Wheat sector outlook: Grain market daily

Wednesday, 14 October 2020

Market commentary

- UK feed wheat futures (Nov-20) lost £0.45/t yesterday to close at £182.05/t.

- The latest US crop progress report was released yesterday following the US public holiday on Monday. With clearer weather, the US maize harvest was 41% complete as of 11 Oct, 9% above the five year average. The US soyabean harvest was 61% complete as of 11 Oct, 19% ahead of the five year average.

- US winter wheat planting was at 68% complete as of 11 Oct, ahead of the five year average by 7%.

- This morning, FranceAgriMer upped estimates for French non-EU wheat exports to 6.7Mt, up 0.1Mt from estimates last month. Soft wheat ending stock estimates were also cut to 2.6Mt from 2.9Mt last month. This was due to a 0.3Mt reduction to production estimates.

Wheat sector outlook

This marks the first of the three sector round-ups that are to be released this week following our Grain Market Outlook conference held virtually yesterday. We hope you found the content useful and informative.

Below, we examine three key sections including fundamentals that will affect future price direction for domestic wheat markets.

Weather will be a key fundamental in wheat markets this season. The declaration of a now active La Nina weather event will impact on weather systems in certain areas of the globe. This impact is most seen in the Americas and across Australia. Whilst these countries do not export vast tonnages of wheat to the UK, it is more the effect on global price direction that this weather impact is seen.

Australia

Looking at Australia first, the indications point towards a wetter season. Back in 2010/11, a moderate La Nina event brought with it the wettest two-year period on record. Wheat production levels in the 2011/12 season reached 29.9Mt, a then record in figures dating back to 1960. The more frequent rainfall this season has upped production estimates to be estimated at 28.5Mt, according to ABARES. As the wheat harvest has begun in almost all states across Australia now, we will start to see initial yield estimates come through.

Argentina

Argentina is in the midst of the drier impacts of the La Nina event, as its wheat crop enters the mid-season growing stage. The duration and intensity of the drought conditions will dictate the impact on final crop yields. Though already the Rosario Grain Exchange have reduced production estimates to 18.9Mt from 22.0Mt earlier this season.

Argentina is a key exporter of wheat, particularly to Brazil and Chile, and also to Asian regions. Australia may likely increase its exports of wheat to Asian regions and increase its share in import schedules over Argentina. From a global standpoint, such reductions are a price supporting factor though this support will likely be capped by stronger Australian and Canadian production figures.

Black Sea and Russia

Dryness is also a feature across the Black Sea and Southern Russia. This has become a developing issue in recent months. Though for Ukraine, rainfall has replenished surface moisture levels to a degree in the last couple weeks.

The dry conditions have slowed progress for winter cereal and oilseed plantings in Ukraine. As of 5 October, 47% of the intended wheat area had been planted vs 65% at this point last year. There is a risk of winter frost damage for the later planted crops.

There are delays too for Russian winter wheat, though an increase in spring wheat area could become a possibility, should delays persist. Reduced production figures next season for Ukraine and Russia could add an element of support to global wheat prices, given their presence as top wheat exporters.

The US

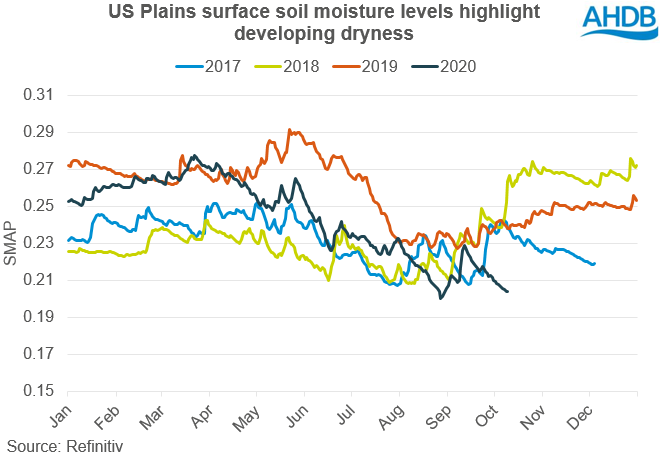

One feature of a La Nina event is the onset of drier weather across the US Southern plains, a key wheat producing region. As you can see from the graph, a lack of significant rainfall in recent weeks has put the US Plains at their lowest in the last three years. Concerns for the US and Black sea wheat crop for next season have added support to wheat markets and the uncertainty from La Nina weather will persist.

