National cow supply down, what are the drivers? - Beef market update

Friday, 4 July 2025

We have seen rapid growth in cow prices over the last few months, hitting record highs, as supplies remain tight. We take a more detailed look at these supplies and what may be driving the cow market in 2025.

Key points:

- Like the prime market, we have seen record highs in cow prices in recent months, following a period of rapid growth in the first half of 2025

- Supply tightness has underpinned this growth in prices, with cow kill for the year to date down 5% on the year previous

- We have seen year-on-year falls in both dairy and suckler cow kill, with strength in the dairy market incentivising cow retention and therefore limiting cow availability

Price

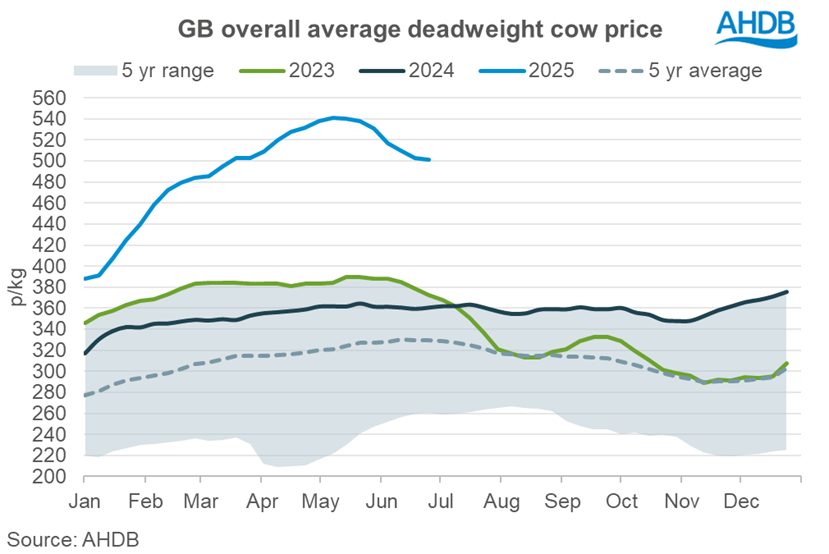

The beginning of 2025 brought rapid price growth in cows, with the overall GB deadweight cow price peaking in the week ending 10 May at 541p/kg, almost 40% higher than the price in the first week of the year.

We have since seen this price fall away steadily but remain significantly elevated over any levels seen prior. In the week ending 28 June, the price sat £1.41/kg higher than the same week of last year and £1.71/kg above the five year average.

Supply

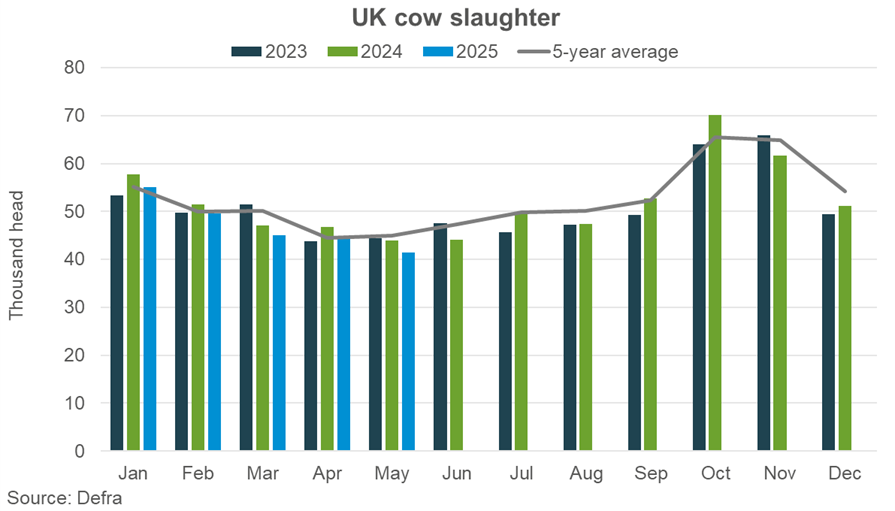

Defra’s production figures show UK cow kill for the year to date (Jan-May) totalling 236,000 head, back 5% on the same period of 2024. We have seen numbers fall each month, following seasonal trends, to hit their lowest this year in May. It will be interesting to see if the usual seasonal uplift occurs in June, or whether tighter availability bucks this trend and restricts growth. AHDB’s estimated slaughter figures for the 4 weeks ending 28 June show a 9% fall on the same period of 2024, suggesting this supply tightness has continued in recent weeks.

