Spring watch – where will the weather bubble burst: Grain Market Daily

Friday, 24 April 2020

Market Commentary

- UK feed wheat futures have fallen back so far this morning, taking respite following a week of gains. Today is the first notice day on May-20 futures and as a result, we will likely see that contract becoming increasingly “technical” over the next few weeks.

- Nov-20 futures closed yesterday at £169.25/t, an increase of £0.30/t. Markets continued to rise on concerns over new crop dryness (read more below).

- Paris rapeseed futures (Nov-20) are down just €1.00/t Thursday-Thursday, with losses for vegetable oils likely offset by a small recovery in crude oil. Despite strength towards the end of this week, sterling is down against the euro Thursday-Thursday, leaving rapeseed futures up £0.53/t in sterling terms.

Spring watch – where will the weather bubble burst?

As we move through April, and even in the midst of a global pandemic, we have hit the inevitable weather bubble. Since last Friday, new crop UK feed wheat futures (Nov-20) have increased by £5.45/t and new crop (Dec-20) Paris milling wheat futures by €4.50/t.

To my mind there are four global weather situations playing out at the moment and a further one that is very much worth keeping an eye on.

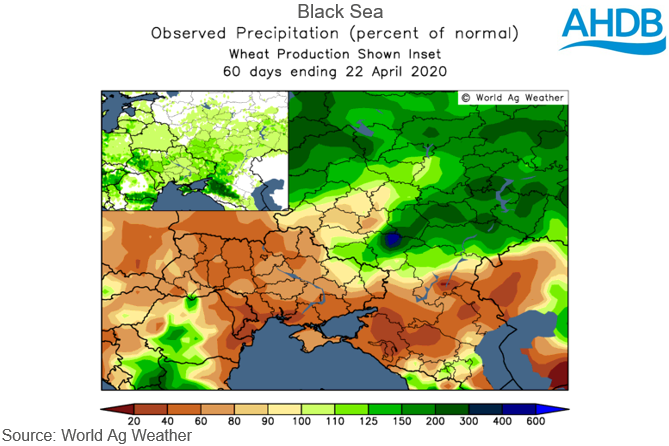

Black Sea – Dryness has offered support to the market. Rainfall is expected in the next 15 days, although current forecasts suggest it may not be sufficient in key areas.

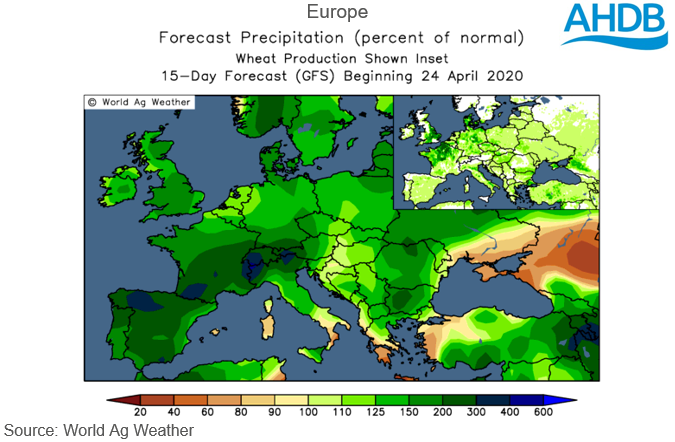

Europe – Remains dry and crop conditions have fallen in kind. EU weather offersless market support than Black Sea conditions with smaller crops already expected. Rainfall is expected to be greater than average over the next 15 days for much of the continent.

South America – Maize crops remain dry in both Brazil and Argentina. Significant rain is expected in the later in the next 15 days, although Brazil is forecast to stay dry. In my opinion this situation alleviates a bearish lack of demand, rather than being rampantly bullish.

North America – Planting of spring wheat and maize is behind the average pace, following cold weather. Spring wheat area temperatures are set to hot up, while some of the corn (maize) belt is expected to return to normal.

Black Sea fundamentals play a very large part in global wheat price formation, and ongoing weather and trade stories from the Black Sea this season are no different. We have already seen restrictions on old crop grain exports from the region buoy markets, and this positive sentiment is being supported by ongoing concerns about dry weather.

In the South of Russia, the key region for wheat production, rainfall indices for March and April are very much below normal, with recent rains offering little in terms of relief. Similar is true for weather in Ukraine.

Over the next 15 days, rainfall is expected to hit parts of Russia and Ukraine. However, current forecasts suggest levels will be average or below in key grain producing regions and as such, are unlikely to alleviate the bullish sentiment.

The challenges for new crop production are starting to be seen in some production forecasts. IKAR, the Russia’s Institute for Agricultural Market Studies, reduced its 2020/21 production estimate by 2.3Mt earlier this week to 77.2Mt.

Russian cash prices have seen significant support over the last month. Nearby milling wheat (12.5%, FoB Novorossiysk) has gained $22/t over the month to $230/t yesterday.

While demand is being capped by coronavirus measures in Europe, dryness on the continent (as well as in the UK) is a growing concern.

After the winter we have had, it seems surreal to say that there are now reportedly drought concerns building in some countries, bringing a new sad irony to the phrase “it never rains but it pours”.

Over the next 15 days, rainfall in many key grain-producing parts of Europe is expected to be limited. The fundamental support from a tightening of EU and UK production is less than that of the Black Sea region. Non-EU trade is already likely to be reduced next season, and parts of the EU (inc. UK and France) are already expected to see dramatic reductions in their export campaigns year-on-year.

French crop condition scores from FranceAgriMer declined once again in the week ending 20 April. The proportion of French winter wheat rated “good” or “very good” fell by 3%, while the proportion of spring barley fell by 9%.

Despite the ongoing dryness, above average rainfall is expected in the next 15 days, which will alleviate some concerns.

At present in Brazil, the safrinha maize crop is going into the ground. However, conditions in South America have been less than ideal for both the maize and soyabean crops.

Soil moisture in key maize growing parts of Brazil remains well below average, with recent rains doing little to alleviate the poor conditions. The maize picture is serving more to ease downward pressure on prices rather than acting as a rampantly bullish factor, as it normally might. This is primarily driven by the overwhelming lack of demand for maize from the ethanol sectors in both North and South America.

Nearby Chicago maize futures have seen a small resurgence in the past week, but this is not overly surprising given prices had fallen to their lowest since August 2016.

Dryness is similarly an issue for Northern Argentina. The Beunos Aires Grain Exchange has reduced its forecast for soya production as a result in the past couple of weeks.

As we move through April and into May the pace of plantings in North America will be a key watch point for markets. Although still very early days, plantings of both maize and spring wheat are behind their respective five-year averages.

Cold weather has reportedly been delaying plantings, with spring wheat planting particularly behind schedule in Minnesota, Montana and the Dakotas.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.