Ukrainian rapeseed pressuring UK rapeseed prices? Grain market daily

Wednesday, 18 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £184.65/t, down £0.10/t on Monday’s close. New crop futures (Nov-24) closed at £199.00/t, up £0.15/t over the same period.

- Domestic markets were sheltered from the pressure on global grain markets to some extent as sterling weakened against both the US dollar and euro. Yesterday sterling closed at: £1 = $1.2178 and £1 = €1.1515.

- Nearby Paris and Chicago wheat markets dropped yesterday as markets lacked any fresh bullish news to give support. Markets supported off the back of Chinese demand have dropped on the back of competitive supplies continuing to leave the Black Sea.

- Paris rapeseed futures (Nov-23) closed yesterday at €420.00/t, down €4.25/t on Monday’s close. Over the same period, all other contracts gained from support in Chicago soyabeans over concerns of planting delays in Brazil. Ongoing US soyabeans harvest is limiting large gains.

Ukrainian rapeseed pressuring UK rapeseed prices?

Since 2019/20, the UK has been a net-importer of oilseed rape (OSR), with imports ramping up as production has gradually reduced. For this marketing year, the UK is provisionally estimated to have produced 1.2 Mt of OSR, down 154 Kt from 2022. In 2023, this crop was largely variable with yields impacted by both weather and pest pressure.

This means that for 2023/24 significant imports of rapeseed are expected to continue, but what exactly does that mean for domestic rapeseed pricing?

Although a domestic deficit would usually indicate a premium to continental rapeseed pricing (to attract imports), over the last six months rapeseed markets have been significantly pressured, with the domestic physical values discounted in comparison to the futures contract values.

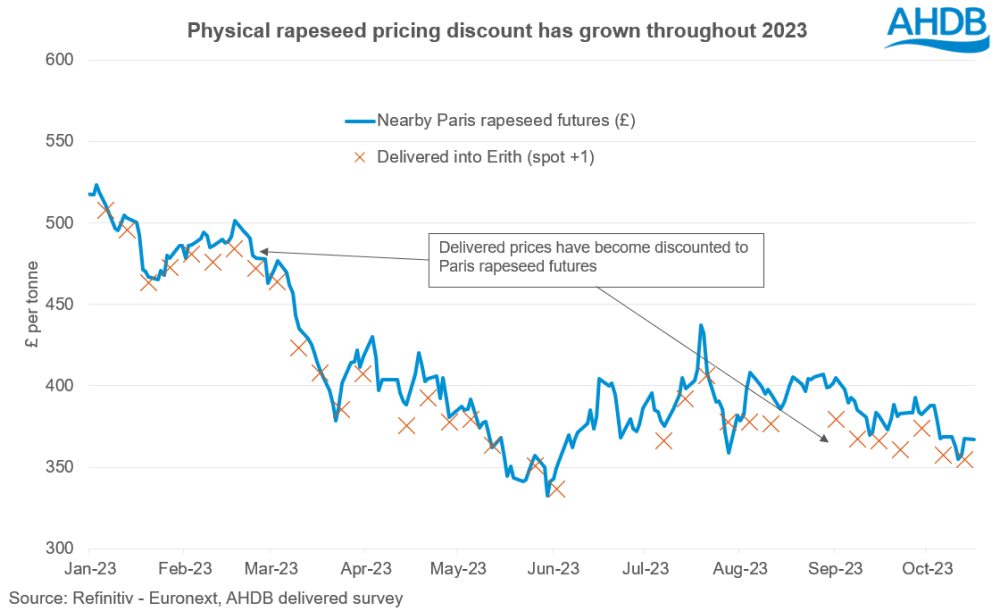

Domestic prices to Paris rapeseed futures

Despite expected to be a net-importer of rapeseed this marketing year, currently nearby domestic rapeseed prices are sitting at a discount to Paris rapeseed futures.

As shown in the graph above, delivered rapeseed (spot +1, into Erith) at the start of this marketing year were at a £3.16/t discount to nearby Paris rapeseed futures. However, based on last Friday’s quotes, spot domestic rapeseed was quoted at £354.50/t, a £13.20/t discount to Nov-23 Paris rapeseed futures, which closed at £367.70/t. This discount has widened since the start of 2023, despite the UK continuing to be a net-importer of rapeseed.

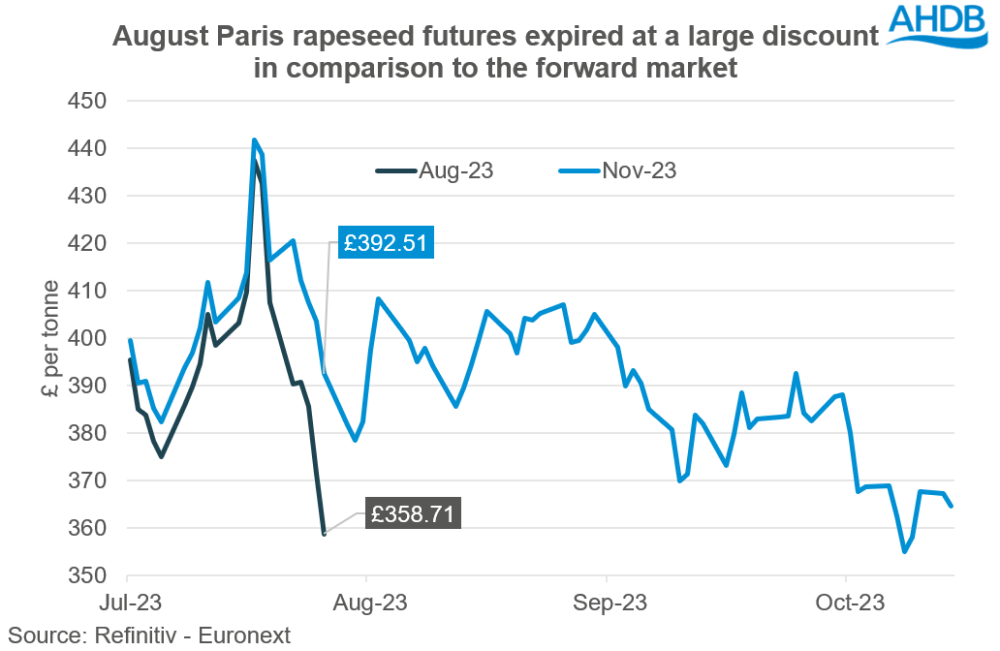

Further to that, August Paris rapeseed futures expired at a large discount to the respective November contract.

This large price drop at the expiry of the contract indicates that there are cheaper physical supplies of rapeseed on the global market.

Why have prices been pressured?

Causing this pressure on rapeseed is the wider longer term pressure in the oilseed complex, from a large South American soyabean crop expected in 2024. A large amount of Ukrainian rapeseed is causing the element of short term pressure to nearby prices.

Currently the continental rapeseed market is being supplied by large amounts of Ukrainian rapeseed. As of 11 October, 1.8 Mt of rapeseed has been exported from Ukraine for 2023/24. Throughout the month of August, Ukraine alone exported 711 Kt of rapeseed, with the potential to export near 1.6 Mt more this season (UkrAgroConsult). There is an element of optimism for continued Ukrainian exports as new sea routes are opened, and Ukraine is pushing to continue expanding its agricultural commodities export routes through countries such as Moldova and Romania.

This large amount of Ukrainian rapeseed is why nearby physical domestic rapeseed prices are discounted in comparison to the nearby Paris rapeseed futures values, and this trend could be set to continue as supplies are scheduled to continue leaving Ukraine.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.