Oilseed rape for harvest 2022 – how could you mitigate some risk? Grain Market Daily

Friday, 21 May 2021

Market Commentary

- New crop UK wheat futures (Nov-21) closed yesterday at £177.50/t, gaining £1.50/t on Wednesday’s close.

- Domestic markets followed the gains seen in Paris wheat futures (Dec-21) which rose €2.00/t to close yesterday at €212.25/t. Strength in the maize market offset pressure from favourable crop conditions for Northern Hemisphere wheat.

- Chicago maize (Dec-21) closed yesterday at $217.32/t gaining $5.12/t on Wednesday’s close. Recent strong US export sales to China, combined with a forecast short-fall in the Brazilian safrinha crop provided support to the market.

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Play a part in creating accurate data for your industry by completing the planting survey form. Five minutes of your time can provide huge value to our great industry.

Oilseed rape for harvest 2022 – how could you mitigate some risk?

The support in harvest 2022 oilseed rape (OSR) values could pose a significant incentive for growers to plant this crop this summer.

Many growers have turned away from OSR in recent years, often citing challenging weather and pest issues as the reason. However, Farmbench data from 2017 to 2020 illustrates that positive net margins are still possible if yields can be achieved.

So, what are OSR prices for harvest-22?

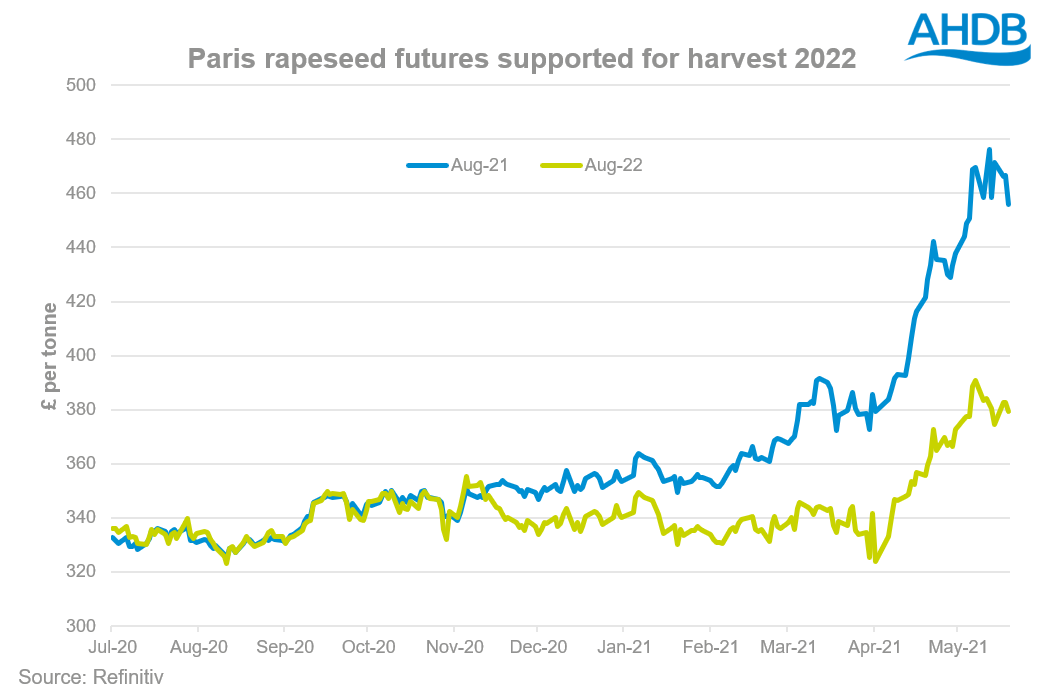

Currently the 2022/23 season OSR harvest prices are well supported. Yesterday, Paris rapeseed futures (Aug-22) closed yesterday at £381.89/t. However, it has closed as high as £390.64/t on May 7th. Fundamentals driving the whole oilseed complex have been well documented, and the continued bullish outlook is providing support to both Aug-21 and Aug-22 contracts.

Forward selling but mitigating risk

With harvest-22 prices considerably above 2017-2020 ranges, some may be looking to forward sell to lock in some of these gains. However, depending on the size of the commitment, forward selling a percentage comes with the risk of unexpected yield loss. Overcoming such exposures may increase a growers cost of production, and subsequently erode potential margins.

This pressure could be mitigated by taking out an options contract on the Euronext rapeseed futures contracts. For an introduction guide on options trading, be sure to read Alex’s article on this.

By trading options, you can gain an income off the market moving up or down depending on if you buy a call or put option.

So how does Aug-22 currently stand?

Presently there isn’t sufficient data or evidence to steer whether the 2022/23 marketing year is bullish for rapeseed.

However, as plantings and intentions become more concrete by the end of this year, fundamentals can start to clarify market sentiment. Some of these key pieces of information are:

- US soyabean crop production for 2021/22 - this can drive the global market, thus impacting 2022/23 marketing year.

- South American 2021/22 soyabean planting progression – impacted this season by the moderate La Nina.

- EU 2022/23 winter OSR planting intentions – planting intentions in the EU at this point will be largely set.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.