US crops remain in focus: Grain market daily

Tuesday, 18 June 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £198.45/t yesterday, down £4.10/t from Friday’s close.

- Global wheat markets were pressured yesterday as fund selling pressure weighed, with a short trading week in the US. US crop conditions and wheat harvest progress are also a key watchpoint, read more on this below.

- Paris rapeseed futures (Nov-24) fell €8.75/t yesterday, ending the session at €467.00/t.

- European rapeseed prices followed the wider oilseeds complex down yesterday. Chicago soyabeans (Nov-24) fell 1.7% yesterday on the back of forecasts of rain in key soyabean areas in the US. A firm US dollar also impacted export demand.

US crops remain in focus

As mentioned above, global grain prices were driven largely by US crop conditions and harvest progress yesterday. Winter wheat harvest is progressing rapidly, and maize is currently in its vegetative stage, with forecasts of hot weather last week causing concerns over its development. So, what could current conditions mean for grain price movement over the coming weeks?

Winter wheat harvest well ahead of average

Yesterday evening the USDA released its latest crop progress report including data up to week ending 16 June. In a pre-report poll carried out by Reuters, analysts on average had expected winter wheat harvest to have reached 22% completion. However, the USDA reported that harvest was now 27% complete, well ahead of estimates and the five-year average of 14% at this point in the season.

As can be expected, states further south have made the most progress, with winter wheat harvest in Oklahoma now 83% complete. This is ahead of the five-year average for this state of 37% complete at this point in the season.

Over the next few weeks harvest pressure from the US could continue, though information on yield and quality will also be a key watchpoint.

Maize crop conditions

Over the coming week, parts of the US maize belt, including Ohio valley, the Northeast and the Mid-Atlantic, are forecast an extreme heatwave. However, rainfall is also due in these regions limiting the market reaction to these high temperatures. Recent rainfall also helps minimise drought concern.

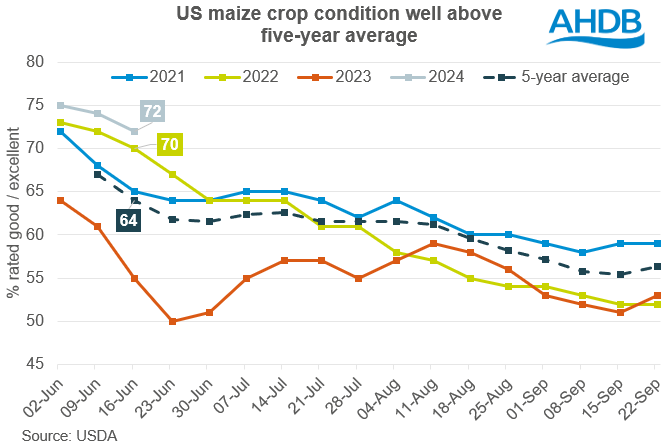

With the US maize crop still in its vegetative stage, the impact of hot and dry weather is also minimised. Though the crop will become more sensitive over the next few weeks as it enters its flowering phase. In yesterday’s report, 72% of the US maize crop was rated in good/excellent condition, down from 74% a week earlier, but above the five-year average of 64%.

Moving forward, the condition of the US maize crop will remain a key watchpoint in global grain markets. If concerns over dryness continue into the crops’ critical development stage, we could see some support in prices as a result – something to watch out for over the coming weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.