What could the EU-Mercosur trade deal mean for UK livestock farmers?

Friday, 12 July 2019

It’s taken 20 years, but on 28 June 2019, the EU and Mercosur (Argentina, Brazil, Paraguay and Uruguay) agreed a trade deal between the two blocs. The agreement in principle is not legally binding but summarises the results of negotiations. The trade agreement still needs to be converted into legal text and ratified by EU member states as well as the European Parliament. Nevertheless, it is significant enough for the President of the European Commission, Jean-Claude Junker to call it a “historical moment”. In this article, we look at the implications of this trade deal on EU agricultural trade and what it could mean for the UK.

What’s been agreed?

This deal would see a reduction of around €4 billion in terms of tariffs for EU exports to Mercosur. However, the main sectors that would benefit from this are car manufacturers, machinery, chemicals and pharmaceuticals, where tariffs of up to 35% will be gradually removed over 10-15 years.

In terms of agri-food trade, EU exports of chocolates and confectionery, wines, spirits and soft drinks will benefit from the reduction of high Mercosur tariffs (ranging from 20-35%). EU dairy product exports (especially cheese) would also be able to take advantage of tariff-free-quotas (TRQs), and is discussed in more detail below. However, for other sectors such as beef, the EU has had to make some concessions to the South American trade bloc.

Beef

The EU will open up a beef TRQ for Mercosur of 99,000 tonnes (carcase weight equivalent), this is larger than any existing EU beef TRQ but equates to around 1% of EU production. The split between fresh/chilled and frozen beef is currently reported as 55/45. The in-quota tariff is set at 7.5%. Brazil will have around 44,000 tonnes of this TRQ with around 30,000 tonnes for Argentina and volumes will be phased in 6 equal stages throughout the year.

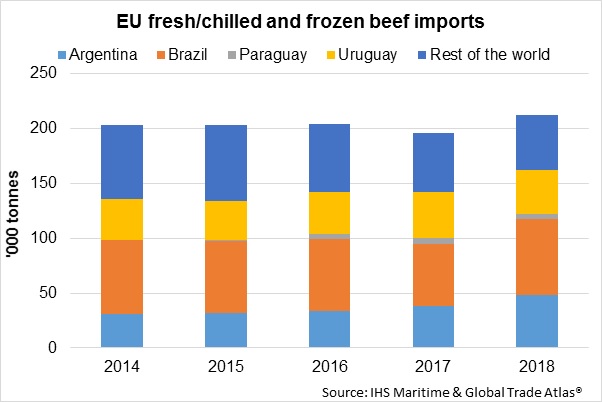

EU tariff rates for third country imports of beef1 range from around 41%-171% in ad valorem2 terms. According to trade data, beef imports into the EU from Mercosur have averaged 143,437 tonnes (2014-2019). With the TRQ described above, these South American exporters are likely to increase their market share in the EU market as their prices are likely to be more competitive given the reduction in tariffs and the fact that their costs of production are relatively lower than their European counterparts.

In addition, the EU’s high quality beef ‘Hilton” quota (of 67,000 tonnes) currently allows Mercosur beef imports at a tariff of 20% (in quota). This will be eliminated for the South American bloc, allowing in-quota tariff free access, whereas imports from other countries that have access to this TRQ (Australia, USA, New Zealand)3 will still be subject to the 20% tariff.

The increased access to the EU beef market, provided to Mercosur under this deal has been met with opposition from EU farmers and, in particular, the Irish beef sector.

Between 2014 and 2018, Irish beef exports to the EU (including UK) have averaged 87% of total Irish beef exports. Competition from South America is likely to cut into the Irish share and Brexit could amplify things further. Around 46% of total Irish beef exports are destined for the UK. Depending on how Brexit negotiations play out, the introduction of UK tariffs on imports, under a ‘no-deal’ scenario, would hamper Irish exports to the UK, even though the UK tariff schedule is lower than that set by the EU. This could be mitigated, to some extent, by a 230,000 tonnes erga omnes (open to all) TRQ the UK government has announced will be available in the event of ‘no-deal’.

For UK beef exports, the prospect of leaving the EU under a ‘no-deal’ scenario would be challenging given that the 90% of total UK beef exports (2014-18 average) shipped to the EU would have tariffs imposed on them. The added competition from Mercosur for the EU market, is likely to add to this challenge. The fact that the UK is a net-importer of beef, offers some respite to domestic beef prices.

Pig meat

For pig meat, Mercosur will have access to a 25,000 tonne TRQ, which will be equally divided in to 6 annual instalments. The in-quota tariff will be €83 per tonne, which is considerably lower than full MFN tariffs and most in-quota TRQ tariffs at present. The meat eligible for import under this TRQ must be from ractopamine-free pigs.

The amount of pig meat currently imported into the EU from Mercosur is quite small (averaging around 37 tonnes between 2014 and 2018). Although the negotiated Mercosur TRQ is much larger than this, the overall quantity of the TRQ is a mere fraction of the amount of pork the EU produces, consumes and exports.

Tariffs on EU pig meat exports to Mercosur will be eliminated. Between 2014 and 2018, EU pig meat exports (including offal) have averaged around 8,500 tonnes. Only around half of this is fresh/frozen pork, with processed products and offal also exported. It is not yet clear whether all pig meat products will be liberalised.

