Latest WASDE - expectations, revisions, and market reactions: Grain market daily

Thursday, 13 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £283.35/t yesterday, down £2.10/t from Tuesday’s close. The Nov-23 contract fell £1.90/t over the same period, ending the session at £272.10/t

- Domestic markets followed global movements yesterday. Chicago wheat (Dec-22) futures were down $6.89/t, closing at $324.14/t

- Continuing to follow the wider oilseed complex, Paris rapeseed (Nov-22) climbed €2.75/t over the day, to close the session at €633.00/t

- The latest UK trade data update was released yesterday. From July to August, according to HMRC data, 110.8Kt of wheat has been exported over the two months. This up 81Kt from the same period in the previous year

Latest WASDE – expectations, revisions, and market reactions

Yesterday the latest USDA’s monthly WASDE (World Agricultural Supply and Demand Estimates) report was released. So how did the report compare to trade estimates?

Soyabeans

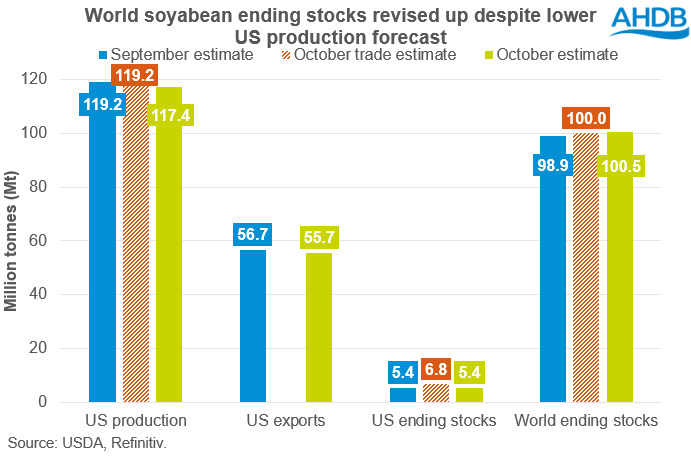

Traders had predicted that soyabean production would see revisions up (Refinitiv). The average of trade estimates pegged yield at 1.36t/acre with production expected to be 119.24Mt. Unexpectedly, US soyabean yield forecast was pulled back to 1.33t/acre. Therefore, production was revised down to 117.38Mt, down 1.5% from September’s figure. This is still higher than the previous 5-year and 10-year US production average.

With traders expecting a slight boost in soyabean production, the news of a reduced US crop saw Chicago soyabean futures jump up on Wednesday. The Nov-22 contract gained $7.26/t over yesterday’s session, closing at $512.89/t. This was the highest close since 29 September.

Having said this, the reduced US production figure was balanced out by cuts to US export demand (down 1.9% from September), resulting from increased international competition. While US ending stocks were down, world ending stocks of soyabeans were pegged at 100.52Mt, up 1.6% from September’s estimate and up 8.8% from 2021/22. This was due to an increase to Brazil’s soyabean production forecast (now at 152Mt) contributing to an increase in global output. Going forward, the global supply outlook for the rest of the season will depend largely on plantings in South America and competitive prices coming on the market.

Grains

In anticipation of yesterday’s report, analysts had predicted that due to unfavourable weather, US maize yields would be cut once again resulting in a lower production forecast (Refinitiv). Trade yield estimates averaged 4.34t/acre and production estimates averaged 352.67Mt. They had also predicted that maize world ending stocks would be reduced to 301.44Mt.

Analyst predictions were close, and in the report, maize yields were cut to 4.34t/acre, resulting in US production being pegged at 352.95Mt. World ending stocks were revised down slightly more than expected, at 301.19Mt. As maize figures were relatively in line with predictions, Chicago maize futures (Dec-22), remained unchanged over yesterday’s session, and with a tight supply outlook will likely maintain this floor of support going forward.

World ending stocks of wheat were also trimmed in yesterday’s report, though not as much as was expected by analysts (Refinitiv). Analysts predicted 267.49Mt of wheat ending stocks. In the report released yesterday, ending stocks were pegged at 267.54Mt, down 0.4% from September’s estimation due to small overall cuts to world production (cuts to US and Argentinian crops). A tightening balance of the US wheat supply will be something to watch going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.