So comes a big unknown for global wheat markets. Both the USDA and the EU have forecast a return to ‘normal’ demand levels for Q4 2020 and into Q1 2021. However, the resurgence in infection rates globally now means this target to normality is perhaps a way off.

In the UK, infection rates have increased over the course of September and October as concerns over further lockdown measures mount. Earlier this year in March – June, declines to wheat consumption figures for human & industrial usage were observed. Against the three year average, figures for all wheat usage in H&I declined 10.6% for March – June.

In the previous lockdown, my colleague James covered the impact of coronavirus on wheat demand. Further falls to consumption could increase wheat availability and reduce the import requirement. There was instances of increased demand as we saw ‘panic-buying’ of flour and bread in retailers.

In the global market, wheat consumption levels across developing regions, such as parts of Asia and Northern Africa, are a watch-point for wheat demand. We are seeing an increased volume of tenders from the MENA region already this season, from a growth perspective and perhaps a stockpile perspective too. These tenders are an important factor for short-term price direction if demand continues into winter months.

Russian export quota

Politics and economics are playing a key role in the formation of global domestic wheat pricing.

One of these key drivers is the potential imposition of protectionist measures in Russia. The Russian rouble is currently weak, the 2021 crop is going into dry conditions and FoB prices are elevated. These elements combined increase the likelihood of an export restriction.

Last season we saw an export restriction imposed in January, this sentiment offered supported prices. The quota imposed last winter was more than the volume available to be exported, but prices were still elevated.

This leads us to the assumption that even the discussion of the imposition of a tariff could drive short term support for prices, even if it is not actualised. This support would be seen in both global and domestic markets.

Brexit and tariff risk for wheat

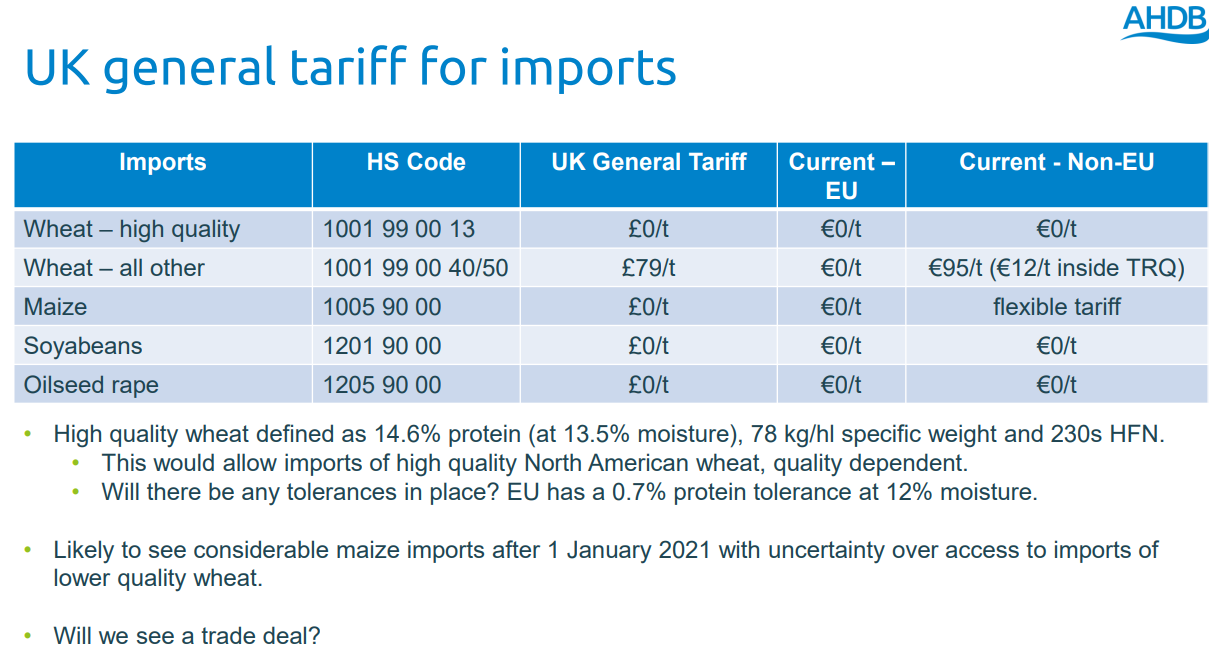

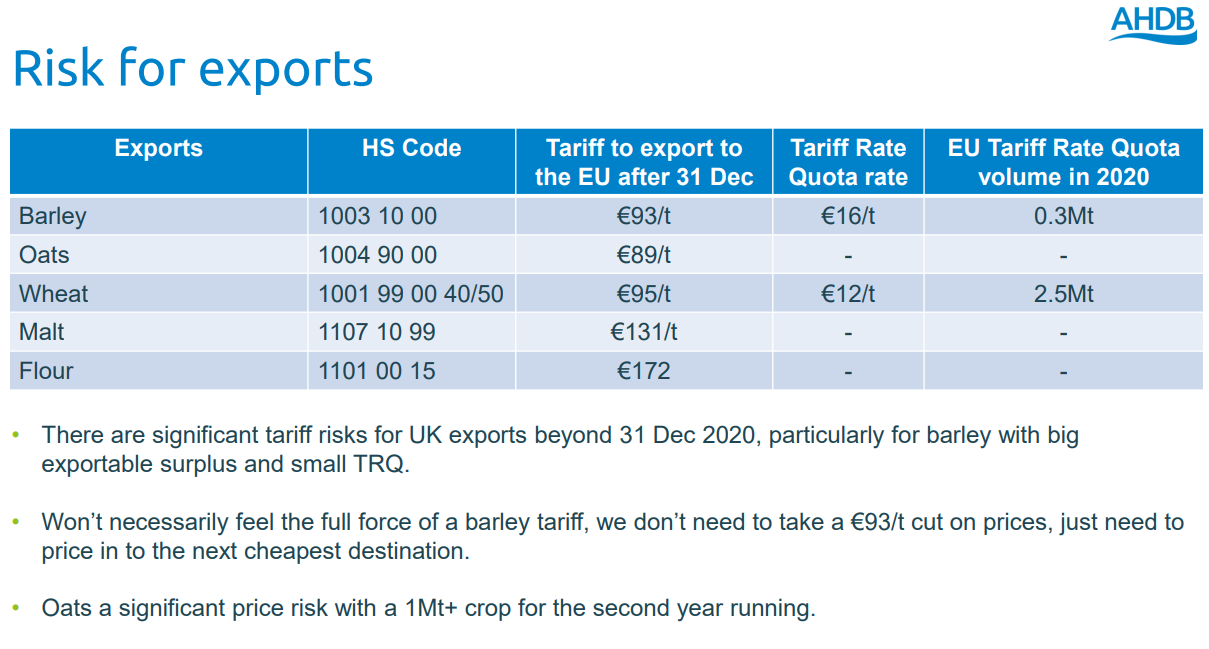

One key driver of UK markets in the next six months is going to be developments in the EU exit trade deal. At present it is proposed that wheat imported into the UK below a 14.6% protein (13.5% moisture) would face a £79/t tariff. This is a significant risk in a year where domestic protein has fallen short, production is at an almost 40 year low and we have a significant need to import.

