Prime cattle carcases trending leaner in seven-year data review: Beef market update

Friday, 15 August 2025

Using data from our GB deadweight price reporting sample, we examine how the classification of cattle carcases has changed over time.

Key points

-

GB prime cattle carcases have trended leaner in the period 2019-2024

-

In 2019 grades E to U represented 19% of the total kill and by 2024 this had dropped to 16% following a gradual reduction throughout the period

-

However, in 2024 the proportion of throughput achieving P grades fell year on year by 0.5% returning to 2019 levels

-

For the year to date (to the week ending 9 August) in 2025, 42% of prime cattle throughput achieved either an R3 or R4L classification, compared to 38% over the same period in 2024.

How have prime cattle carcase classifications changed over time?

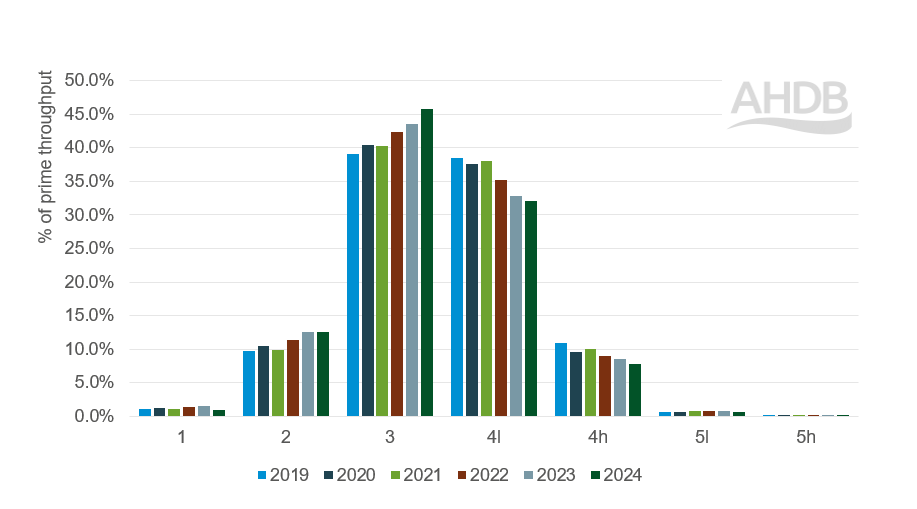

In comparison to 2019, 2024 total prime cattle kill in the AHDB deadweight price sample (including heifers, steers and young bulls) was down across most classifications, with the most marked reductions in numbers being observed on average in higher confirmation and fat classes.

Indeed, carcases trended leaner throughout the 5-year period. In 2019, 50% of GB prime cattle kill was a fat class of 4L or above; by 2024 this had fallen to approximately 41%.

Figure 1. Proportion of all prime kill by fat class 2019–2024

Source: AHDB

Average confirmation across all prime cattle also shifted throughout this period. In 2019, grades E to U represented 19% of the total kill and by 2024 this had dropped to 16%.

