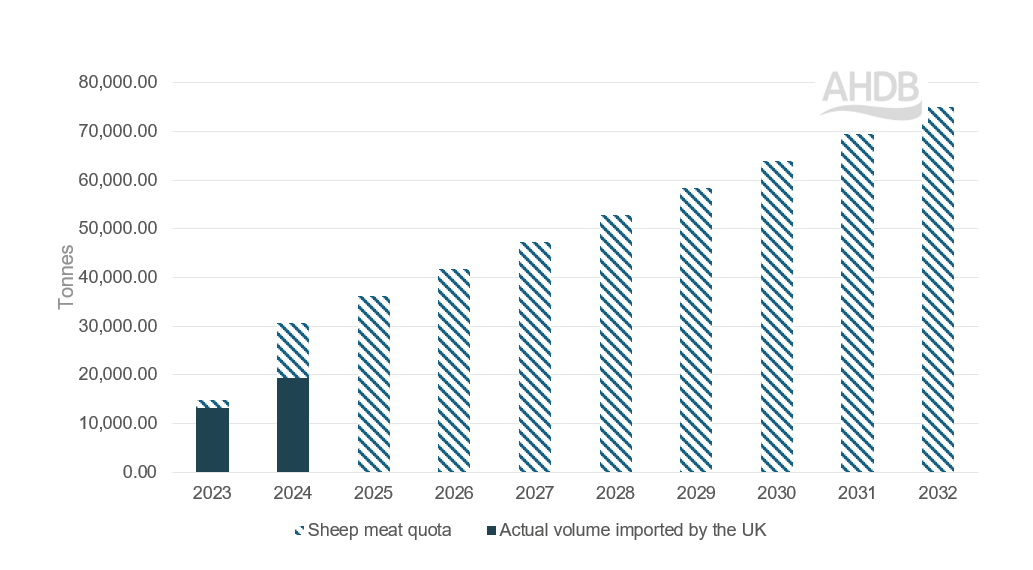

Australia sheep meat quota fulfilment under the UK-Australia FTA

Source: TDM LLC

After Brexit the EU WTO quota for Australian sheep meat was divided between the EU and the UK. In 2025, this equated to a sheep meat quota of 13,335 tonnes to the United Kingdom, before tariff rates are applied.

Since 2023, under the UK-Australia FTA, Australia has gained access to a yearly increasing UK sheep meat quota. Australia has under-utilised this sheep-meat quota for the first two years of the agreement, but as the quota grows, and Australian production increases it will become increasingly important to monitor these volumes.

In the first month of this year, UK sheep meat imports from Australia were up 30% from last year's January volumes. Yet it is important to note the seasonality of UK lamb imports, therefore it will be more representative to review these imports after periods of key demand in the spring.

As Australia continues to explore new and growing markets, we could anticipate that volumes to the UK might continue to grow. However, China and the US are anticipated to continue to absorb much of the volumes of Australian sheep meat alongside geographically more convenient destinations around the Pacific, potentially limiting the potential impacts on the UK sheep sector somewhat.

Products

The sheep meat products that Australia exports vary depending on their intended destination. For example, 60% of exports to mainland China in 2024 were mutton, compared to only 3% to the United States which recieves predominently fresh and chilled bone-in cuts of lamb. This variance in products explains the differences in values and volumes between different destinations e.g. the United States is the highest value market but only the second highest volume.

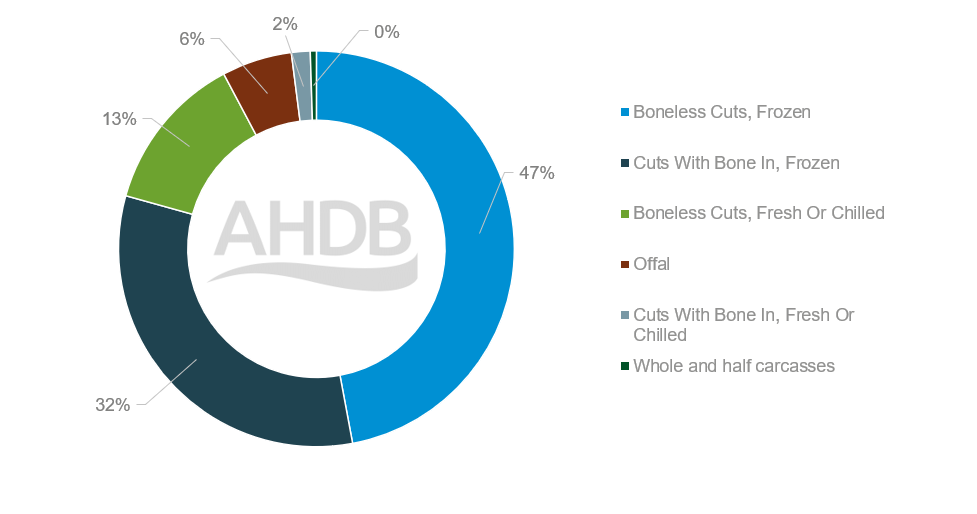

Australian sheep meat exports to the UK 2024 by volume

Source: TDM LLC

Lamb legs have traditionally dominated dominated exports to the UK, providing up to 52% of volumes in 2024. Recent years have also seen the growth of boneless cuts during the summer months and just before Christmas, highlighting the changing patterns of lamb consumption in the UK.

Conclusion

With the contrast between the strength of the Australian sheep meat sector and the declining production levels of other major global flocks, we can anticipate that Australia will be a key player on the global export market in the coming years.

For the UK, with our own declining flock numbers, this could mean a further increase of Australian sheep meat imports. However, this will remain dependent on consumer demand for lamb. Furthermore, the UK currently provides quite a small market for sheep meat exports, therefore if demand were to increase in larger markets, like the US and China, sheep meat volumes would likely be redirected there.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.