Prices higher despite positive US maize conditions: Grain market daily

Wednesday, 2 June 2021

Market commentary

- UK feed wheat futures (Nov-21) gained £5.00/t yesterday, to close at £179.00/t. The move higher echoed gains in wider grain markets, with support seen for Paris and Chicago wheat.

- Estimates of Brazilian maize production have seen further cuts, over the past couple of days (read more below). Agrural, a Brazilian agribusiness consultancy, shaved 5Mt off its estimate of Safrinha production, pegging output for the second crop at 60Mt.

- Weather concerns for Northern Hemisphere crop production have come to the fore again. With dryness in the US northern plains and Canadian prairies key watch points.

Prices higher despite positive US maize conditions

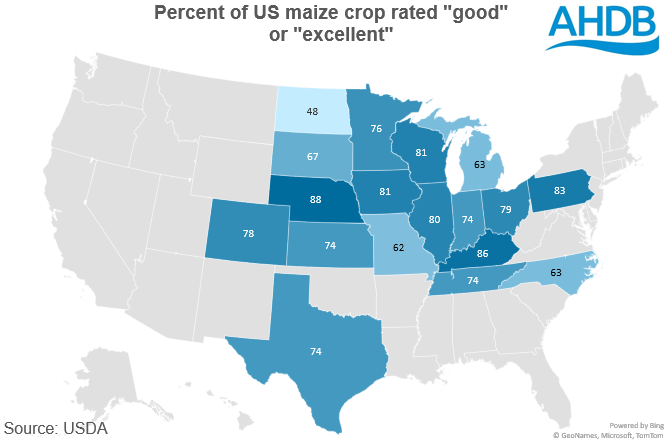

The latest USDA crop report was published yesterday. The report shows the condition of wheat and maize crops at 30 May. Maize crops overall in the US are considered to be in a very strong position, with 76% rated “good” or “excellent”. This is the strongest position for maize crops in week 21 (week ending 30 May 2021) since 2018.

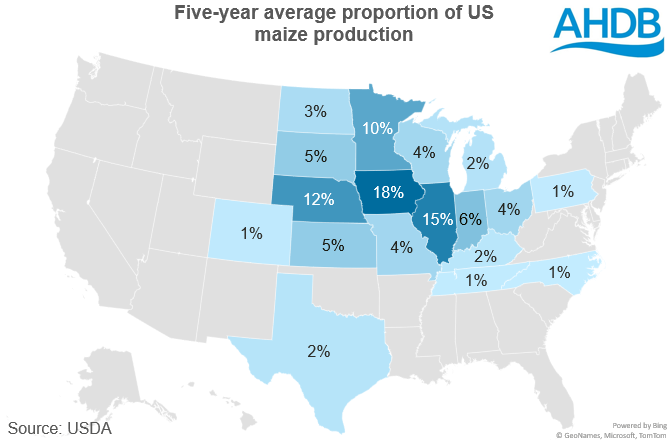

Despite a strong start to the year for maize crop conditions, the relationship between condition in May and final yield is limited to say the least. The strongest relationship is seen between yield and conditions in Kentucky, however that is just a 1.6% US maize production.

A large amount of the impact of crop condition scores at this stage will dictate sentiment, rather than the actual impact on supply and demand. If maize conditions continue to look strong then the positive sentiment would push prices lower.

Despite, the positive sentiment from crop conditions, Chicago maize futures (Dec-21) strengthened again yesterday. There are both technical and fundamental drivers for some of the strength we have seen in the past couple of days.

From a fundamental point of view, StoneX Brazilian office slashed its forecast of maize production by 10.6Mt, to 89.7Mt, including 62.0Mt for the Safrinha crop. Both the USDA and Conab estimates will be updated next week.

A drop in conditions for spring wheat in the US is also a factor of support for grain markets, down two percentage points, at 43% rated “good” or “excellent”. The forecast for key spring wheat states continues to look warm and dry.

From a technical perspective, there are signs of a reversal in the MACD oscillator for Dec-21 maize. The MACD measures the relationship between two averages (12 day and 26 day). The gap between short and long-term average is converging, suggesting a move higher. The latest turning point also sat near to 61.8% retracement of the 30 March low and 7 May high.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.