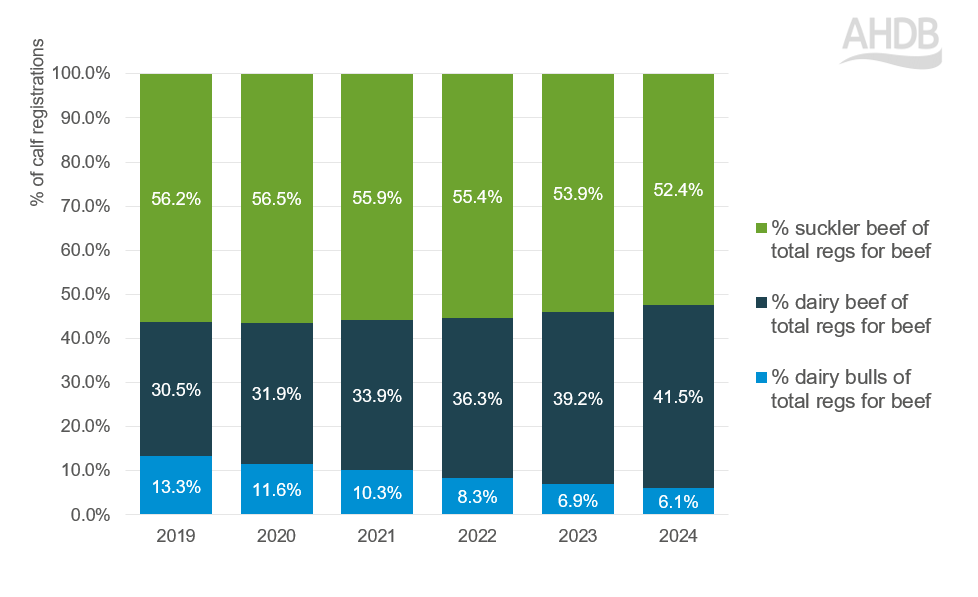

In short, prime cattle carcases have become leaner and have achieved gradually lower confirmation scores throughout this 5-year period, a trend which can be in part attributed to a greater prevalence of dairy-beef animals in the supply chain, as dairy herds find more valuable outlets for calves not intended for breeding.

In 2024, the proportion of GB calf registrations destined for the beef supply chain (beef-bred animals, dairy beef heifers and steers, dairy bulls), that originated from the dairy herd increased to 47%. Dairy beef animals specifically (beef sired to dairy dams) made up 44% of total registrations to beef sires, compared to just 33% in 2019.

Figure 2. Annual percentage calf registrations (for the beef supply chain) by type

Source: BCMS

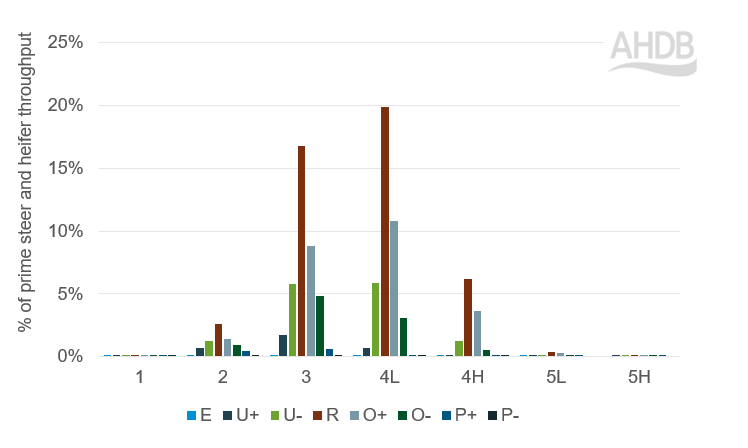

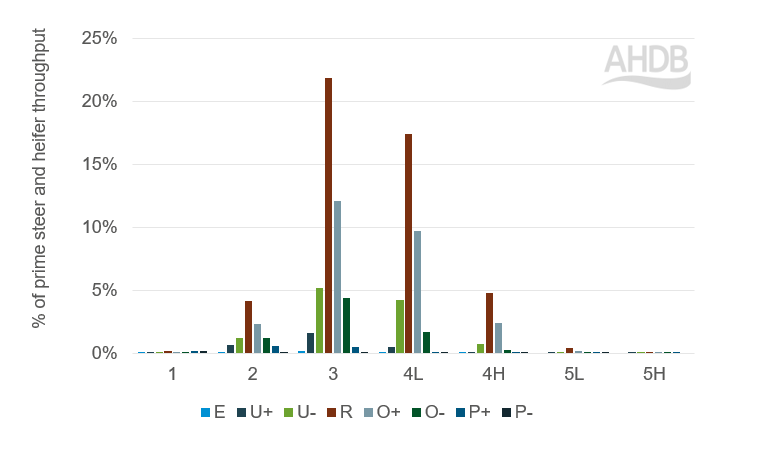

There is, however, some important nuance to these carcase classification figures. From 2023 to 2024 the proportion of prime cattle throughput achieving P grades fell year-on-year by 0.5 percentage points, returning to 2019 levels. This change followed a period in which the proportion of P grades increased year-on-year between 2019 (figure 3) and 2023 (figure 4).

