Store cattle price inflation remains above the deadweight market

Friday, 25 July 2025

While record deadweight cattle prices have grabbed the headlines recently, the store market has also seen some exceptional dynamism. This article examines the current position of the store cattle market and explores recent underpinning trends.

Prices as of week ending 13 July 2025

Key points:

- Store markets have seen impressive momentum throughout 2024 and 2025 with prices for cattle currently standing over 40% higher year on year for certain categories.

- Average prices paid for 18–24-month-old stores peaked in the week ending 3 May 2025 – and are currently declining.

- Prices paid for 12–18-month-old stores have started to rise in the past couple of weeks potentially as finishers compete to secure long-term supplies.

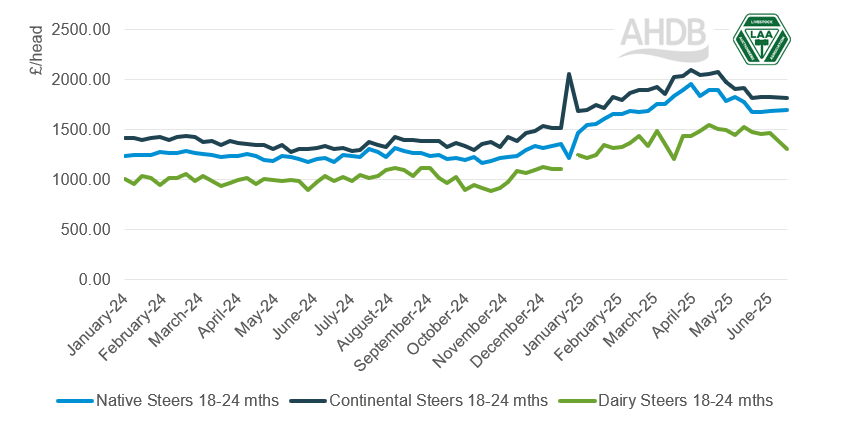

18-24-month-old stores

The market for 18–24-month-old stores has seen some significant movements in the last 18 months. Average prices paid in this category across all types have been on an upward trajectory since October last year, peaking in the week ending 6 April this year for continental and native steers at £2,100/head (+£737/head year-on-year) and £1,956/head (+£720/head year-on-year) respectively. This peak in prices for these older stores was seen 4 weeks before the peak in prime finished deadweight prices in the week of ending 3 May this year.

England & Wales store steer prices 18-24 months

Source: LAA

Since this point, average prices paid for 18–24-month-old store animals have eased week on week to stand as below for the week ending 13 July:

- £1,733/head for native steers

- £1,577/head for native heifers

- £1,809/head for continental steers

- £1,688/head for continental heifers

- £1,470/head for dairy steers

Reduced returns at finishing are likely to be a key driver of store price direction as average deadweight prime cattle prices have fallen back to levels seen in February.

Nevertheless, again much like deadweight prices, although these declines look dramatic, they are still very much elevated on the year, with the largest inflation as of the week ending 13 July being seen in the price of native heifers (+48% from the same week last year), followed closely by continental heifers (+47% from the same week last year).

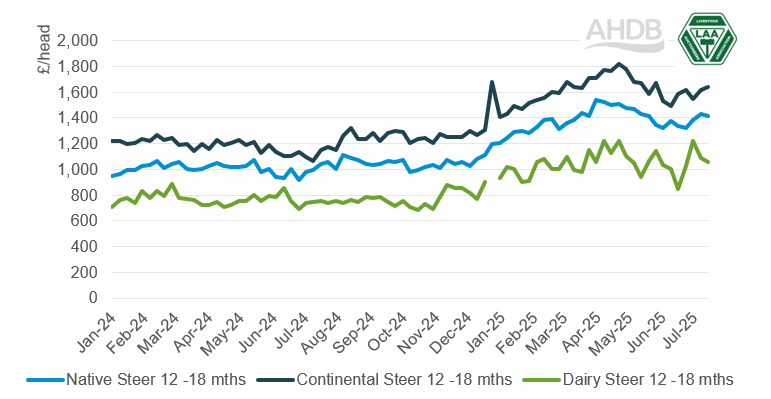

12-18 month-old stores

The 12–18-month-old category has also seen incredible strength over the past 18 months, with average prices for continental steers peaking at £1,817/head in the week ending 27 April before falling gradually.

England & Wales store steer prices 12-18 months

Source: LAA

Despite the current lack of forage for much of the country; unlike the 18–24-month-old category, in the week ending 13 July, the average prices paid for beef bred animals in the 12-18 month category rose across most categories to stand at:

- £1,431/head for native steers

- £1,178/head for native heifers

- £1,617/head for continental steers

- £1,449/head for continental heifers

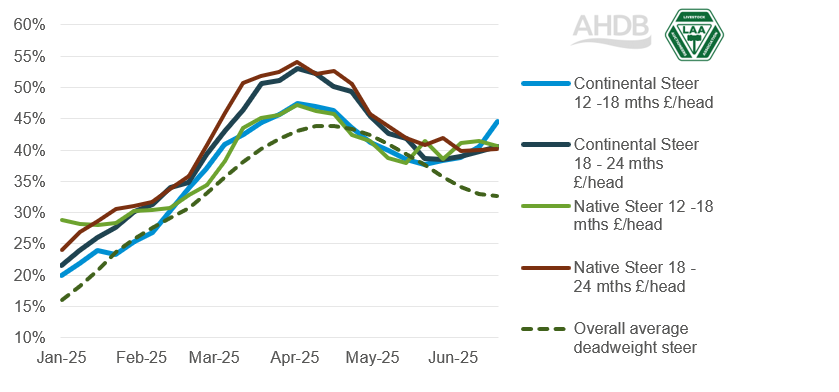

Year-on-year price inflation in the store market has remained mostly above that of the deadweight market since the start of 2025. Indeed, in the week ending 13 July, average annual price inflation for native store steers (12-18 months) stood at 42% compared to the overall average deadweight steer price inflation of 33% year-on-year. This points to the current strength of the store cattle market relative to finished, and the effect that this has on producer margins will be a key watchpoint over the coming months.

Comparing year-on-year price inflation for store and finished cattle; average store steer prices vs overall average deadweight steer price for England & Wales

Source: LAA, AHDB

Notes: prices are 4-week rolling averages.

Throughput

Reductions in cattle supply have materialised in livestock markets in so far in 2025. In fact, year to date cattle (including dairy heifers) aged 12–24-month numbers passing through markets in England and Wales are currently down by -11%, potentially going some way to explaining the price growth we have seen in both live and deadweight sales.

The animal types which have seen the largest reduction in throughput have been dairy steers. Continental type animals have declined in number across all age categories, which aligns with trends highlighted in BCMS calf registration data. Continental type animals have maintained their price margin over native type animals.

© Livestock Auctioneers Association Limited 2025. All rights reserved.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.