Young bulls: slaughter trends and future supplies?

Thursday, 5 May 2022

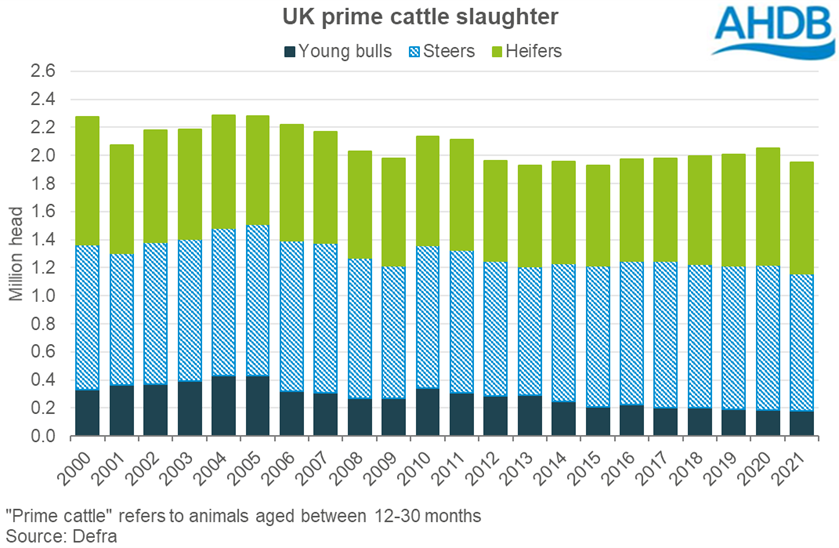

Slaughter of young bulls in the UK (bulls aged between 12-30 months, according to Defra) has been in a state of long-term decline, but particularly in the last decade. Indeed, total prime cattle slaughter has generally fallen during this time. However, steers have been gaining share against bulls. In 2021, young bulls made up 15% of prime male cattle slaughter; 20 years ago, they made up around one quarter of the male kill.

Recently, this decline in young bull numbers has been partly related to a decrease in the number of pure dairy male cattle being born, owing to more beef and sexed dairy semen being used in dairy inseminations. Handling safety and meat quality are other considerations that may have affected finished bull numbers over time.

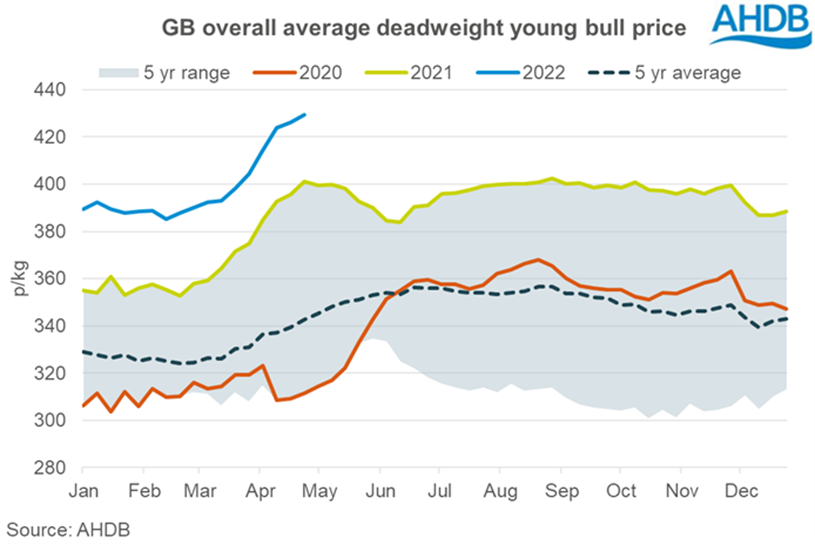

As bulls are typically finished on cereal-based rations, this sector will be particularly exposed to the recent rise in feed costs (indeed as will any system that buys-in feed). As with other cattle, young bull prices have been in growth over the last 18 months, with the overall GB average young bull price currently running around 30p/kg higher than where it was a year ago. While this increased return will be welcome, it is unlikely to fully compensate for more expensive inputs.

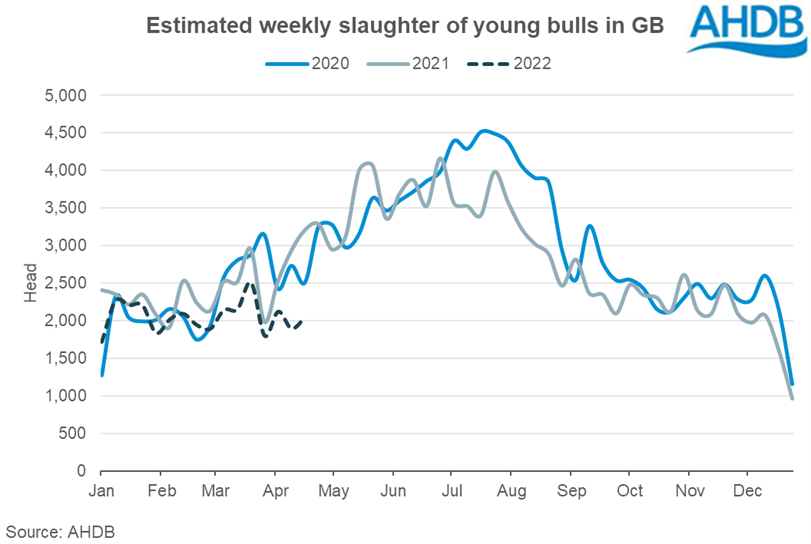

As such, it will be interesting to see how the current situation with input costs will affect producer decisions, and thus future supplies of bulls (and indeed all cattle) coming to market. Young bull slaughter so far in 2022 is at the lowest level it has been for some time, and 15% below the same period in 2021. However, some of this will be associated with tighter cattle supplies nationally and other factors mentioned above.

With the cost of feed being as it is, we could well see more forage being incorporated into rations, and more alternatives being sought. We may even see slightly lighter carcase weights, which could offer a guide to what we might expect with other prime carcase weights more generally this year. With silage season having already begun in southern parts of the UK, quality and quantity of forage produced this season will be watched with a keen eye. We regularly monitor grass growth around the country as part of our Forage for Knowledge programme.

In the short-term, we can see a slight increase in the number of pure dairy males in the pipeline, likely as an indirect result of changes to calf management policies in milk buyer contracts. However, long-term, we would expect pure dairy male numbers to return to a downward trend, as these animals are essentially bred out of the system. Indeed, this can be seen in BCMS figures for calves aged 6 months and under.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.