The tariff would in theory allow for imports of high protein wheat from North America, however early results from the Canadian wheat quality survey show protein is averaging just 14.0% (13.5% moisture) in Manitoba, and just 13.5% across Western Canada. It is plausible that this result will increase as more wheat is sampled but it does pose a big risk.

Another important aspect of the tariff system is the imposition of a tariff on flour exports, 97% of which go into the EU, the rate to export into the EU is 40% of the traded value between 2015/16 and 2019/20.

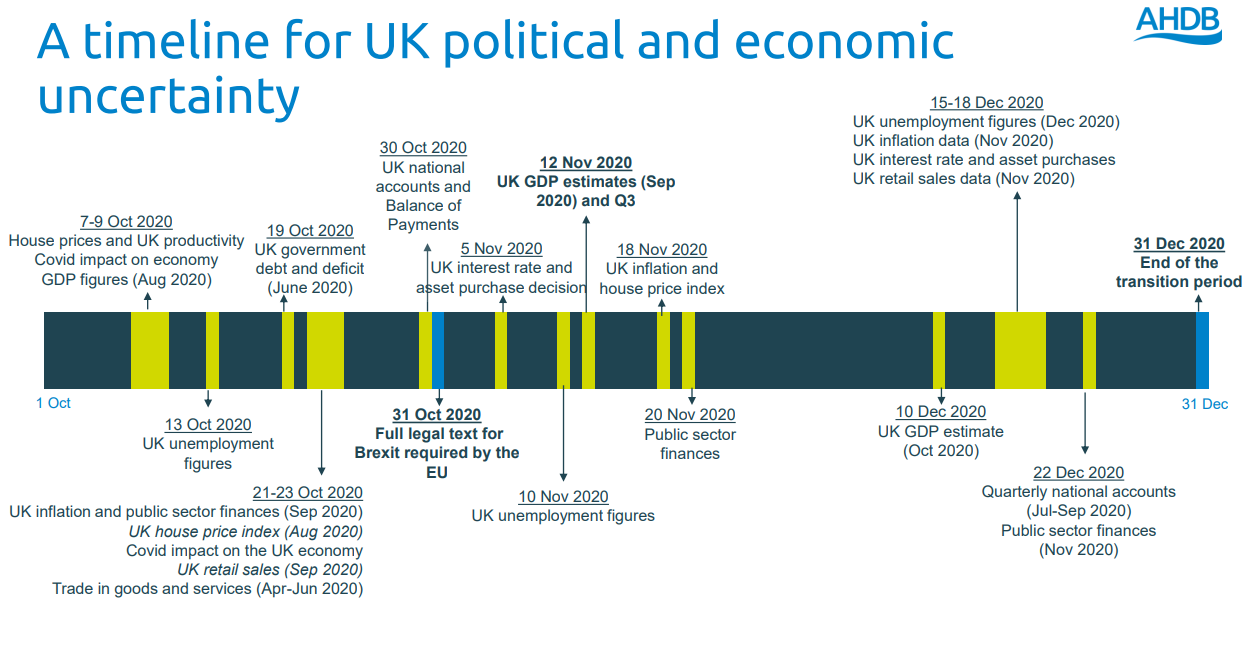

Currency risk

Finally currency is another key risk and driver of market volatility going forward. Sterling will react to the developments in Brexit and the publication of economic data. Between now and the 31 December there are a number of key economic releases for the UK, including interest rate decisions and economic growth forecasts. Adding Brexit and a US election into the mix, sterling has the potential to significantly impact the value of UK wheat.

If the value of sterling falls, all other things being equal, the price of UK will rise in order to maintain or exceed import parity. If sterling rises in relation to the data going forward then UK markets will be pressured. With the deadline for a Brexit deal looming, and progress seemingly lacking, it feels as though sterling has more downward potential than upward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.