Old crop gains and new crop caution: Grain Market Daily

Tuesday, 3 December 2019

Market Commentary

- Although the value of the pound has fluctuated on a day to day basis against the euro as we move closer to the upcoming General Election, there remains a trend for an upward trajectory against the Euro, breaking free of the previous range bound value of £1=€1.16 to settle in the £1=€1.17 range over the last couple days.

- The strengthening pound has somewhat prevented new crop UK feed wheat futures (Nov-20) from gaining further relative to Paris milling wheat futures (Dec-20). With Nov-20 UK feed wheat futures potentially pricing at an import level, further strengthening of currency would add pressure to domestic markets.

Old crop gains and new crop caution

Old crop global wheat futures have been recording gains recently. Chicago wheat futures (May-20) have risen over 5% from the market low in mid-November. Similar gains have been recorded in Paris futures, with May-20 having gained over 3% from 15 November.

Part of the drive for increasing global wheat prices has been rising Black Sea markets as both export and domestic demand has reportedly seen an increase.

Support for old crop markets has also come from further cuts to production estimates for the drought impacted Argentinian wheat crop. Analysts have reduced the crop forecast to 18.5Mt from 18.8Mt (Buenos Aires Grain Exchange). USDA currently forecast a 20Mt crop with the next WASDE due December 10.

With a severely impacted Australian wheat crop, Asian markets will likely procure an increased proportion of Argentina wheat from this downgraded crop. This could well provide some additional support into 2020 for old crop markets.

New Crop Caution Required

Yet while there are some supportive factors for old crop markets, caution is required for the extent to which global markets can lift.

The outlook for 2020/21 is for a continued well supplied global market. It has been reported that the Russian winter wheat area has expanded again, with 18.2Mha of sowing complete, up from 17.6Mha. Additionally, a Russian weather centre (Hydrometcentre) has stated that winter crop conditions are better than last year and have improved following recent rains.

Conditions of winter wheat in the US are also in line with previous years with 52% of the crop in good or excellent condition at the end of November and milder temperatures than usual.

The good condition of US wheat and a likely increase in supply across the Black Sea region will underpin much of the global market outlook for 2020/21.

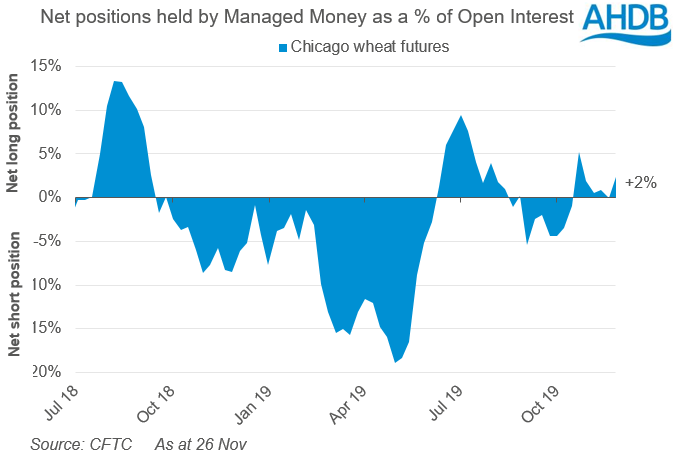

As such, the overall net position of investment funds in Chicago wheat is in a very marginal long position, indicative of a market which currently lacks any clear long term bullish sentiment.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.