What can we expect from the November WASDE report? Grain market daily

Wednesday, 8 November 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £200.20/t, up £0.35/t on Monday’s close. The Nov-24 contract closed at £208.20/t, up £0.40/t over the same period. The UK market gained slightly yesterday off the back of sterling weakening against both the euro and US dollar.

- Both the Paris and Chicago wheat markets were pressured yesterday from improved US winter wheat conditions with good-to-excellent ratings at 50%, remaining the highest for this time of year since 2019, this is having the potential to boost supplies in 2024. Further to that, improved prospects in Argentina and Australia after rainfall, were posing optimism for wheat supplies going into the start of 2024.

- Paris rapeseed futures (May-24) closed yesterday at €446.75/t, down €5.25/t on Monday’s close. Rapeseed was pressured yesterday with Chicago soyabeans. Markets took a downward turn slightly after the recent support from the mixed weather in Brazil.

What can we expect from the November WASDE report?

Tomorrow will be the release of the USDA World Agricultural Supply & Demand Estimates (WASDE) for November and the US crop production reports.

With the US soyabean and maize harvests nearing the end there is greater clarification on potential yields for US spring cropping, with both crops expected to set the sentiment for the remainder of the 2023/24 marketing year. All in all, they both look sizable and have escaped any major weather events.

What could be expected tomorrow?

The trade tomorrow is expecting a small upward revision to US maize production. Average estimates peg the crop at 383 Mt, off the back of marginally higher yields. The soyabean crop is forecast much unchanged, with US production estimate to be marginally revised down by 27 Kt , with the crop sitting around 111.7 Mt, with the yield unchanged.

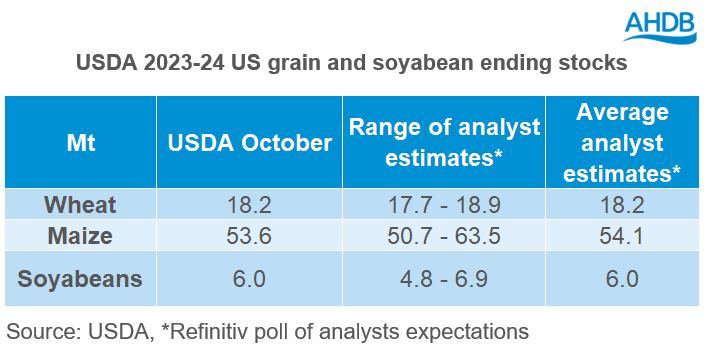

For US ending stocks, they are anticipations that stocks for wheat and soyabeans could remain near unchanged in the latest report. For maize stocks though, based on average estimates stocks could rise to 54.1 Mt. Though there is a broad range of expectations amongst analysts, ranging from 50.7 Mt to 63.5 Mt, this will be a focus for markets to where this November figures sits for availability.

Could there be any changes globally?

However, with US weather benign, recently driving the market has been the weather in Brazil which is having implications for the plantings of their soyabean crop, which inherently could impact their second maize crop planting at the start of 2024. Though this WASDE report is probably not going to revise any Brazilian crops as it is still early in the growing cycle to confirm that there is going to be downward revisions to this crop.

Another potential watchpoint is Chinese demand for soyabeans. The latest October WASDE estimated Chinese soyabean imports for 2023/24 at 100 Mt, but the latest USDA Beijing attaché has estimated this figure at 105 Mt. Could we see official figures revised up as China’s soyabean imports are likely to stay high throughout the fourth quarter of 2023 (Refinitiv).

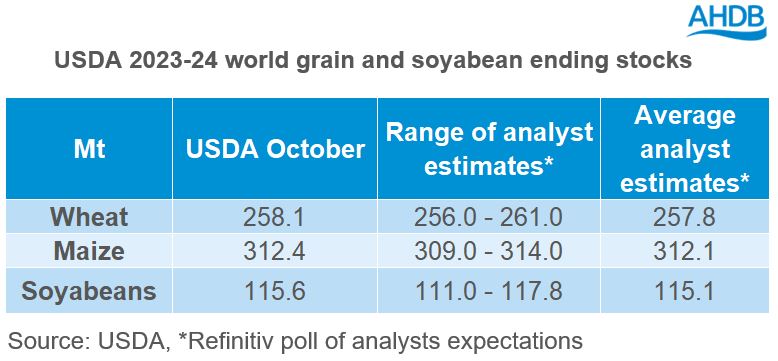

On a global scale, ending stocks for 2023/24 for grains and soyabeans are expected to tighten slightly further.

Concluding thoughts

All in all, the November WASDE is expected to bring a slight tightening of global stocks, but this is very marginal. The key watchpoint will be where exactly the US maize ending stocks are estimated at, as the average analyst estimates are broad. Going forward as months progress, potential revisions to Brazilian crops will be the focus.

Amongst the trade there aren’t any expectations of huge swings in global supply and demand that will shift sentiment hugely. However, if these figures deviate away from expectations there could be support or pressure depending on the results in the report, which will be released tomorrow at 17:00 (GMT).

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.JPG)