Cow kill by type

Using data from the British Cattle Movement Service (BCMS) it is possible to get an indicator of the proportion of dairy and beef cattle contributing to total cow kill. We can do this by looking at kill numbers of females aged over thirty months (OTM), split by type (dairy/beef).

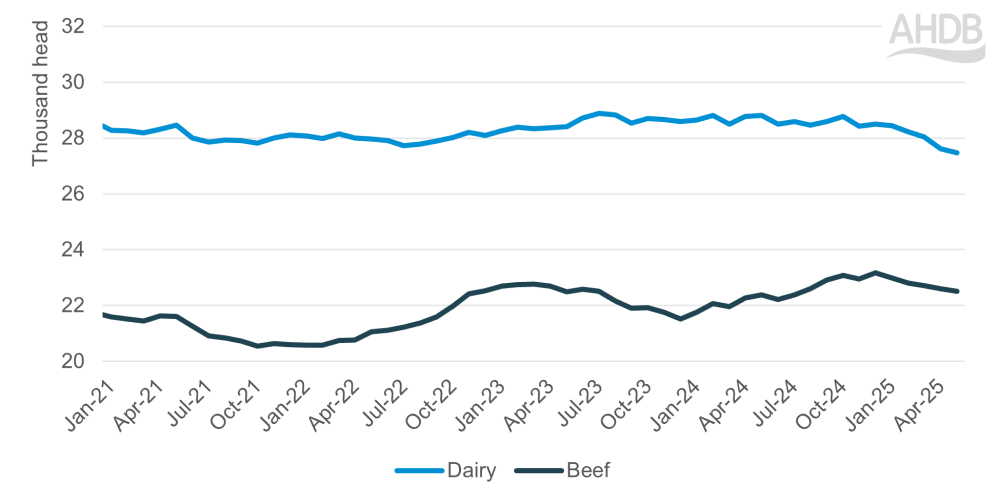

Historically, greater dairy cow populations have consistently led to a larger proportion of dairy animals in OTM female slaughter than beef. However, we have seen that proportion of total OTM female slaughter as dairy ease back from 57% in 2023 to 55% in 2024 and the same for 2025 year to date. This has, in tandem, meant that the contribution of beef females has increased.

If we look at this movement in terms of actual kill numbers on a longer-term trend, we can see that whilst dairy female kill has stayed relatively level over the past five years, beef female slaughter has risen throughout 2024, contributing to higher cow kill during the year. This was likely at least partly driven by strong beef prices.

Coming into 2025, numbers of both dairy and suckler cow kill have fallen away. The drop appears steeper for dairy, with the number of dairy female OTMs slaughtered down 9% year on year for the period Jan-May. In comparison, beef female OTMs have seen a 7% fall in the same period.

Rolling 12 month average OTM female kill by type

Source: BCMS, AHDB calculations

There are a few potential drivers for reductions in slaughter on the dairy side. Stronger milk prices of late may be incentivising greater cow retention to maximise production income, while reports suggest sourcing replacement heifers is difficult due to cost and movement restrictions for disease on the continent. We have seen the dairy herd size begin to stabilise, following a few years of steeper decline, potentially indicating a slowing in national herd reductions, again reducing cows available for slaughter.

Turning to sucklers, the challenges leading to long term declines are well documented and include the continued decrease in government support payments and other policy changes, competition for land use and profitability concerns. With this long-term trend of herd reduction, against fairly steady annual slaughter rates, are we now reaching a crunch point where available supplies are not able to sustain historic kill levels? Looking at BCMS registrations data, we have seen a slowing in the rate of decline for beef calf registrations, however this growth is mostly driven by increases in dairy beef with continued decline in suckler-bred calves.

Conclusion

The data from early 2025 points to a continued tightening of cow supplies, with both dairy and suckler cow kill numbers declining compared to previous years. The sharper reduction in dairy slaughter appears to be linked to increased retention of cows and heifers, while structural challenges persist for the suckler herd.

With ongoing market and policy headwinds, it seems likely that historic levels of cow kill may not be sustained in the near future, with the latest beef outlook reflecting this sentiment. This ongoing supply tightness would be expected to continue to support prices, however demand will be a key watchpoint to maintain the balance.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.