Life after BPS – what is in store for Arable farms? Grain Market Daily

Tuesday, 9 March 2021

Market Commentary

- UK feed wheat futures (May-21) closed yesterday at £206.30/t, up £0.80/t from Friday’s close. New crop futures gained £0.30/t yesterday, to close at £171.80/t.

- Stratégie Grains cut the EU and UK end of 2020/21 season rapeseed stocks yesterday, by 180Kt to 1.1Mt. This is due to fewer imports and high crush margins. Ending stocks are now forecast to be 800Kt down on last year.

- Weather maps for the US indicate 1 to 1.5 inches of rain is destined for western Kansas and the Oklahoma panhandle, with a possibility of 3 inches plus in central and eastern Kansas. There is hope this may ease drought conditions. The proportion of the winter wheat crop rated “good” or “excellent” in Kansas reportedly dropped to 36%, down 1%. Regular crop condition reporting for the US will commence in April.

Life after BPS – what is in store for Arable farms?

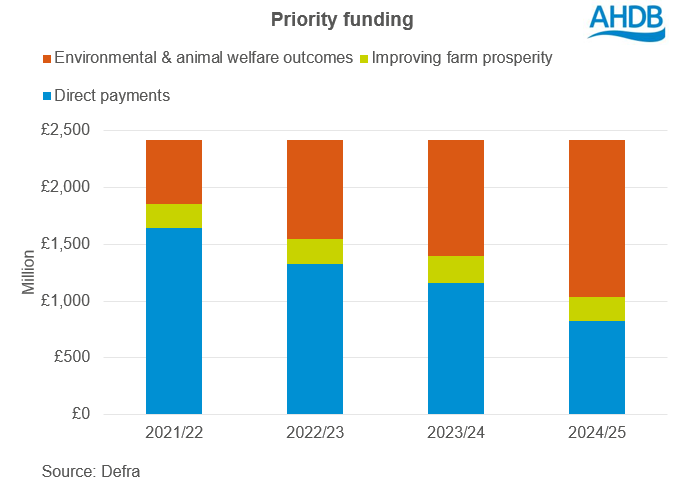

Direct payments as part of the basic payment scheme (BPS) are set to phase out from this year. First year reductions are to be felt most by the largest recipients, though direct payments have played a considerable role for many farm businesses.

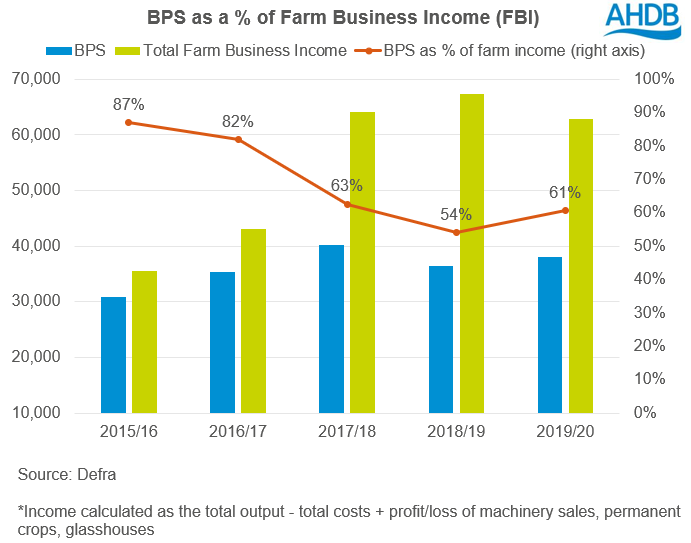

According to Defra farm accounts data, BPS reliance has been lessening over the past 5 years. This is down to increasing farm business income (FBI) rather than reduced payments. Based on Defra’s total FBI calculations, last year (2019/20) total FBI for cereals farms averaged £62.8K, of which direct payments accounted for 61% (£38.1K). In 2015/16, average FBI for cereals farms totalled £35.5K, of which direct payments accounted for 87% (£30.9K). In fact, BPS received increased over the past 5 years by £7.2K.

Last year, the return on agriculture activities for cereal farms stood at £800/farm, according to Defra. This dropped from £10.2K in 2018/19, caused by significantly increased variable and fixed costs.

Understanding costs is increasingly important for arable farms looking ahead. With spring crop drilling to start soon, gross margins are set to feel a further squeeze with approaching rises in red diesel costs. Fertiliser cost is also set to be high this year, rising with the tight global supply and demand of grains.

Future funding – where will it be?

As we know, the government are calling for a move towards delivering public goods and this is the main priority for funding in the upcoming years.

The Environmental Land Management scheme (ELMs) is the main tool in implementing this new strategy. There are 3 outcomes to the ELMS scheme: Sustainable Farming Incentive, Local Nature Recovery and Landscape Recovery. Though, unlike direct payments, these schemes are designed to deliver outcomes which will be a crucial consideration for calculating risk versus reward.

There are many opportunities going forward for arable businesses, and understanding where your focus is and what you want to achieve will be the first stop to deciding your next step. Click here to listen to a Farmers Weekly and AHDB webinar on the transition from BPS to ELMS.

Helpful links:

- Subscribe to our market report, for up-to-date market information and drivers for key grains and oilseeds.

- Business Impact Calculator tool – direct payments.

- Preparing for Change: The Characteristics of top Performing Farms.

- What is shaping the future for cereals and oilseeds? Agri-Market Outlooks

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.