New Zealand's sheep crop and what it could mean for exports

Thursday, 6 April 2023

Beef and Lamb New Zealand market update

Looking at Beef & Lamb New Zealand’s outlooks and updates for the 2022 – 23 season, the current estimated lamb crop sits at 20.2m lambs alongside 15.4m breeding ewes. This represents an estimated fall of 8.5% for lamb, and a 6% fall for breeding ewe crops for export from the previous spring.

Production levels fell in the North Island, with farmers holding onto more lambs for later processing as more grass became available, and production fell in the South Island as dryer conditions led to farmers selling stock. These conditions, alongside the unknown impacts of recent weather events of Cyclone Gabrielle, have seen estimates for overall sheep meat export volumes fall on previous years. Since 2018, the overall number of breeding ewes has fallen from 17.2m, a decline of 10.5%.

Where has New Zealand exported to?

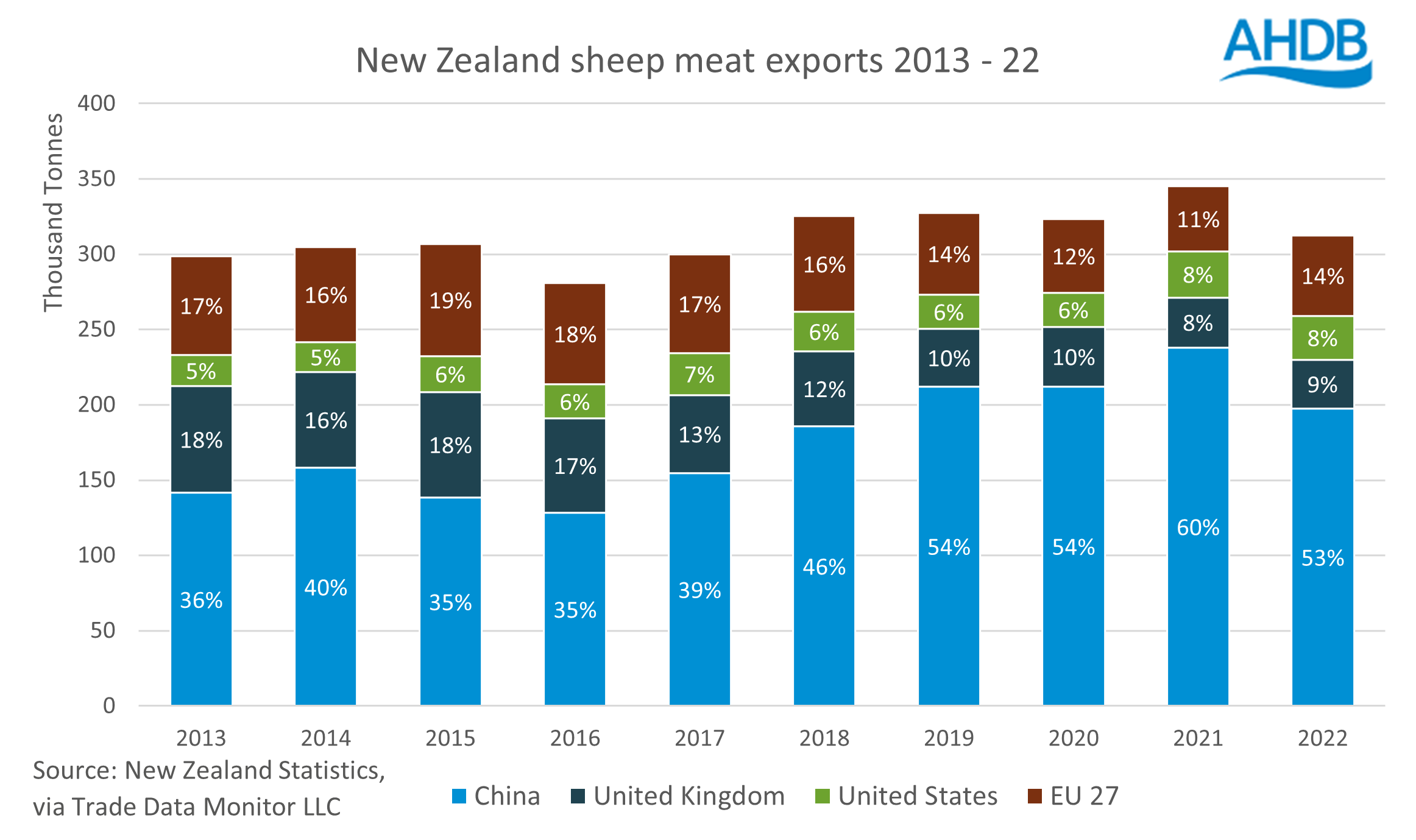

China

Examining the volumes and products that New Zealand export, China has been a key destination over the last five years. Between 2018 – 22, New Zealand sent just under 1.05m tonnes of total sheep meat to China. Total sheep meat exports to China made up 53% of all of New Zealand’s sheep exports from 2018 – 22, which has increased from 37% for the previous five years. Exports to China have risen by 325,000 tonnes (45%) between the 2013 – 17 and 2018 – 22 periods. Frozen bone-in sheep represents 82% of the total sheep meat exports to China over the past five years.

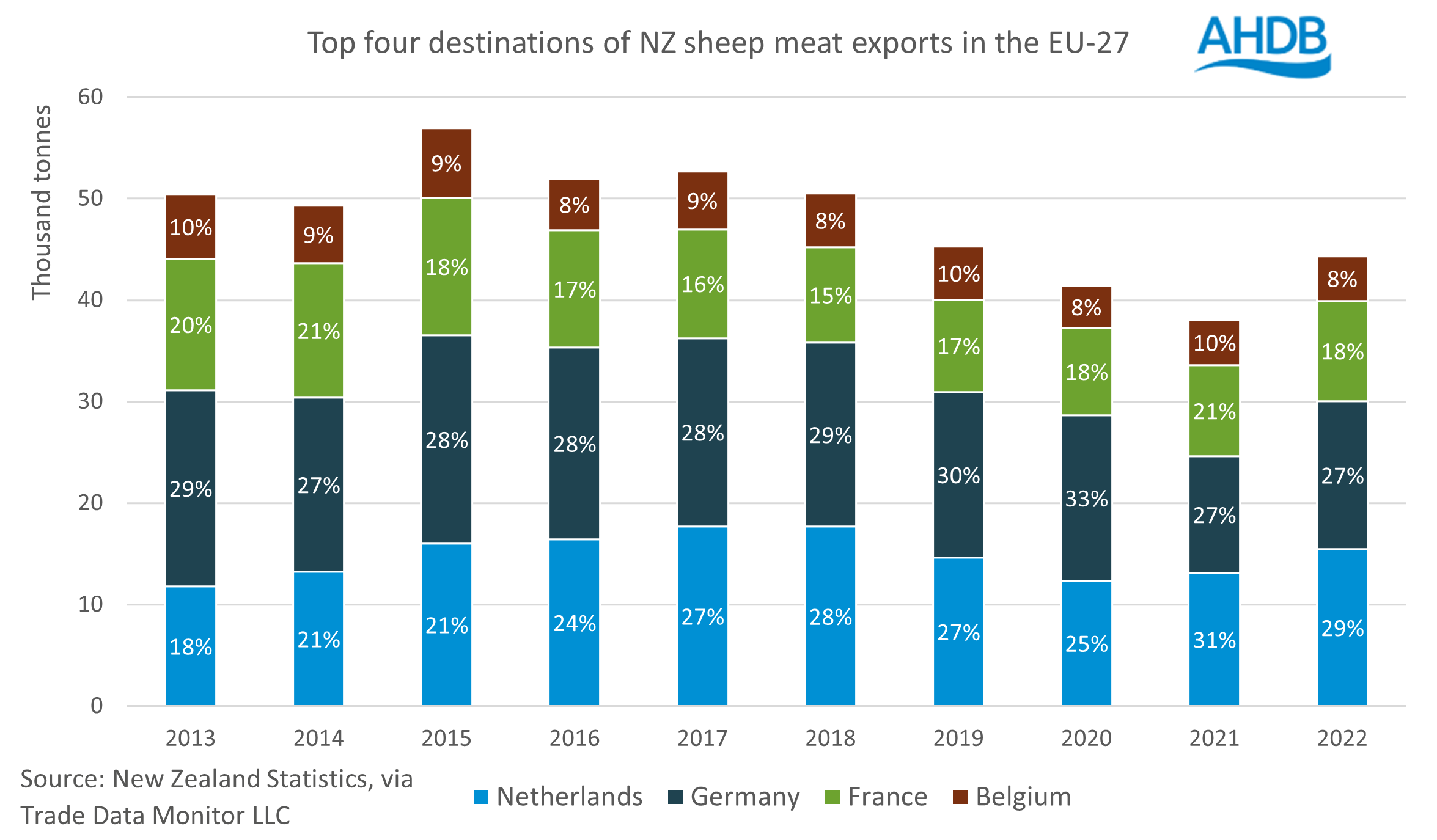

European Union (EU-27)

The second largest market for New Zealand exports is the EU-27. The total volume for this destination was 263,000 tonnes for 2018 – 22, which made up 13% of New Zealand’s global exports. This is down from 18% for the 2013 – 2017 period. From 2017 onwards there has been a slow decline in sheep meat exported to the EU-27 countries, with a low of 43,000 tonnes in 2021.

United Kingdom

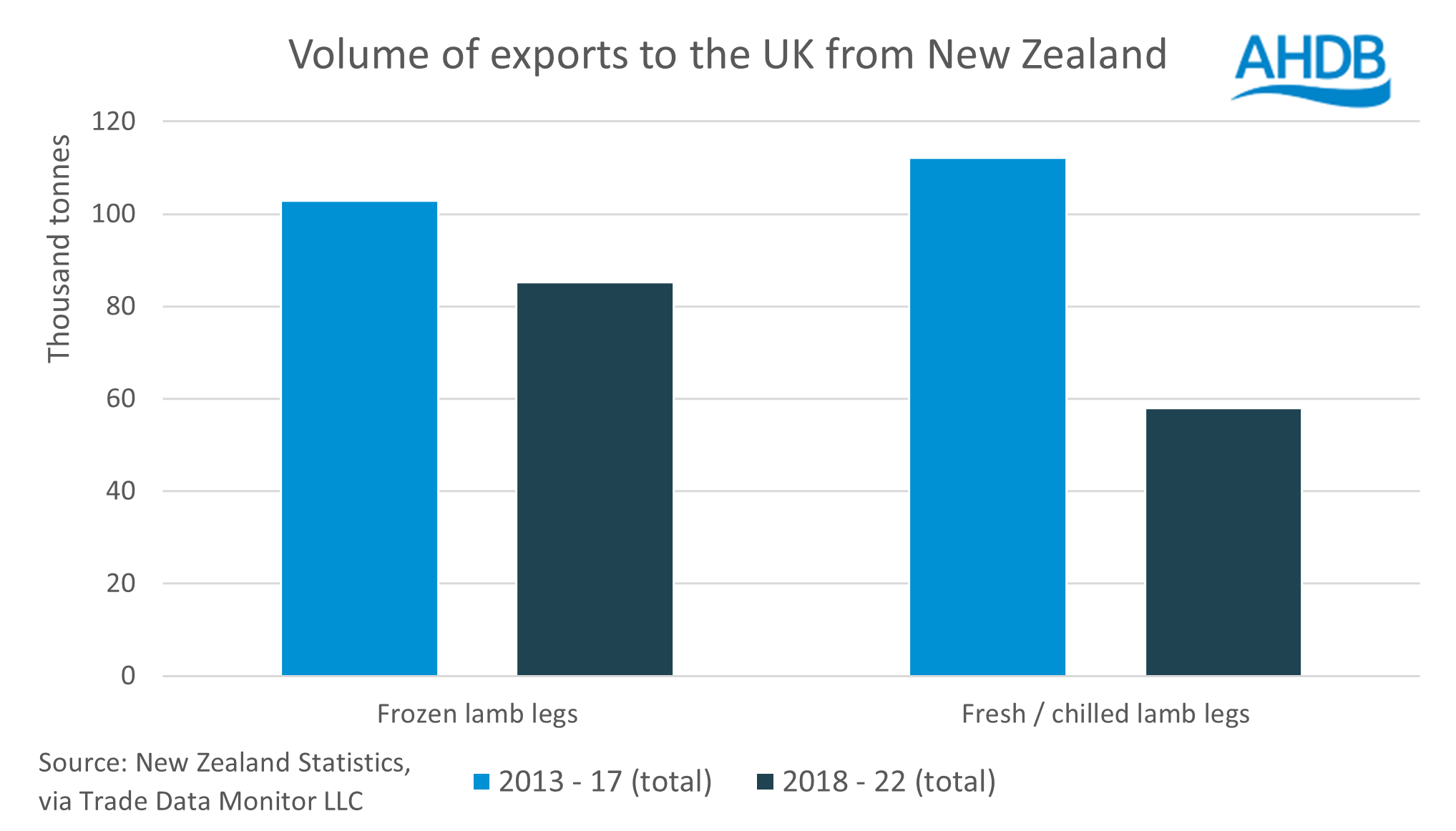

Exports to the UK totalled 193,552 tonnes for 2018 – 22, making up 9.9% of total exports from New Zealand. This is down from 16.3% between 2013 – 2017. Similarly, volumes have dropped by 126,000 tonnes from the 2013-17 to 2018-22 periods.

The largest commodity sent between 2018 -22 is frozen bone-in sheep, as frozen lamb legs. This has seen a 17,700 tonne drop from the total of 2018 – 22 compared to the previous five-year total. The second largest commodity sent to the UK is bone-in fresh sheep meat, as fresh lamb legs, with 58,000 tonnes sent between 2018 – 22. This is down from 112,200 tonnes for the total of the previous five years, representing a 48% drop.

United States (USA)

Exports to the USA made up 6.7% of New Zealand’s total for 2018 – 22. Volumes exported for this period were 131,200 tonnes, which is an increase of 15% from the previous five-year period, from 114,100 tonnes. Frozen sheep meat, bone-in is the highest volume export to the USA at 74,000 tonnes, making up an average of 56% of the total sheep meat exports to the USA over 2018 – 22.

This shows that destinations of New Zealand’s sheep meat exports have evolved over the past ten years, developing the marketplace in China and the USA, at the cost of quantities moving from EU-27 and UK destinations.

How might this impact the UK?

From New Zealand’s export data, we can understand developing trends in NZ’s sheep meat exports. As tighter sheep meat supplies have been estimated in New Zealand, alongside developing dynamics in key export destinations, we may see further falls in exports to the UK and EU-27, with increases to the USA and China depending on market conditions.

This is however dependant on the continued removal of ‘zero Covid’ policies in China, which has slowly opened up their domestic market, with the majority of New Zealand’s sheep meat going to food service industries. As a result of changing consumption patterns from Covid, Chinese consumers were reluctant to eat out, and demand for sheep meat dampened through 2022. The build-up of demand for New Zealand’s sheep meat exports in China hinges on maintaining consumer and business demand through 2023.

If we see consumer demand taper in China through 2023 or wider trade disruption, there could be diversion of New Zealand’s exports to other countries and regions. The recent outline agreement for the UK to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) is expected to have little impact on New Zealand’s exports to the UK, given the existing bilateral trade agreement in place.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.