Russian wheat to continue to weigh on the market? Grain market daily

Tuesday, 7 February 2023

Market commentary

- Old crop UK feed wheat futures prices (May-23) closed yesterday at £235.90/t, up £1.55/t from Friday’s close. New crop futures (Nov-23) closed at £230.10/t, gaining £1.20/t over the same period.

- Our domestic market followed Paris wheat futures up, which were supported by strong international demand. There were two new tenders issued by Algeria to buy 50Kt of soft milling wheat yesterday. Also, South Korea’s Major Feedmill Group purchased around 65Kt of feed wheat in a private deal on Friday, with a mixed origin.

- Paris rapeseed futures (May-23) closed at €549.75/t yesterday, up €4.50/t from Friday’s close. Rapeseed prices followed upward movements in palm oil markets, following Indonesia reviewing its palm oil export quota (Refinitiv). Meanwhile, Chicago soyabean futures were pressured yesterday by concerns for the future of US sales to China due to geo-political issues.

Russian wheat to continue to weigh on the market?

An abundance of Russian wheat coming to the market has been pressuring prices in recent months. UK feed wheat futures (May-23) have dropped £10.10/t since the start of the 2023 (based on yesterday’s close) and that’s despite the market being supported to some extent over the last couple of weeks.

Russian wheat continues to be competitive in international tenders and exports are continuing to leave the country. Egypt’s state grain buyer, GASC, provisionally purchased 535Kt of Russian wheat in its latest international tender, to be supplied over February and March. Russian origin for the whole amount was offered at a CIF (cost, insurance and freight) price of $322.80/t – $325.80/t.

Russian consultancy, SovEcon, have estimated wheat exports for January at 3.7Mt, significantly higher than the 1.4Mt recorded in January 2022. This takes total exports for this marketing year to date (Jul to Jan) to an estimated 26.2Mt. Currently, SovEcon have full season Russian wheat exports pegged at over 44Mt, which leaves around 18Mt to be shipped from February to June. However, the analytical firm, Interfax, has recently suggested that Russia may export between 30 to 35 million tonnes of grain during the first half of 2023, with the majority of that likely wheat.

Looking ahead, there is a lot that could happen between now and the end of this marketing year. For example, the Ukraine grain export corridor may not be renewed in March or Russia’s export tax could kick in, constraining exports in the name of ‘food security’. These will be a critical watchpoints, but as it stands now, it’s looking likely Russia will continue to supply the market with wheat.

What can the future hold for Russian wheat?

Currently, plantings for harvest 2023 are also a critical watchpoint. What we do know for the future is that Russia provisionally still has a very large wheat crop coming, which has the potential to continue weighing on grain markets as we head into the 2023/24 marketing year.

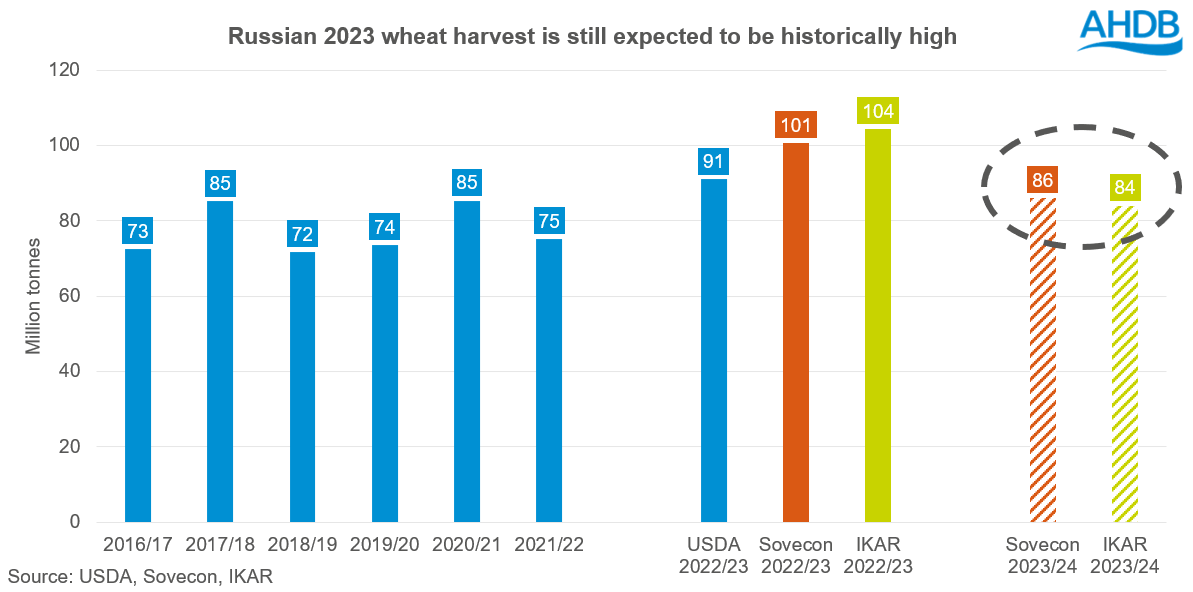

Both SovEcon and IKAR estimate the 2023 Russian wheat crop at 86Mt and 84Mt, respectively. Recently IKAR have revised their wheat estimate down (-3Mt) as there is drought concerns in the southern parts of the country. SovEcon have maintained their forecast, but did note that dry weather is becoming a problem. What is critical to note, although down on the year, the size of next season’s crop remains historically high.

On the point of weather, rains are expected in the North Caucasus and southern regions of Russia over the next week, which will improve some soil moisture concerns.

To conclude, this season’s record Russian wheat crop has the potential to continue weighing on the whole grain complex, if the export pace remains. Looking to next season and Russia are expecting another large production year, albeit not as big as 2022. Russia’s wheat exports this season, and the size of next year’s crop will likely continue to be a macro sentiment setter for global and domestic wheat markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.