Sheep meat imports rose 37% in 2024 amidst record prices and lower domestic throughput

Thursday, 20 February 2025

Lower UK production and sustained demand led to record deadweight sheep prices in 2024, hitting highs of 893 p/kg (SQQ) in May. These lower volumes and higher prices created an interesting yearly trade picture, with a dramatic increase in total sheep meat import volumes (up 37% on 2023), and a decrease in export volumes (down 5%). However, the value of exports grew 6% on the year.

Key points

- Sheep meat imports to the UK increased by 37% in 2024.

- Australia’s share of UK sheep meat imports is growing but is less than a quarter of total UK sheep meat imports.

- UK sheep meat exports declined by 5% over the year but increased in value by 6% reflecting the strong domestic prices seen in 2024.

Imports

In the newly released December 2024 trade data, we saw a continued trend of falling imports of sheep meat (down 11% from November volumes) from the peak volumes seen in June.

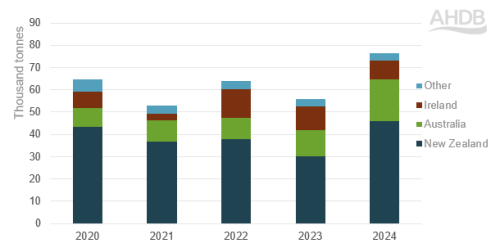

For the whole year of 2024 import volume was up 37% to 76,500 tonnes, mirrored by an increase in value of 29% to £353 million.

This increase in imports was driven by the shrinking domestic supply, high UK farmgate prices, and the co-incidence of religious festivals spurring demand. Imports from the southern hemisphere grew to meet UK demand with imports from New Zealand, the majority supplier, up 51% to 45,800 tonnes and imports from Australia up 62 to 19,000 tonnes.

Total UK sheep meat imports by supplier (annual)

Source: HMRC Data Compiled by Trade Data Monitor LLC

All product categories saw increases on the year, but high value cuts such as frozen legs of lamb and frozen boneless cuts led the way for imports making up 27% and 19% of 2024 imports respectively.

Peaks in imports from the southern hemisphere were once again observed seasonally in March and June, but were far more pronounced than year earlier levels, demonstrating a 58% increase in March and a 68% increase in June compared to 2023.

UK sheep meat imports from Australia and New Zealand

Source: HMRC Data Compiled by Trade Data Monitor LLC

Australia’s proportion of imports continued to grow under the FTA with 62% of its 2024 30,566 tonnes sheep meat quota fulfilled. Australia’s share of UK imports is increasing, potentially signalling a move to diversify their exports and reduce reliance on demand from China. However, the UK remains a small market for Australia, taking only 3% of sheep meat exports, by volume. Moving forwards, after an intense period of destocking, Australian flock numbers and southern hemisphere sheep prices appear to be stabilising, strengthening the global market and somewhat reducing the price differential.

Exports

December 2024 continued the trend of increasing monthly export volumes seen since July, up 10% from November to 9,600 tonnes, reflecting the seasonality of UK production and demand.

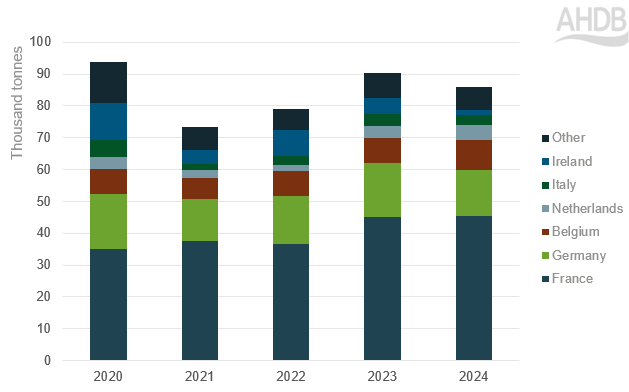

Looking at the yearly totals, total sheep meat export volumes decreased by 5% in 2024 to 86,800 tonnes, driven by lower domestic supply with the lowest number of sheep slaughterings on record observed in October.

However, the value of UK sheep meat exports increased by 6% year on year to £599 million, likely reflective of strong prices both domestically and on the continent.

UK annual export volume by destination

Source: HMRC Data Compiled by Trade Data Monitor LLC

Initially at the start of the year, UK prices were competitive in comparison to the continent, driving exports to the EU. However, as supply constraints started to show, and the UK lamb price gained momentum into the spring, the price differential fell away, as GB prices outstripped French prices from March to June, in line with seasonally reduced export volumes. Exports lifted in the second half of the year, as supply constraints eased slightly, and the GB price returned below France.

The primary exports from the UK in 2024 continue to be fresh and frozen whole and half carcasses (totalling 65,000 tonnes) and fresh/chilled bone-in cuts (totalling 11,800 tonnes).

Whole and half carcase exports saw volume reductions throughout the year, with the largest reductions seen in H1 (down 9% compared to H1 2023) before volumes recovered in H2.

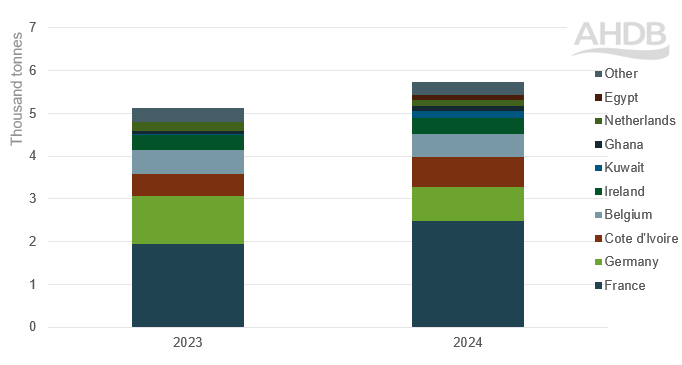

Exports of sheep offal remain important for adding value to the overall carcase. The UK continues to rely on EU for offal exports, but this dependence appears to be reducing with 77% of offal exports destined for the European Union in 2024 compared to 85% in 2023. Notable increases in offal exports to Kuwait and Cote d’Ivoire were in part responsible for this change.

Annual UK sheep offal exports by destination

Source: HMRC compiled by Trade Data Monitor

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.