US prices climb amid tightening supply: Beef market update

Wednesday, 15 October 2025

US beef prices continue to set records as shrinking cattle herds and strong domestic demand squeeze supply. This is influencing the global market. We unpack the latest stats around the US market, examine the impact on trade flows, and the potential impact for the UK market.

Key points

- US beef prices reached record highs in September, up 30% year-on-year, as feedlot inventories continued to contract.

- Production is forecast to fall 4% in 2025 as slaughter rates ease and carcase weights fail to offset lower throughput. Production is forecast to reduce further in 2026.

- Year-to-date (Jan-Jul) total US beef exports are down 8% year-on-year, with shipments to China dropping by 46%.

- Imports surged by 28% year-on-year (Jan-Jul), led by Brazil and Australia. However, new tariffs are expected to cool volumes during the remainder of the year.

- Global tightness in cattle supply continues to lend support to UK prices, while retaliatory tariffs on US beef may benefit UK exporters in Asia.

Prices

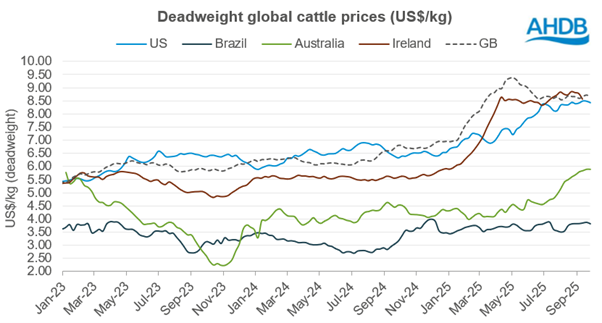

US cattle markets have risen significantly through mid-2025, driven by tightening supply and robust wholesale demand. US average dressed deadweight steer prices in the key five-area marketing region* reached a record $8.50/kg for the week ending 12 September. This record is 30% ($1.96/kg) above the same week a year ago.

Store prices have also surged. Futures markets are currently pricing in continued strength into 2026, with USDA increasing their forecasted figure for 2026. Wholesale boxed beef prices peaked around the July 4th holiday, later easing slightly but remaining historically high.

Despite record prices, projected beef consumption figures for July 2025 have remained consistent with July 2024 sitting at 59.1lbs (26.8kg) per capita. Taken together, this signals price-inelastic US demand for beef and helps demonstrate the role the US has in influencing global beef prices and the direction of trade.

Source: AHDB, European Commission, INAC, MLA, Consorcio de Exportadores de Carnes Argentinas, Informe Ganadero Argentina

Production

A key driver of elevated prices is that US beef production is tightening and is expected to contract further. The USDA now expects 2025 output at 25.93 billion lbs (11.76m tonnes), a 4% year-on-year decline, reflecting a slower pace of slaughter and lower carcase weights in the second half of the year (H2).

Year-to-date US cattle slaughter has totalled 21.1m head as of 20 September 2025, down 1.6m head (-7%) compared to at the same point in 2024.

Feedlot placements (numbers entering intensive finishing systems) have fallen steadily. August saw 1.73 million head placed, down 10% year-on-year. Total cattle on feed at the start of September reported at 11.1 million head, 1% below 2024 levels. These declines are being driven by limited calf availability and higher levels of heifer retention for breeding.

USDA estimates show a 1.3% year-on-year drop in the national calf crop for 2025, while the breeding herd has also contracted, with beef cow numbers down 1.2% year-on-year as of 1 July.

The outlook for 2026 also remains tight, with USDA projecting a further 2% decline in beef production as lower calf numbers and greater heifer retention limit slaughter availability.

Fewer heifers on feed may tentatively point to the slow beginnings of a herd rebuild. In the short run (likely through 2026) this keeps US beef supplies tighter, and prices underpinned. The supply response from larger calf crops would likely not materially emerge until 2027–2028, assuming favourable weather and costs.

Historical and forecast trends in quarterly US beef production (million tonnes)

.png)

Source: USDA

Trade

Exports

Total US beef exports (fresh, frozen, processed and offal) have slowed notably in 2025. July shipments totalled 86,000 tonnes, down 18% year-on-year, with total year-to-date (Jan-Jul) exports at 662,000 tonnes, down 8%.

The most significant reduction was to China, where volumes fell by 46% year-on-year. This was largely due to the lapse of facility registrations and the imposition of retaliatory tariffs and ongoing trade tensions. The USDA now forecasts full-year 2025 exports at 2.68 billion lbs (1.22m tonnes), down 11% on 2024.

Elsewhere in the export picture, South Korea retained its position as the largest overseas market for US beef in the first half of 2025. Shipments totalled 145,000 tonnes between January and July, up 10% on the year, driven by consistent demand for high-quality grain-fed cuts despite broader economic headwinds.

