Lowest cereals and OSR area in GB for over two decades: Grain market daily

Friday, 5 July 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £199.25/t yesterday, up £1.75/t from Wednesday’s close. The May-25 contract gained £2.35/t over the same period, to close at £207.70/t.

- European markets rose following a technical bounce. In addition, China’s weather bureau cast concerns over crop production in several regions following forecasts of a prolonged heatwave during July.

- Paris rapeseed futures (Nov-24) closed at €507.50/t yesterday, falling €0.75/t from Wednesday’s close. The May-25 contract fell €2.75/t over the same period, to close at €506.50/t.

- Malaysian palm oil stocks have now risen for three consecutive months, weighing on the vegetable oils complex. This is due to slower exports in June despite a fall in output. Also, the Argentina’s 2023/24 soyabean harvest has been completed at 50.5 Mt, the largest soyabean production for five years (Buenos Aires Grain Exchange).

- US markets were closed yesterday for a public holiday (Independence Day), which subdued market movements.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Lowest cereals and OSR area in GB for over two decades

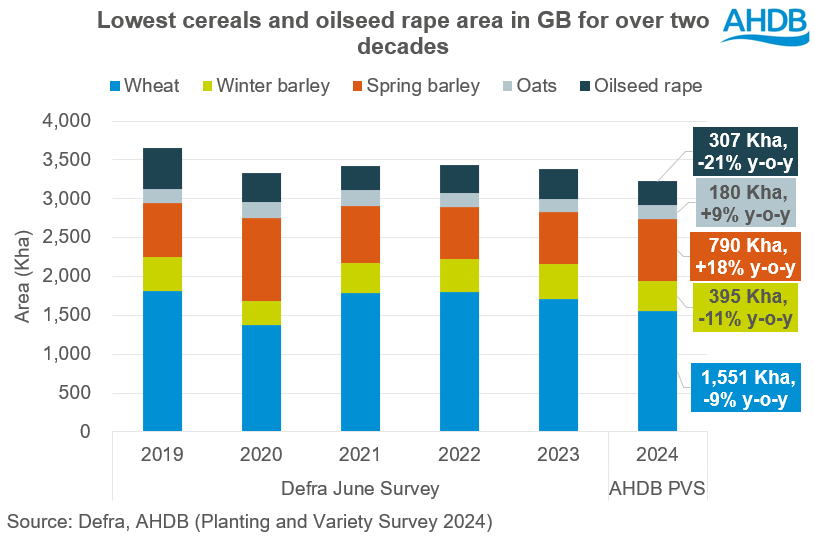

AHDB’s Planting and Variety Survey for harvest 2024 has been published today, estimating a rise in barley and oats areas and a reduction for wheat and oilseed rape (OSR) areas. For GB, the area of total cereals and OSR is estimated to be the lowest for over two decades.

The changes in the cropped areas from 2023 are less severe than the AHDB Early Bird Survey had indicted. That survey took place during March, when many had not even started spring planting. Due to persistent spring rainfall, many were unable to undertake the planting they had planned, including re-planting poorly established winter crops.

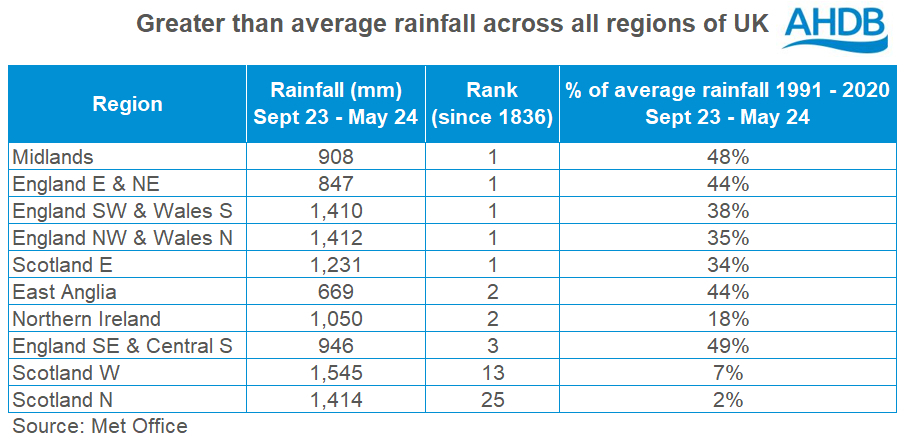

Rainfall from September 2023 to May 2024 was the greatest on record (since 1836) at 1,157 mm. For comparison, this is up 15% on rainfall over the same period for 2020/21.

_since_records_began_(1836).jpg)

All regions across the UK experienced greater rainfall in comparison to their respective 1991-2020 average, ranging from 2% to 49% above. For five regions, autumn 2023 to spring 2024 was the wettest on record and considerably above the 1991-2020 average.

The survey responses for the Planting and Variety survey were collected from 15 April to 14 June. Therefore, the winter crop areas are estimated higher and spring crop areas lower than what was expected in March.

This change in results from March contrasts what was experienced ahead of the 2020 harvest, when despite a wet autumn and winter, a drier spring improved the opportunity for plantings.

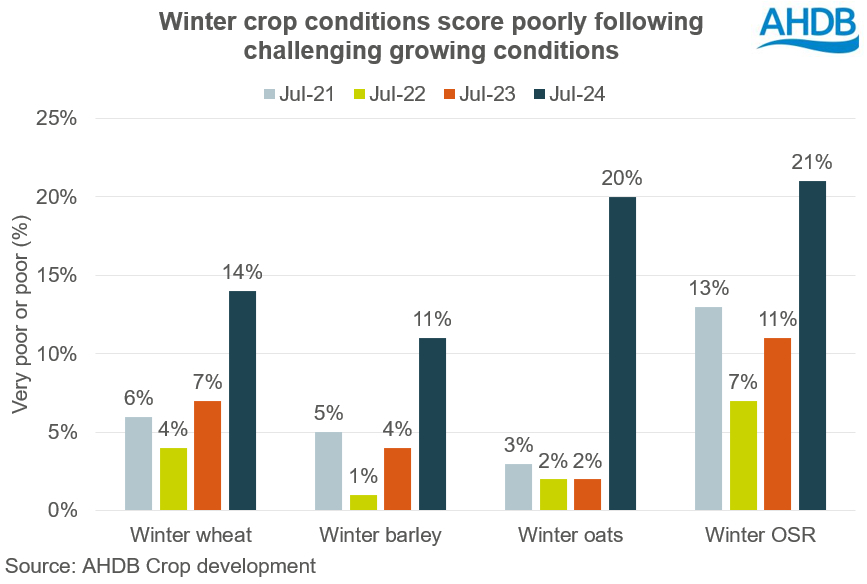

Winter crop conditions remain poor

Also published today was the AHDB crop development report capturing data up to 03 July. Crop conditions have broadly improved again since May, and crops are on track for a timely harvest. But unsurprisingly, winter crops remain in much poorer conditions compared to recent years. For example, 14% of the GB winter wheat crop is rated very poor or poor, down from 18% in May but notably higher than 7% last year.

Winter barley crops are beginning to turn golden and therefore ample sunshine hours are needed. Across GB 11% of winter barley is in very poor or poor condition, down from 17% in May, but still higher than last year at 4%.

Winter OSR has been rated 21% very poor to poor, unchanged on the month, but considerably greater than this time last year of 11%; desiccation has begun in some areas.

Spring crops have benefitted from relatively better growing conditions and overall, potential appears strong. But it is unclear whether crops will be carrying the intended yield, having sped through their development stages.

Flag leaves are now beginning to emerge for spring barley and 71% is rated good or excellent condition, gaining 16 percentage points from last month. The score is also up from 53% at the same point last season. For the spring oat crop, 77% has been rated good or excellent, up 4 percentage points in May and, in contrast to the winter crop, better than this time last year of 69%.

What could this mean for the 2024 crop?

The smaller area and poorer crop conditions mean the UK is expected to not only experience a relatively smaller wheat crop, but quality is also more uncertain than usual. Therefore, while wheat imports have been elevated since the turn of the new year, it is likely that the higher pace will continue into the next marketing year. Milling wheat premiums will consequently remain reactive to price movements of imported bread wheat.

While there’s still some uncertainty over yield potential from the lateness of spring planting, larger barley and oat areas could support production. With a considerably smaller wheat area, this could pressure wheat’s competition within the livestock feed ration should barley and oat production be larger. Furthermore, maize is also pricing more competitively and could apply additional pressure upon wheat’s share within the livestock feed ration.

The GB OSR area continues to be pressured and, as highlighted in the latest crop development report, uncertainty regarding the its viability as a key break crop re-surfaces. Although production estimates in some key exporting regions have declined on the year, oilseed rape prices are back to levels seen before the outbreak of war in Ukraine, tightening margins.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.