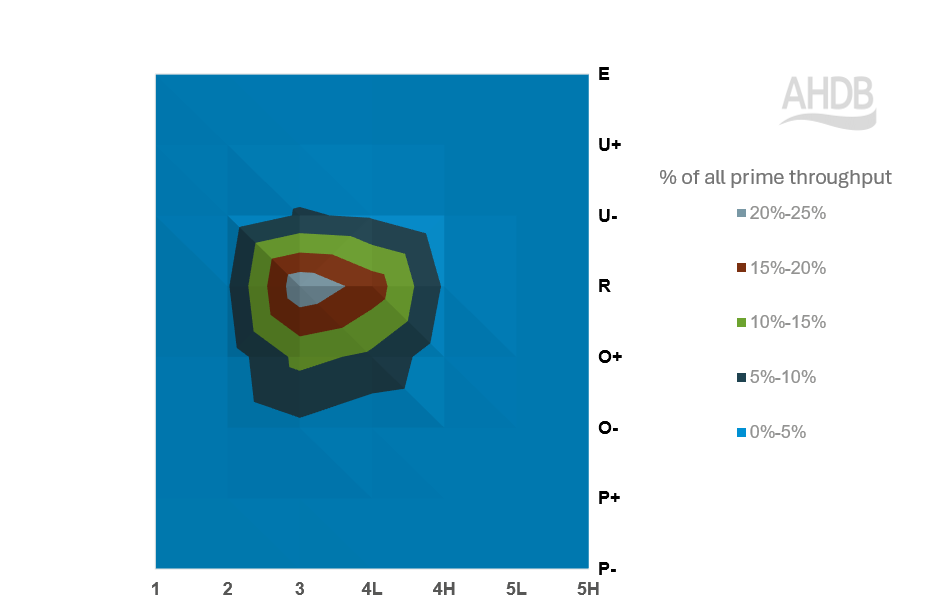

Figure 3. The proportion of GB prime steer and heifer throughput achieving each carcase classification on the EUROP grid in 2019

Source: AHDB

Figure 4. The proportion of GB prime steer and heifer throughput achieving each carcase classification on the EUROP grid in 2024

Source: AHDB

Trends in 2025

Moreover, in the year to the 9 August figures for 2025 signal a further concentration in throughput in the centre of the EUROP grid in comparison to the same period in 2024. Over this period in 2025, 42% of prime cattle achieved either an R3 or R4L carcase classification compared to 38% of YTD 2024 prime throughput in the same period.

Figure 5. Proportion of GB prime cattle throughput across the EUROP grid, 2025 year-to-date (w/e 9 August)

Source: AHDB

Genetic shifts

This concentration in the centre of the grid, combined with the increased dairy beef proportion suggests that there is potentially evidence for continued genetic shifts within the sires used to produce dairy beef. Different traits such as carcase classification, calving ease and days to slaughter are prioritised and re-prioritised depending on conditions and market factors.

Market drivers

Indeed, market factors can be very influential on carcase weights and finish. Higher beef prices and favourable feed costs may incentivise producers to increase finishing weights. Conversely, animals may be sent to slaughter at lighter weights when beef prices are lower and the cost to finish an animal to a higher weight wouldn’t make economic sense.

A prime example of this can be seen in the comparison of the distribution of steer carcase weights between 2022 and 2024. In 2022, key feed components such as wheat and barley peaked in price. Meanwhile, 2024 saw feed prices stay relatively stable and the beef price rose exponentially in the latter half of the year. As such in 2022, carcases trended lighter, with 32% of steer carcases weighing over 380 kg, in comparison to 2024 when 35% of steer carcases weighed over 380 kg. It is also important to note that these trends may have also been compounded by weather conditions. 2022 saw drought across much of the country, whereas 2024 saw a cooler and wetter summer – both of which would have impacted the availability of grazing, forage and the practicalities of keeping cattle.

When looking at our GB deadweight cattle sample so far in 2025, prime cattle carcase weights have tracked above 2024 for much of the year, potentially encouraged by historically high beef prices and comparatively low feed costs. This is further supported when cross referencing with BCMS data which shows an elevated age at slaughter so far in 2025.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.