Lamb market update: deadweight prices supported by demand and supply

Thursday, 21 March 2024

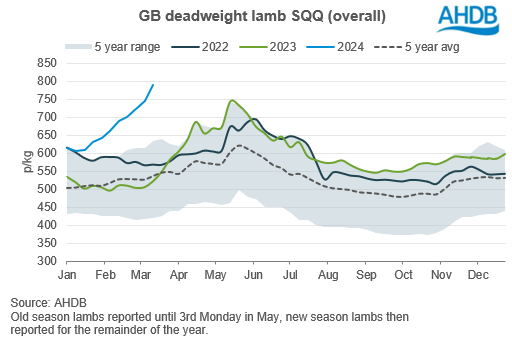

As the GB deadweight SQQ continues to reach new heights, domestic supplies remain tight, with robust consumer demand and imports somewhat below expectations.

Key Points:

- Current production levels below last year, as estimated kill remains over 100,000 head lower through the year-to-date.

- Latest trade figures for January showed an annual rise in imports and exports, with growth in shipments from New Zealand and Australia. However, given market fundamentals, import levels were arguably lower than industry expectations.

- Consumption levels are strong against the same period last year, with lamb proving popular through Christmas and Valentine’s Day in retail, supported by some promotions.

- Farmgate lamb prices have been supported by these factors; the deadweight OSL SQQ reached nearly 790p/kg for the week ending 16 March.

Supply-side factors

Production

UK sheep production fell in February, to 21,500t, a decline of 1,700 tonnes from January. This was driven by clean sheep slaughter which saw decline of 77,000 head (-8%) from January to 909,000 head. Similarly, a 9,000 head decrease in adult sheep kill from January to February was recorded, the lowest February kill since 2020.

Looking into AHDB estimated kill for GB, the year-to-date total (to week ending 16 March) sits at 2.27m head, which is an estimated decline of just over 105,000 head. This would indicate that clean sheep slaughter has continued to decline through March, as domestic supplies have become tighter with lower carryover. The AHDB lamb outlook for 2024 predicts that total carryover of hoggets will be 10% lower than in 2024, a decline of around 430,000 head.

Trade

Sheep meat trade throughout 2023 saw boosted exports and a decline in imports compared to 2022. The most recent trade data for January 2024 shows further growth in export volumes, up 820t from December 2023, to 6,800t. This is the strongest start to the year for exports since 2020, as volumes to France have grown by over 1,000t for January. Demand for UK sheep meat has remained robust on the continent, despite narrowing price differentials since January.

Looking into imports, total volumes for January have grown on the year, to 3,900t, as New Zealand has recovered from poor export volumes experienced in Q1 2023 due to Cyclone Gabrielle. However, industry commentary suggests that a combination of factors have been slowing the flow of New Zealand lambs to market of late, including lower lamb pricing and better forage quality encouraging producers to hold some lambs back on farm to increase weights. For Australia, January volumes grew by 190t to 860t in 2024, as commentary suggests that Australian exports are focussing on other nations. Southern Hemisphere exports to the UK may be marred by shipping issues in the Suez Canal.

Demand-side factors

In the 12 weeks to the 18 February 2024, 21,441 tonnes of lamb were sold through retail, up 5.6% on the same period in 2023 according to Kantar. While during this period, the majority of volumes still came through from Christmas sales, we also saw uplifts for volumes at Valentine’s Day. The average price paid for leg roasting joints fell by 1.7% year-on-year, reflecting the depth of promotions seen over the 12-week period. Shoulder roasting joints saw the biggest change in average price paid to +10.6%, over the 12-week period.

The growth in lamb volumes have been slowing since Christmas but remain up on 2023 levels. Retailers dropped many of the promotions in February, but this didn’t stop shoppers from purchasing more than they did last year. Hearty and treaty meals with lamb are appealing to a range of shoppers as we see most ages and life stages increasing their lamb consumption. After a year of cutting back and checking prices, we see consumers turning to lamb for a treat with an increase in instances of consumers picking lamb because of taste.

As we look forward to a period of celebration with Easter and Eid-al-Fitr in the next few weeks, we anticipate lamb will continue to see robust volume sales with many retailers already advertising promotional offers on lamb in a bid to win the big Easter shop.

What does this mean for prices?

Combining the factors of a lower domestic supply, limited import volumes, growing exports, and higher-than-expected demand, prices continue to reach new heights. The GB deadweight OSL SQQ has grown by 174p/kg since the beginning of the year, with price increases of up to 46p recorded week on week. In the week ending 16 March, the measure rose by 46p from the previous week, with an increase of 51% (267p) from the same week in 2023.

GB deadweight lamb SQQ

Source: AHDB

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.