Will your milling premiums rise further? Grain Market Daily

Wednesday, 10 June 2020

Market Commentary

- UK feed wheat futures continued their recent fall yesterday, moving a further £1.00/t lower, closing at £168.00/t. Improved weather in the Black Sea region has seen Russian analysis firm SovEcon up their estimate of Russian wheat production.

- Further pressure for wheat markets is seen from Australia where ABARES has raised its estimate of wheat production for the 2020/21 season from 21.3Mt to 26.7Mt. Rainfall this season has improved the outlook for the crop following consecutive droughts.

- The latest Brazilian maize production forecasts from Conab have curbed production by 1.3Mt, to 101Mt. In spite of the cut, December maize futures recorded a decline yesterday following their recent rally.

Will your milling premiums rise further?

New crop delivered milling wheat premiums (North West) have recently extended to their widest point over new crop feed futures, in June, since 2011/12.

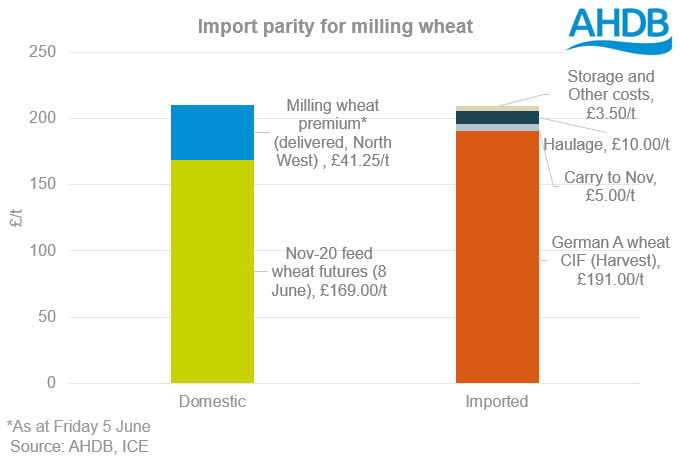

On Friday (5 June), new crop milling wheat delivered (North West) was quoted at £213.00/t, £41.25/t over Nov-20 feed wheat futures at Thursday’s close.

The extension of premiums is a reflection of the uncertainty around supply and quality of the domestic milling crop. This uncertainty has caused challenges in originating grain further supporting premiums.

It is widely expected that the UK wheat crop could be 10Mt or less. Assuming that we have a five year-average split of varieties (questionable given the drilling year we have had), nabim Group 1 & 2 wheat would be circa 34% of the total crop. Even before quality has been determined, the challenge of a small milling crop is evident.

Where next for 2020/21 milling premiums?

Much will depend on what happens between now and the end of harvest. Nevertheless, whatever happens it is likely that prices will be capped towards import parity. This means that premiums will only extend to the point at which mills can replace UK wheat with imported wheat.

In Monday’s imported prices, CIF German A wheat was quoted at £191.00/t, for Harvest delivery. Even allowing for a carry to November, haulage, storage and other costs, imported milling wheat is already beginning to look competitive in the domestic market. That said, the need for merchants to fulfil previous domestic sales may prevent reduced import prices from capping domestic values pre-Harvest.

As we move through to the new season, the value of imported wheat will need watching closely. Finally, we cannot ignore the tariff schedule, which poses challenges for domestic wheat imports. In a no-deal Brexit scenario, a £79.00/t tariff will be levied on imported “low” and “medium” quality wheat from 1 January 2020.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.