Poultry

While it appears that the EU pig meat sector will be less affected by the EU-Mercosur trade deal, the poultry industry will face greater competition along with beef. For poultry, there will be a TRQ of 180,000 tonnes, (carcase weight equivalent) tariff free, for Mercosur, split into six equal annual stages. In terms of product weight, the TRQ is for 128,571 tonnes, which will be split equally between boneless and bone-in cuts.

Between 2014 and 2018, EU poultry imports (including offal) from Mercosur averaged over 95,000 tonnes, with the majority originating from Brazil. There are already Brazil –specific TRQs available for fresh/chilled and frozen cuts amounting to 12,708 tonnes as well as erga omnes (open to all) TRQs of 39,790 tonnes. The TRQ for Mercosur described above is likely to increase the bloc’s market share in the EU poultry market. Currently, poultry meat imports (including offal) from Mercosur account for an average of 57% of total EU poultry meat imports (2014-2018).

As the EU is a net-exporter of poultry meat, this additional TRQ would increase competition for the EU poultry producers. Increased supplies of poultry meat from South America is also likely to put downwards pressure on EU poultry prices which is likely to increase poultry meat’s price competitiveness against red meat. Poultry meat consumption per capita is already higher than that for red meat in the EU (including the UK). Relatively cheaper prices could increase the gap further.

Dairy

Mercosur imposes tariffs of up to 28% on dairy imports. Under the trade deal various TRQs will be available to the EU, allowing eventual tariff free access at the end of a ten year period:

• Cheese – 30,000 tonnes (over 10 equal annual phases)

• Milk powders – 10,000 tonnes (over 10 equal annual phases)

• Infant formula – 5,000 tonnes (over 10 equal annual phases)

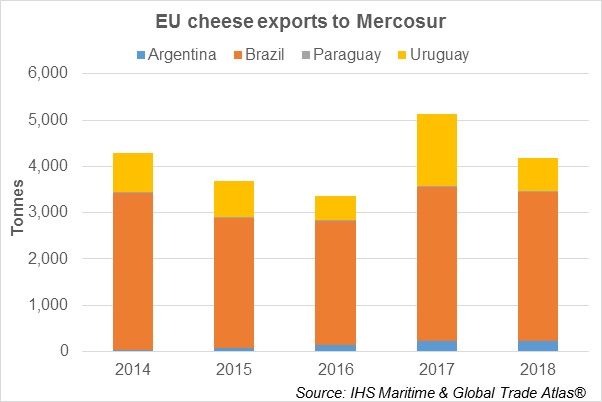

These TRQS will also apply to EU imports from Mercosur to accommodate the contrasting peak dairy production periods in the northern and southern hemispheres. However, if we look at recent cheese trade between the EU and Mercosur, an average of over 4,000 tonnes of cheese was exported from the EU to Mercosur (majority going to Brazil) compared with just 23 tonnes exported from Mercosur to the EU. This means that the EU is more likely to benefit from the introduction of these TRQs.

Soya bean meal

The EU-Mercosur trade deal also states that taxes on raw materials such as soyabean products (used for animal feed) will be reduced or removed. While there is no tariff on soya meal imports into the EU, Argentina, for example, imposes a domestic tax on soyameal exports, which limits the amount of soyameal that can be exported. Lowering or removal of this tax is likely to lead to increased availability of soyameal on the global market which would put pressure on prices, and be advantageous to the EU due to the bloc’s protein deficiency in animal feed protein.

Standards

In terms of food safety, animal health and plant health, the agreement states that EU standards will not be reduced for the benefit of Mercosur. These sanitary and phytosanitary measures ‘are and shall remain non-negotiable’. The EU has also gained protection of around 355 Geographical Indications (GI) names of food, wine and spirit products as part of the agreement. This means that imitations of products such as ‘parma ham’ and ‘gorgonzola cheese’ will not be allowed in the Mercosur bloc.

What next?

As mentioned at the start, the EU-Mercosur agreement needs to be ratified by EU member states. There is opposition from the EU farming sector, including the Irish beef industry, regarding the increased access to the EU market this deal provides for Mercosur. Environmental groups have also voiced their concerns citing that practices such as deforestation in South America are incompatible with the EU’s environmental targets.

Ireland, France, Poland and Belgium have already written to President Juncker, expressing their concerns. If ratified, the EU-Mercosur trade deal is expected to come into effect at around 2022, with full concessions applying around 2027/2028.

What does this mean for the UK?

The EU-Mercosur trade deal will only apply to the UK if it a member of the EU. Given the expected timeline for the deal to come into force, it is unlikely that the EU-Mercosur trade deal will apply to the UK (unless the UK decides to remain part of the EU).

However, even if the UK leaves the EU, it will still be indirectly affected by the EU-Mercosur agreement as for beef and poultry products, in particular, there is likely to be increased competition for the EU market from Mercosur.

The EU-Mercosur trade deal highlights that agriculture is not always a government’s priority when it comes to negotiating trade deals. In this case, the EU industrial sector, particularly car manufacturers were the winners, with agriculture having to offer concessions. This is worth bearing in mind as the UK strives to make trade deals post Brexit, given that the manufacturing sector’s contribution to UK GDP is considerably higher than that from agriculture.

Outside of the EU, the UK’s negotiating power is likely to be diminished – potential trade partners such as Mercosur countries or Japan, for example, are likely to push the UK to make concessions.

1 Based on most common cuts imported

2 Calculated using 2016-18 average unit prices

3 Canada also has access to this TRQ but under the CETA agreement, it has in-quota tariff free access

Topics:

Sectors:

Tags: