Lamb market update: What’s driving global sheep prices?

Friday, 16 August 2024

Key points:

- New Zealand lamb prices have grown in recent weeks by nearly 20p/kg

- New Zealand lamb supplies seem to be tightening, placing pressure on domestic procurement

- Australian lamb kill has also dropped as the supply of old season lambs is declining

- Prices in Australia reached a peak at the end of July but have since declined

New Zealand

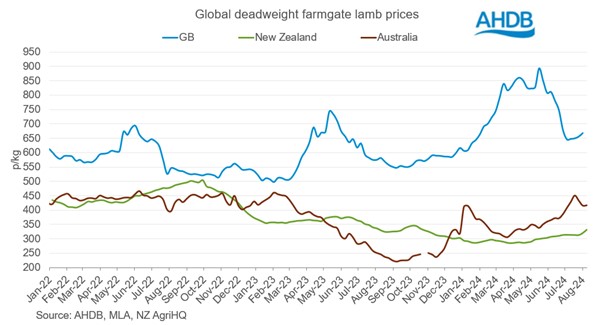

Since the beginning of 2024, New Zealand prime lamb prices have been substantially pressured, hitting a trough of 284.8p/kg (GBP) at the end of March. Since then, there have been marginal gains in the price, but still barely scraping above 300p/kg until late June.

In the past three weeks to the week ending 10 August, prices have risen from 312.9p/kg to 331.2p/kg. Prices this high have not been seen since October 2023, when kill transitioned between new and old season crops, providing some procurement competition.

Industry commentary notes that this has been driven by a shortage of finished lambs for the domestic New Zealand market with some procurement pressure starting to creep in.

The seasonal reduction in finished lamb numbers has come quicker than previous years, and quicker than some expected, which has provided support to pricings. The typical New Zealand slaughter year runs from September-September, as slaughter had declined to seasonal lows by early July, earlier than a typical season. This shortage of domestic lambs should provide strength to lamb prices coming into spring in the southern hemisphere.

Australia

Australian lamb prices have strengthened over the past month, reaching a peak of 450.6p/kg at the end of July, before moving down to 416.4p/kg for the week ending 11 August. This was preceded by months of downturned prices, following record-high slaughter levels of prime lambs.

Insight from Rabobank suggests that the flow of old season lambs into market is slowing down, which has supported these price increases. Other market reports note that demand for light lambs from the Middle East in the earlier part of the season led to additional lambs being slaughtered earlier on rather than retained for market at a later point.

Rabobank also highlight that prices may be further buoyed by a slower stream of new season lambs, which would usually start to come forward in the coming weeks and months. This is due to the elevated levels of sheep slaughter including replacement ewes over the past year, which could point to a falling breeding flock. This may have limited the number of lambs available to kill at the beginning of the season.

What does it mean for the UK?

The recent growth in lamb prices in both Australia and New Zealand may be a somewhat welcome sign for UK producers. Lamb imports from the southern hemisphere have been higher than 2023 so far, as their lower prices have provided incentive to import more product at a time when our domestic price was higher than ever.

With Australian and New Zealand prices on the rise, and potentially set to continue to grow as supplies tighten in the short term, the import incentive may weaken somewhat. This may be compounded by the arrival of the main UK new season lamb crop over the coming weeks, although currently supplies remain lower than usual.

Global deadweight farmgate lamb prices

Source: AHDB, MLA, NZ AgriHQ

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.