US prices remain elevated despite late-year correction: Beef market update

Friday, 23 January 2026

While US prices have eased from record summer highs, underlying supply constraints persist. The market is characterised by historically tight cattle numbers and record carcase weights. These dynamics continue to influence global beef trade flows and remain relevant for UK market conditions.

Key points

- US dressed steer prices peaked at $8.50/kg deadweight in August 2025, before easing. Early January 2026 prices remain 14% higher year-on-year

- US beef production fell by 4% in 2025, with a further 1% decline forecast in 2026. Tighter cattle availability continues to constrain supply despite record carcase weights

- US beef exports (Jan–Oct) declined 12% year-on-year, driven by sharply reduced shipments to China and limited exportable supply

- Imports rose strongly through 2025, up 20% year-on-year (Jan–Oct) tightening global availability of frozen beef and lending broader support to international prices

Prices

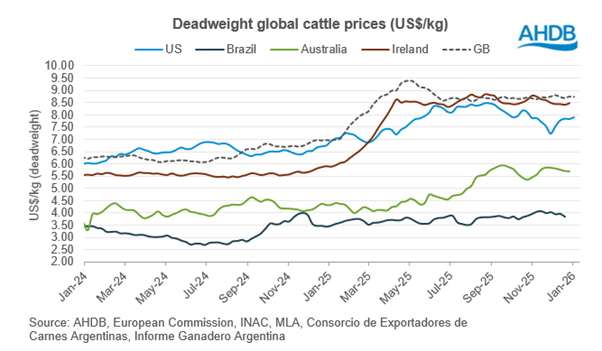

US cattle prices reached record levels during the summer of 2025 before easing through the final quarter of the year. Average dressed steer prices peaked at $8.50/kg (five-area marketing region) in mid-August, 31% higher year-on-year. Prices subsequently declined through October and November, and uncertainty in the US beef futures market.

Despite this correction, prices remained historically elevated and firmed again into year-end. As of the week ending 2 January 2026, deadweight prices averaged $7.92/kg, still 14% above the same week a year ago.

Despite these significantly higher prices, US beef consumption in 2025 remained broadly flat versus 2024, increasing by 0.2%.

The USDA predicts stable consumption into 2026, although with prices as high as they are, there is a risk this stability may be disrupted in the event of further price rises.

Firm prices are mirrored globally, underlining world cattle availability and the influence of the US market on the global picture.

Production

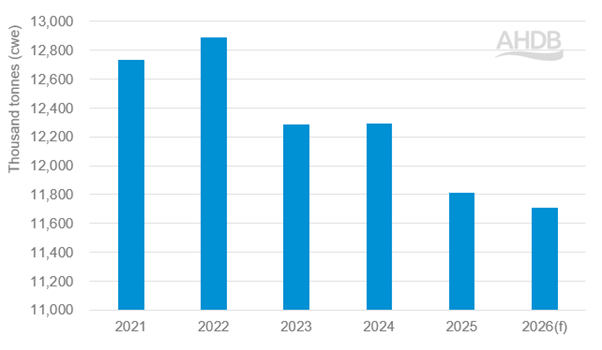

US beef production remains constrained, despite some offset from heavier carcase weights. Total output in 2025 fell by 4% year-on-year to 11.8 million tonnes, reflecting lower slaughter numbers as cattle availability tightened through the year. Record carcase weights in the second half of 2025 helped temper the decline but were insufficient to fully offset reduced throughput, leaving overall production lower. According to USDA statistics, Brazil has now overtaken the USA to become the world’s biggest beef producing nation.

Feedlot placements remained below year-earlier levels during 2025, driven by limited calf availability, continued heifer retention and exacerbated by import restrictions on live Mexican cattle. Lower cow and bull slaughter has further tightened availability of lean beef for processing. While fewer heifers on feed may point to the early stages of herd rebuilding, the near-term effect has been to keep US beef supplies tight.

US domestic beef and veal production (carcass weight equivalent)

Source: USDA

Exports

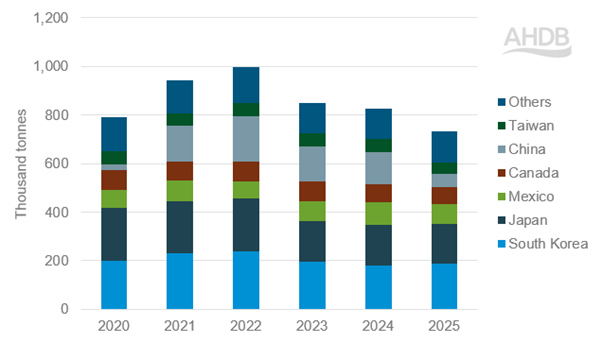

US beef exports weakened through 2025 as strong domestic demand and historically high prices constrained export availability. From January to October, volumes totalled 731,000 tonnes, down 12% year-on-year (-97,000 tonnes) (including fresh, frozen, processed beef and offal).

Shipments to China saw the steepest fall, following the expiration of US plant registrations and the continuation of retaliatory tariffs. This loss of access to a previously high-value outlet drove much of the overall reduction in US exports.

China’s new safeguard tariff rate quota (TRQ) on all beef imports from 1 January 2026 caps US access at 164,000 tonnes in 2026, with out-of-quota tariffs of up to 77%, significantly limiting competitiveness once quota volumes are filled. Although effective in 2026, the measure underscores the structural decline in US beef exports to China observed through 2025.

South Korea remained the largest destination over the period, with exports rising to 188,000 tonnes, up 5% year-on-year (+8,400 tonnes). This was underpinned by resilient demand for grain-fed beef. Exports to Japan totalled 165,000 tonnes, down 2% (-3,600 tonnes), as higher prices weighed on consumer demand.

Shipments to Mexico declined by 12% year-on-year to 79,000 tonnes, while exports to Canada fell by 6% to 73,000 tonnes. Overall, the data reinforces the theme seen throughout 2025: domestic demand increasingly absorbed available US beef supplies, leaving export markets to bear the adjustment.

US beef exports by destination country (YTD Jan–Oct)

Source: Trade Data Monitor LLC

Imports

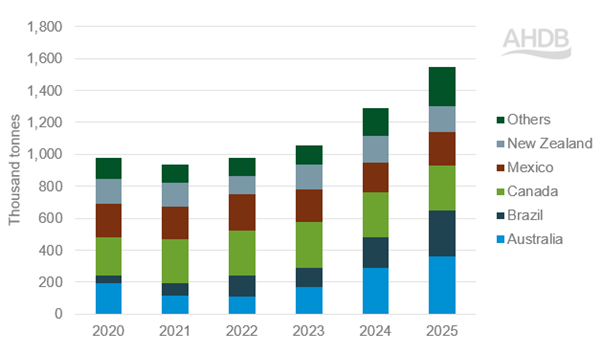

In contrast, US beef imports rose sharply through most of 2025 as processors sought lean beef amid constrained domestic availability. Year-on-year (Jan–Oct), imports increased to 1.6 million tonnes, up 20% year-on-year (+254,000 tonnes). This represents an increase of $2.56 billion year-on-year, Jan to Oct (+27%).

Australia remained the largest supplier, with shipments rising by 25% (+72,000 tonnes) year-on-year to 362,000 tonnes. Imports from Brazil showed the strongest growth rate, increasing by 51% to 284,000 tonnes. Brazilian shipments slowed later in the year as the nation

Imports from Canada edged down by 1% year-on-year to 283,000 tonnes, reflecting reduced cattle numbers, while shipments from Mexico increased by 13% to 208,000 tonnes. Imports continued to be dominated by frozen beef, reflecting its role in US grinding demand, and contributing to tighter global availability.

Looking ahead to 2026, the USDA forecasts a 2% increase in imported beef, year-on-year.

US beef imports by supplier country (YTD Jan-Oct)

Source: Trade Data Monitor LLC

Implications for the UK

While the UK has historically had limited direct trade in beef with the USA, developments in the US market remain influential given its role as a major global producer and consumer. From 2026, UK beef exporters also benefit from guaranteed access to the US market through a newly implemented 13,000-tonne tariff rate quota, providing greater certainty for premium UK beef shipments despite broader US tariffs remaining in place.

Tight US cattle supplies, firm domestic demand and elevated import requirements have contributed to a globally supportive pricing environment.

Reduced US export availability, particularly into Asia, continues to reshape global trade flows. Although the UK remains outside the Chinese beef market, tighter competition for premium beef in Asia and strong US demand for imported frozen product may indirectly support UK pricing.

Sustained global supply tightness, evolving trade patterns and continued volatility in US prices reinforce the importance for UK producers and exporters of closely monitoring international market developments as 2026 progresses.

The five-area marketing region includes Texas/Oklahoma/New Mexico; Kansas; Nebraska; Colorado; and Iowa/Minnesota.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.