Market Report - 11 April 2022

Monday, 11 April 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Global supply and demand remains finely balanced this season, with price volatility continuing. Longer term, the market continues to consider the impact of the Black Sea war on global supply.

With demand switching from Ukraine to other origins, supply will remain tight until the Brazilian Safrinha crop arrives in summer 2022. For 2022/23 supply, how much is planted in Ukraine and the US will be key.

Barley continues to follow wheat market movements, as global supply and demand remain tight. In the UK, barley cannot take extra demand from wheat and markets remain illiquid.

Global grain markets

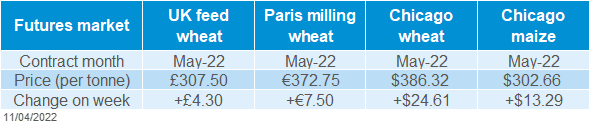

Global grain futures

Last week, global grain markets awaited the latest USDA world supply and demand estimates (WASDE) out on Friday (5pm BST).

Prices remain fundamentally supported by the war between Russia and Ukraine. The trade’s concerns remain for the tightening of global available supplies this season, as well as increasing focus on what this may mean for next season too.

Ukrainian grain exports via rail are reportedly experiencing large delays and ports remain closed too. This means competitively priced Russian wheat is reportedly picking up demand from large importer Egypt, as well as other North African and Middle East countries.

The latest WASDE report reflected increased Russian (+1Mt) wheat exports and reduced Ukrainian (-1Mt) exports. Overall, the global wheat balanced tightened to below trade expectations, as ending stock reduced 3.1Mt to 278.4Mt. This is due to a reduction in global imports (-4.1Mt) and increased global total domestic use (+3.8Mt), despite reducing global exports (-3.0Mt).

The market reacted as Chicago wheat futures (May-22) increased $11.57/t to close at $386.32/t on Friday.

The global maize supply and demand balance eased slightly in the latest WASDE. World ending stocks for 2021/22 were increased 4.5Mt, to 305.5Mt. This was mostly down to increases in production forecasts in Brazil (+2.0Mt), the EU (+0.7Mt) and Southeast Asia (+0.7Mt).

Brazilian first crop maize harvest is now 51.6% complete (as at 02 April 2022, Conab). Conab also increased their Brazilian maize production forecast, up 3.3Mt to 115.6Mt.

Looking to next season, Ukrainian grain harvest is forecasted down 20% year-on-year due to reduced planted area. The latest AMIS report showed Ukrainian wheat production as an area to ‘watch’ for the wheat outlook. Dryness in the US and in south/eastern Europe were also watchpoints.