Exports to Japan, the second-largest market, remained stable year-on-year (Jan-Jul) at 143,000 tonnes (-2%). Japanese consumers have shown increasing sensitivity to price, with some switching towards lower-cost proteins, but US beef has largely maintained its premium position.

Shipments to Mexico and Canada were both lower year-on-year, with volumes down 10% and 7%, respectively. These declines reflect the broader reduction in US beef export availability, as tighter domestic supplies and strong internal demand continue to constrain outbound volumes. While both countries remain key regional markets, elevated US beef prices may also be tempering demand for imported product.

US beef exports by destination country (YTD Jan–Jul)

.png)

Source: Trade Data Monitor LLC

From a product standpoint, the US beef export mix between January and July 2025 was led by frozen cuts, which made up 48% of total volumes. Fresh/chilled beef accounted for 30%, while offal comprised the remaining 19% and processed beef, 3%. This composition was broadly similar to the same period last year, though frozen exports did gain marginal share, up from 46%, likely reflecting stable demand in East Asia compared to closer North American partners.

Imports

In contrast to falling exports, US beef imports surged between January and July 2025, reaching 1.19m tonnes, an increase of 28% year-on-year. This sharp rise reflects continued strong demand for imported lean beef to support domestic processing, amid tight US cattle supplies and elevated prices for domestic beef.

The largest contributor to import growth was Brazil, which sent 259,000 tonnes to the US in the first seven months of 2025, almost double the quantity (+94%) they exported to the US in the same period last year. This has already surpassed 2024 full year Brazilian beef exports to the US. Imports from Australia and Uruguay also grew strongly, up 36% and 45% respectively, while shipments rose 4% from New Zealand and 5% from Mexico. In contrast, imports from Canada declined by 5%, reflecting a smaller cattle herd and reduced exportable supply from north of the border.

News from Argentina hints at potential short-term import growth into the US having temporarily eliminated export taxes on beef from 24 Sept to 31 Oct 2025. Grain duties were re-applied once a US$7bn sales cap was hit after just two days yet meat remains exempt through to Oct 31. Within the US market, imports from Argentina between January and July 2025 totalled 24,400 tonnes, an increase of 41% year-on-year, making this an area to watch when trade data becomes available for September and October.

US beef imports by supplier country (YTD Jan–Jul)

.png)

Source: Trade Data Monitor LLC

Product-wise, frozen beef made up 59% of imports between January and July 2025 significantly higher than the same period in 2024 which showed a 50% share. Fresh/chilled beef comprised 34% down from 42% and the remaining 7% was evenly split between processed product and offal.

Looking ahead, import volumes are expected to ease slightly in the second half of the year following the introduction of a new 50% tariff on Brazilian beef, which took effect on 6 August 2025. This raises the total duty on out-of-quota imports from Brazil to over 76%, significantly eroding their price competitiveness.

Other implications to future US imports include Mexico’s outbreak of New World screwworm intensifying with over 6,700 animal cases confirmed as of 13 September 2025. Over 5,200 of these cases were in cattle representing an increase of 32% since August. This has prompted the US to largely halt imports of live Mexican cattle since May and to keep southern border livestock ports closed as of mid-July. The USDA is also funding a Texas sterile-fly program to bolster the Panama barrier.

Despite this, USDA forecasts still anticipate total 2025 US beef imports to rise by 14% year-on-year, with strong demand continuing to support shipments from other key suppliers.

Implications for the UK

While the UK has limited direct trade with the United States in beef, developments in the US market remains important due to the country’s role as a major global producer and consumer. At time of writing, finer details of the US-UK agreement are yet to be announced.

The continued contraction in US cattle supplies, alongside firm domestic demand, is helping to support underlying strength in global beef prices, a key factor for UK competitiveness in export markets.

Reduced US export availability may also create additional room for other exporters, particularly in Asian markets where the US has historically had a strong presence. Notably, shipments to China have fallen sharply in 2025, following the expiration of plant approvals and the imposition of higher tariffs. While the UK remains out of the Chinese beef market, any rebalancing of global trade flows has the potential to impact overall market dynamics, especially for high-value or premium cuts.

On the import side, the sharp rise in US beef imports, particularly of frozen beef, could tighten global supply availability, especially if volumes from Brazil decline in the second half of the year due to new tariffs. This may support pricing for frozen products in other markets, including the UK.

Tight global supply, firm international demand, and evolving trade patterns continue to shape the outlook for UK beef, reinforcing the need for exporters to remain responsive to shifting dynamics in global markets.

*The 5-area marketing region includes Texas/Oklahoma/New Mexico; Kansas; Nebraska; Colorado; and Iowa/Minnesota.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: