Pork market update: Firmness in North America, but geopolitics present risks

Wednesday, 25 June 2025

Key points

- Pig prices in North America (USA, Canada and Mexico) are currently firm, but have shown volatility over recent months amidst tariff-related uncertainty

- US pig prices are buoyed by lower production and good domestic demand, but strained export relationships pose risks

- Conversely, Canadian prices are supported by robust exports, amid stable production

- Meanwhile, Mexico's market is supported by tight domestic supply and strategic import growth, with disease pressures continuing to limit local production expansion

The three North American markets – USA, Canada and Mexico – are closely linked by trade of both meat and live animals.

Pig (hog) futures markets are currently strong heading towards summer, spurred on by a mix of rising wholesale prices, good demand domestically and for export, and tighter supply across the region.

The tight beef market is also reportedly offering support to the pork sector (and other proteins).

USA

In the USA, lower production and robust consumer demand have kept pig prices firm, while trade tensions have weighed on exports.

The tight US beef market is also adding support to pig prices, as demand for pig meat grows amid beef shortages and price inflation.

Industry forecasts point to slightly lower US pig meat production in 2025, with inventory data showing reductions in the pig crop, potentially linked to disease issues.

The USDA forecasts an annual yield of 12.7 million tonnes, down 1% year-on-year (YoY). Production for Jan-Mar has been slightly lower, as reduced slaughter numbers have offset heavier weights.

The USA is the second largest exporter of pig meat globally behind the EU27, shipping 3 million tonnes in 2024.

US pig meat (incl. offal) exports for Jan-Apr 2025 were down 4% (YoY) at 1.03 million tonnes, with losses to Canada and most key markets in Asia (including China) as tariffs caused friction and uncompetitive pricing.

Exports to Mexico (the USA’s largest market) grew slightly, driven by strong demand. However, US exports were knocked substantially in the month of April, influenced by prohibitive retaliatory tariffs and lack of Chinese export licenses.

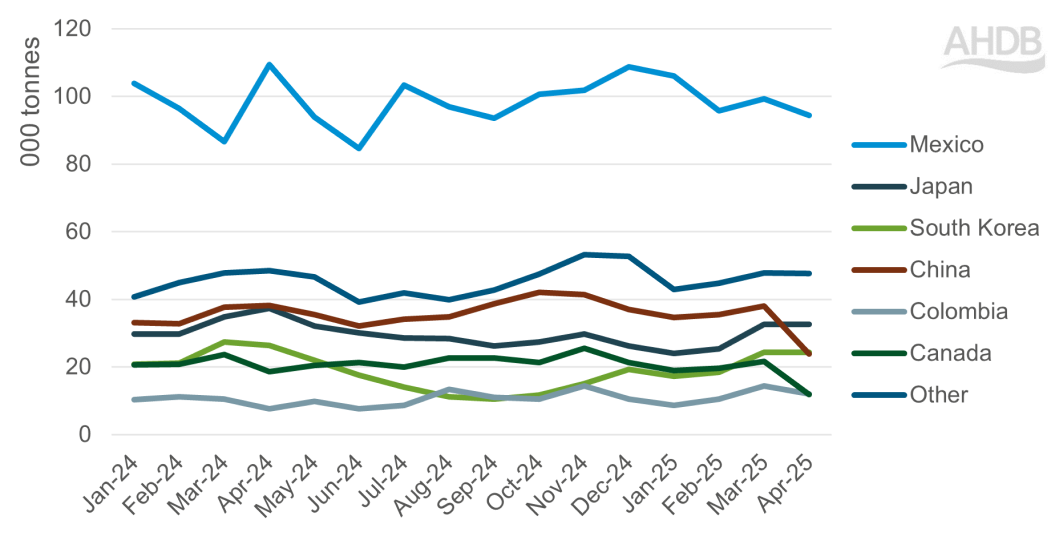

US monthly exports of pig meat (incl. offal) by partner country

Source: US Census Bureau via TDM LLC

This followed a stronger first quarter for China export, as traders looked to shift product ahead of tariff implementation.

In June, a 'trade truce' was reached between the US and China, whereby the steep triple-digit tariffs previously imposed were reduced and a number of pork plants were granted export approval.

This should help trade flows somewhat, but US pig meat and offal (the latter of which the USA is the largest supplier of to China) is expected to remain uncompetitive. The volatile nature of geopolitical relationships remains a risk.

Canada

Meanwhile, across the border, Canadian pig prices are also experiencing upward momentum. Strong export performance has helped to offset higher-than-anticipated production levels in Q1 2025, supporting prices generally.

Against softer feed prices, current pig prices are benefitting producer margins.

Canadian pig meat export volumes were up 4% for the first four months of the year at 491,100 tonnes (incl. offal). Disruption to US exports on the global market is benefitting Canadian trade, helped by a weaker Canadian dollar.

Canadian exports grew particularly to Asian markets including Japan and South Korea, as well as Mexico. Shipments into the USA were down 7% on the year. Canada is the fourth largest exporter of pig meat globally, shipping 1.3 million tonnes in 2024.

Modest increases are forecast for Canadian pig meat production in 2025, supported by more favourable producer margins and reduced live trade into the USA.

Mexico

Mexican pig prices are firm on tighter market supply. Production for the first quarter of the year was up slightly YoY, but disease challenges are persisting and limiting production growth.

This theme is expected to remain through the summer, limiting supply and keeping prices supported generally. However, the USDA forecast Mexican pig slaughter to grow modestly in 2025 (+2% YoY), as high prices and favourable producer margins encourage production.

Mexican pig meat import volumes grew strongly through Q1 2025, up 14% YoY at 437,000 tonnes. Most of the growth came from the USA, despite risks of tariffs.

Mexico’s imports have diversified however, with more product coming in from Canada and Brazil in the first quarter of 2025.

Mexico is the second largest global importer of pig meat behind China, importing just under 1.5 million tonnes in 2024.

Looking ahead

The interlinked nature of the US, Canadian and Mexican pig meat sectors, and their respective placings on the global market means that knock-on effects of changing market dynamics can be far-reaching.

While the current situation appears bullish, the market remains subject to risks of disease and geopolitical tension. Trade disruption between the US and China may weigh on global prices as excess US product finds a home elsewhere.

This could result in additional competition within other prime export markets, but may create opportunity for others into China, particularly for offals. However, the tighter supply outlook for the US may work against this and keep markets relatively balanced overall.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.