How might the EU-NZ trade deal impact trade? - Beef

Friday, 26 April 2024

The EU-NZ Free Trade Agreement (FTA) will enter into force on 1 May 2024. Trade of goods between the two was worth almost 9.1 billion euros in 2022. The agreement provides improved access into the EU market for New Zealand products.

Improved access for New Zealand goods includes:

- 91% of NZ goods trade will enter duty free from day 1. This will rise to 97% after 7 years

- NZ$100 million tariff savings from day one. This will rise to NZ$110 million after 7 years.

- Increased Tariff Rate Quotas (TRQs) for beef and dairy products.

Potential impact on the EU

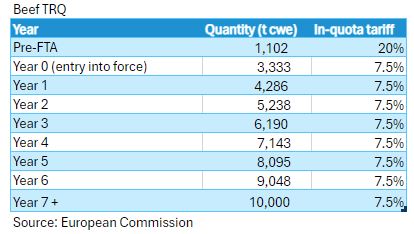

The current quota for New Zealand beef exports to the EU is 1,102 tonnes with a 20% tariff. New Zealand exporters could also access the Most Favoured Nation (MFN) global quota and compete for a total of 116,703 tonnes annually with a tariff at 20%. Any additional export outside of the two quotas would be subject to an out of quota tariff of 12.8% + €141.1 – 304.1 per 100kg.

As agreed in the FTA the TRQ for New Zealand beef entering the EU will rise to 3,333 tonnes in the first year of the agreement and rise to 10,000 tonnes after year 7. There will also be a 7.5% tariff applied to those imports. It is worth noting that these allowances are only available for animals that have been raised under New Zealand pastoral farming conditions which does not include commercial feedlots.

Overview of TRQs and tariffs for NZ beef entering the EU

Source: European Commission

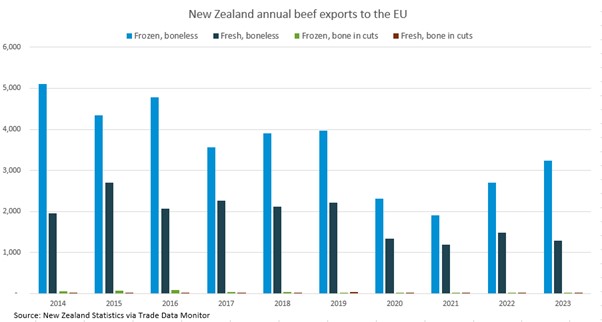

New Zealand beef exports into the EU over the last ten years, showing that exports have almost halved between 2014 to 2023. Volumes have been consistently above the current quota showing that New Zealand beef exporters have also been accessing the MFN global quota. Exports totalled 4,553 tonnes in 2023 slightly higher than the new quota for year 1 of the agreement. Interestingly, even at the highest level in 2014 (6,944 tonnes) this is still a considerable amount lower than the eventual TRQ of 10,000 tonnes. Over the last four years the main cuts exported were fresh and frozen boneless cuts, with approximately one third fresh and two third frozen.

New Zealand annual beef exports to the EU

Source: New Zealand Statistics via Trade Data Monitor LLC

Impact on the UK

In comparison, the UK FTA with New Zealand came into force on 31 May 2023. New Zealand beef will be able to enter the UK tariff free 10 years after the agreement comes into force. The quota volume will increase in equal instalments from 12,000 tonnes in Year 1 to 38,820 tonnes in Year 10. There will also be a safeguard between Years 11 and 15 whereby if volumes exceed the negotiated levels a 20% tariff will apply to New Zealand beef coming into the UK. The safeguard measure will be removed after Year 15 enabling full liberalisation. For more information on the UK-NZ trade deal and the potential impacts see our modelling analysis.

The UK exports a considerable amount more of beef to the EU than New Zealand. On average (2021-2023, 3 year average) the UK exported 90,000 tonnes of beef to the EU. In terms of products, the predominant exports are fresh boneless cuts and carcasses. About a third of New Zealand beef exports to the EU are fresh boneless cuts, but currently in a much smaller amount than the UK, but it will be an important area to keep an eye on as the trade deal comes into place.

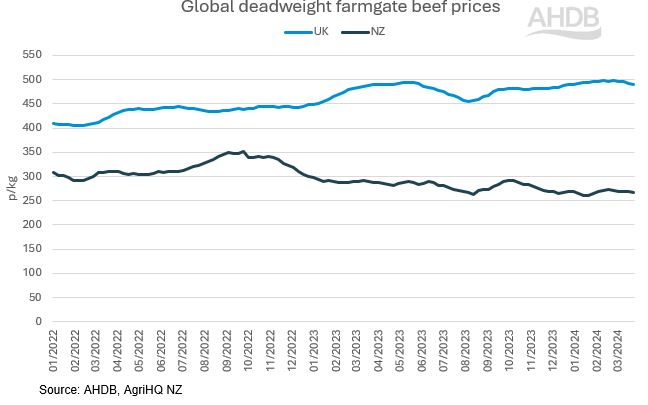

Farmgate prices

Looking at the price differentials across the UK and New Zealand, lamb produced in New Zealand is significantly cheaper than that produced in the UK. As explored in previous articles, cost of production in New Zealand is lower than the UK due to extensive production with little supplementary feeding and housing which will feed into lower prices.

Global deadweight farmgate beef prices

Source: AHDB, AgriHQ NZ

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.