Why have wheat prices taken a turn for the worse? Grain Market Daily

Wednesday, 26 February 2020

Market Commentary

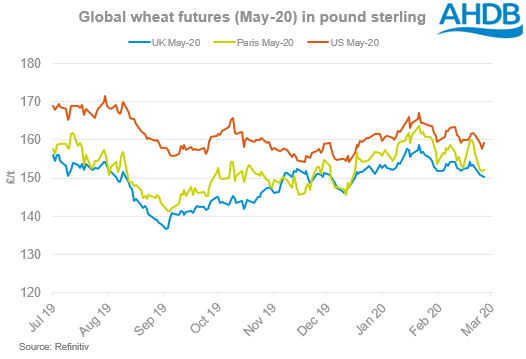

- UK wheat futures (May-20) closed yesterday at £150.55/t, down £0.35/t on Mondays close. The Nov-20 contract remained at £160.00/t from Monday's close. Insight into the decline of wheat markets recently, can be found below.

- Paris rapeseed futures (nearby) have also seen declines, down €1.75/t from Monday to close yesterday at €390.75/t. Much of this decline is the contract following wider declines in crude oil markets. A continued lack of noteworthy Chinese purchases of US soyabeans remains an anchor for oilseed markets.

Why have wheat prices taken a turn for the worse?

European wheat markets took a hit on Monday which sustained into yesterday, amidst global market concern of the scale of the coronavirus. News of large production estimates for the Russian and Ukrainian wheat crop, further added to market pressure in a bleak week so far for wheat markets. London feed wheat futures (May-20) have declined £2.20/t from Friday to close at £150.55/t yesterday.

Over the last few days, news of the coronavirus (Covid-19) outbreak reaching further into Europe and the Middle-East has caused global markets to tumble. Whilst this outbreak has been known to markets since the start of the year, it was thought initially the virus was able to be contained to Asian regions. It is the anticipations of unknown reductions to consumer spending, shipping and haulage logistics, and overall economic impact on growth over the shorter term that has left global markets worried. Brent crude oil, an important watch for agricultural markets, has declined 4% from Monday to 9:30AM (GMT) this morning at $53.91/bbl.

News of Ukraine and Russia expecting large wheat crops also hit markets this week. Warmer temperatures over winter has meant winter crops reportedly avoided frost-kill damage. Large grain production estimates across Black Sea regions will likely translate into a larger availability of exportable grain pressuring global markets.

Ukraine has exported over 40Mt of grain already this season, up circa 23% on the previous season-to-date. Ukrainian wheat exports have totalled 15.6Mt so far, with expectations that the schedule may reportedly finish close to 20Mt.

Russia also may still have a large volume of wheat to export this season. Total grain exports for the season July-Jan were down 17%, as wheat exports totalled 21.8Mt as of 23 Jan. Forecast Russian wheat export volumes for the season, whilst revised lower, still sit at 32.2Mt.

Depending on the degree to which this news is priced in markets are likely to remain pressured by this large supply and coronavirus uncertainty, adding further pressure to the UK import parity.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.