UK focus

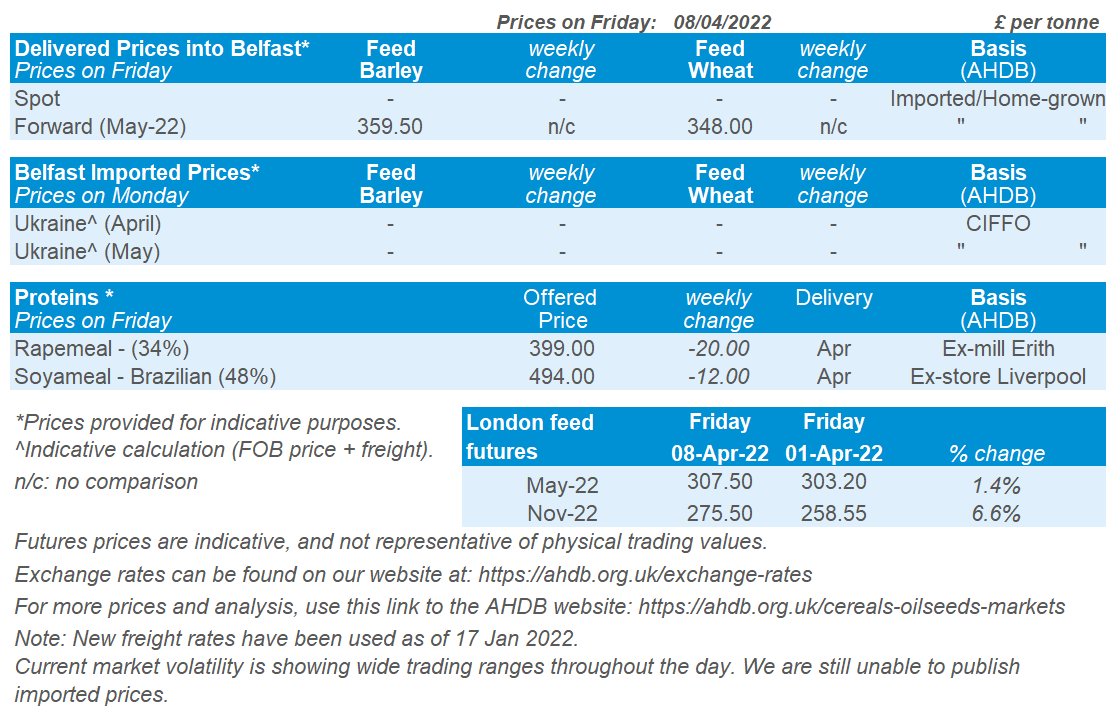

Delivered cereals

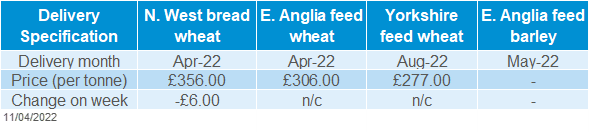

UK feed wheat continued to follow global market movements last week. The May-22 futures contract gained £4.30/t last week, to close on Friday at £307.50/t. The new crop contract (Nov-22) gained £16.95/t last week, to close at £275.50/t. This shows the new-crop prices starting to move closer to old-crop prices, as new season supplies come into focus.

Physical UK prices for feed wheat (delivered into East Anglia, May-22) fell £2.00/t to be quoted as £307.00/t on Thursday. This followed downward market movement (Thursday to Thursday).

North West bread wheat prices (Apr-22 delivery) fell £6.00/t last week, to be quoted at £356.00/t on Thursday.

Oilseeds

Rapeseed

Soyabeans

The rapeseed supply and demand balance remains tight this season, supporting prices. Looking to next season, a reduced area of Ukrainian sunflower plantings is anticipated which may see rape oil demand increase longer term.

USDA report confirms the drought damage to Brazil’s soyabean crop. With Brazilian exports reduced, demand for US supplies will likely increase. Longer-term, US soyabean plantings in May/June are the focus.

Global oilseed markets

Global oilseed futures

A week of support for oilseeds, as commodity funds were net-buyers of Chicago soyabean futures contract.

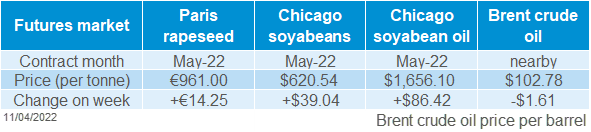

Chicago soyabean futures (May-22) gained $39.04/t (6.71%) across the week, closing Friday at $620.54/t.

Friday’s USDA World Agricultural Supply and Demand Estimates (WASDE) forecast US soyabean stocks at 7.1Mt down from 7.8Mt last month. Reduced US ending stocks are forecasted due to US exports plugging some of the gap created by reduced soyabean exports from Brazil and Paraguay.

Brazil soyabean production was cut by 2.0Mt by the USDA on drought conditions, now pegged at 125.0Mt. The USDA production is still higher than Conab (Brazil’s Ag Statistic agency) who last week revised Brazilian production down to 122.4Mt, from 125.5Mt in its previous forecast.

Malaysian palm oil futures (Jun-22) gained 6.38% across the week, as tighter supplies of soyoil underpinned the market.

Further support comes for palm oil this morning, as end of March inventories have shrunk for the fifth consecutive month to 1.5Mt. As production increased (+24.0%) in the month of March, exports also increased (+14.1%) too (Malaysian Palm Oil Board).

Brent crude oil futures (nearby) were down 1.54% last week, closing on Friday at $102.78/barrel. This comes as International Energy Agency (IEA) members release oil reserves from emergency stocks to offset the reduced Russian supplies due to sanctions imposed.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-22) closed Friday at €961.00/t, gaining €14.25/t across the week.

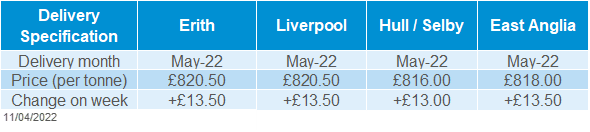

Delivered rapeseed (into Erith, May-22) was quoted Friday at £820.50/t, gaining £13.50/t from the previous Friday. New crop (into Erith, Nov-22) over the same period gained £22.50/t, to be quoted at £692.00/t on Friday.

There is forecast for some heavy snow in canola growing areas of Canada in the coming few days. This is underpinning prices, as it could delay plantings.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.