Pork market update: How has hot weather impacted the domestic market?

Tuesday, 26 August 2025

According to the Met office, July 2025 was the UK’s fifth warmest July since records began in 1884, with daily maximum temperatures 1.7°C above average. This follows an extremely dry spring, resulting in summer rainfall remaining below average across the UK this year. Weather trends have provided some opportunities in pig meat demand, but some productivity challenges on farm.

Production

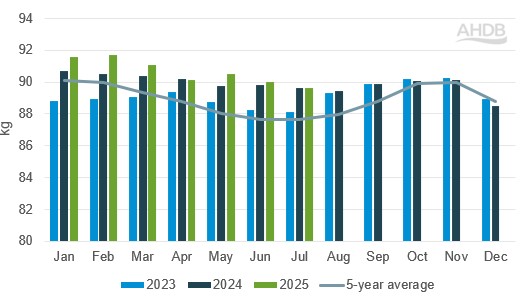

Defra data for the month of July shows that the UK produced 79,700 tonnes of pig meat. This was up on June’s volume by 1,000 tonnes, driven by a larger number of clean pigs slaughtered.

However, year-on-year, pig meat production was 3% lower, the only month in 2025 so far to record a decline.

UK monthly pig meat production volume

Source: Defra

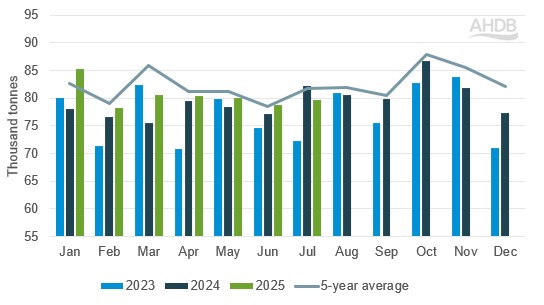

Although slaughter numbers are the key driver to production volume trends in July 2025, carcase weights also have a part to play. Average dressed weights have overall trended higher in 2025 compared to 2024, supporting pig meat production, but in July weights were level year-on-year at 89.6 kg.

Looking at monthly trends, carcase weights have been easing since May, losing 0.9 kg over the last two months (-0.5 kg in June and -0.4 kg in July). Prolonged hot weather in the UK is likely driving this trend, with pig performance lower as a result of the increased risk of heat stress. Excessive heat can reduce growth rates, farrowing rates and litter sizes.

As the hot and dry weather has continued through August, we expect to see a similar trend.

Read more on avoiding heat stress in pigs.

Clean pig carcase weights

Source: Defra

Demand

The Met Office reports in the three months to end of July 2025 there was a 30% increase in sunshine hours compared with 2024 and an 9% increase compared with two years ago.

The increase in sunshine may have helped boost demand for pig meat in the last 12 weeks, but so will its comparative affordability to other red meats, as well as its versatility at mealtimes.

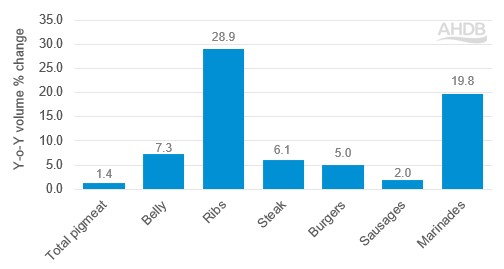

In the last 12 weeks, demand for key BBQ cuts including burgers, sausages, marinades, steaks, ribs and belly have all increased and contributed to pig meat’s overall performance (Worldpanel by Numerator UK, 12 w/e 13 July 2025).

Volume change (%) for key pig meat cuts

Source: Worldpanel by Numerator UK, 12 w/e 13 July 2025

An increase in shopper numbers was a key driver for many of these cuts, particularly for marinades, sausages and ribs, and all of these cuts saw an increase in volumes purchased per shopper (Worldpanel by Numerator UK, 12 w/e 13 July 2025).

Consumers need for variety, speed and ease is seen to matter more through summer (Worldpanel by Numerator UK in home, 2024). Many of these BBQ style pig meat cuts work well with these trends, offering quick to cook meals that are a different way to enjoy pig meat at mealtimes.

Retailers supported many of these cuts with increased promotional activity. Notably, use of temporary price reductions was increased during the 12-week period (Worldpanel by Numerator UK, 12 w/e 13 July 2025), perhaps as retailers reacted to good weather to entice shoppers to impulse purchase these cuts.

As price is one of the key drivers for those cutting back on red meat consumption (AHDB/YouGov, May 2025), targeted promotions for products as key times of year is an effective way to increase consumer demand.

However, it wasn’t just BBQ cuts which contributed to pig meat’s positive performance, with sliced cooked meats, mince, sous vide and ready to cook products also in year-on-year growth (Worldpanel by Numerator UK, 12 w/e 13 July 2025).

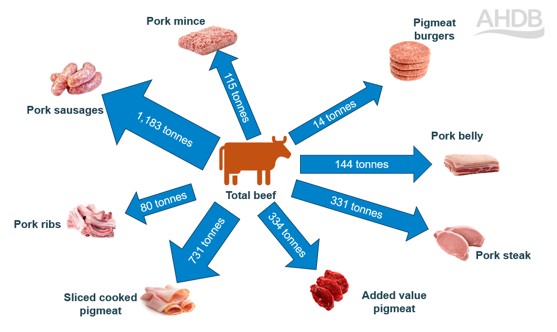

The recent inflation in beef prices will have also likely benefited pig meat positively, as it has been positioned at a significantly cheaper price point. As such, many pig meat cuts have experiences switching into them from beef, likely as a cost saving measure.

Switching movement for key pig meat cuts from total beef

Source: Worldpanel by Numerator UK, switching between beef and key pig meat cuts, 12 w/e 13 July 2025. Added value includes marinades, sous vide and ready to cook pig meat products.

To see more on pig meat performance and retail insights visualised, visit our GB household pork purchases retail dashboard.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: