Rapid US planting weighs on global markets: Grain Market Daily

Tuesday, 5 May 2020

Market Commentary

- UK feed wheat futures (Nov-20) gained £0.70/t yesterday, to close at £161.00/t, as sterling weakened against the US dollar. This was despite a fall in Chicago maize futures, which moved lower as planting of the 2020 crop made rapid progress (more below). The Dec-20 contract fell $1.28/t to $131.50/t.

- Paris rapeseed futures (Nov-20) fell €00/t to €367.50/t due to pressure from the soyabean market.

- The rapid pace of planting in the US was also a factor for the decline in Chicago soyabean prices. However, there was also additional pressure from renewed trade tensions between the US and China – see yesterday’s Market Report – and record April exports by Brazil.

Rapid US planting weighs on global markets

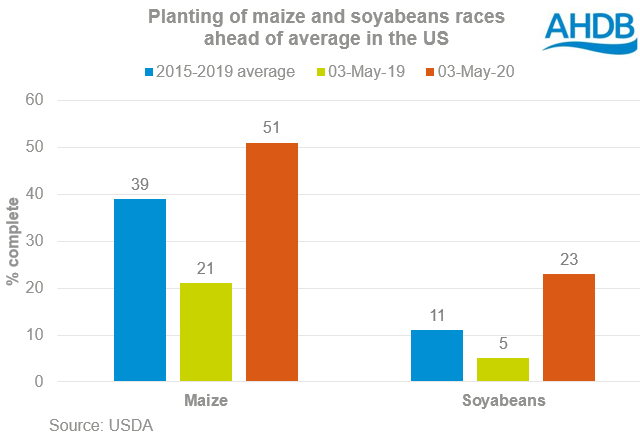

Planting of maize and soyabean crops in the US is ahead of the average pace of the past five years, and the fastest since 2016, according to the latest USDA crop progress report, released yesterday. Progress was also faster than industry expectations according to a poll by Refinitiv before the report was released. The rapid pace was a factor in the fall of Chicago maize and soyabean prices.

By 3 May, 51% of the intended US maize area had been planted. The average for the time of year (2015-2019) is just 39%. Similarly, 23% of US soyabean crops were planted by 3 May 2020 compared to 11% on average. Last year heavy rainfall and flooding badly delayed planting of both crops, so it’s important to compare progress to the 2015-2019 average rather than 2019 alone.

US farmers said back in March that they intended to plant large areas to both maize and soyabeans. The rapid pace of planting increases the chances of the planned large areas being planted.

One area we feel needs monitoring is the potential for US farmers to plant even more fields to soyabeans at the expense of maize. This is because maize prices have fallen sharply due to the coronavirus pandemic, reducing demand for ethanol made from maize (more here). Soyabean prices have also fallen due to the fallout from the coronavirus pandemic but not to the same extent as maize so far.

A larger area increases the chance of an even larger crop. If this should occur, the impact of prices from any possible loss of soyabean trade due to a renewal of tensions between the US and China would multiply up.

Even though European rapeseed supplies are expected to remain relatively tight in 2020/21, UK rapeseed prices will be unable to rise, if global oilseed supplies in total are heavy. The International Grains Council currently expects soyabean production to exceed demand in 2020/21 – the first forecasts from the USDA will be released next week (Tuesday 12 May).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.