- Home

- News

- Store cattle market update: Prices ease with finished trade, but strengthen in recent weeks

Store cattle market update: Prices ease with finished trade, but strengthen in recent weeks

Wednesday, 9 August 2023

Key Trends:

- GB store prices have fallen over the past few months with finished prices

- Uptick in recent weeks store prices for 12-month and 18-month animals, potentially reflecting grass flushes and delayed harvest

- Future grain price volatility continues to drive some uncertainty into the market, while positive grass outlook potentially supports demand in some categories.

Over recent weeks, GB store cattle values have generally fallen, as the finished market eases and store markets have quietened into the summer. We take a closer look at the key market trends.

Deadweight prices

Between the week ending 20 May (when GB deadweight prime cattle prices peaked) and the week ending 5 August (latest available at time of writing), the GB deadweight overall steer price fell by 36p/kg (-7%).

Read our recent analysis on why the beef price has fallen

Store market values

Meanwhile, store cattle prices have shown more mixed movement. Market reports suggest that demand has remained firmer for shorter-keep stores, while smaller cattle have been harder to place.

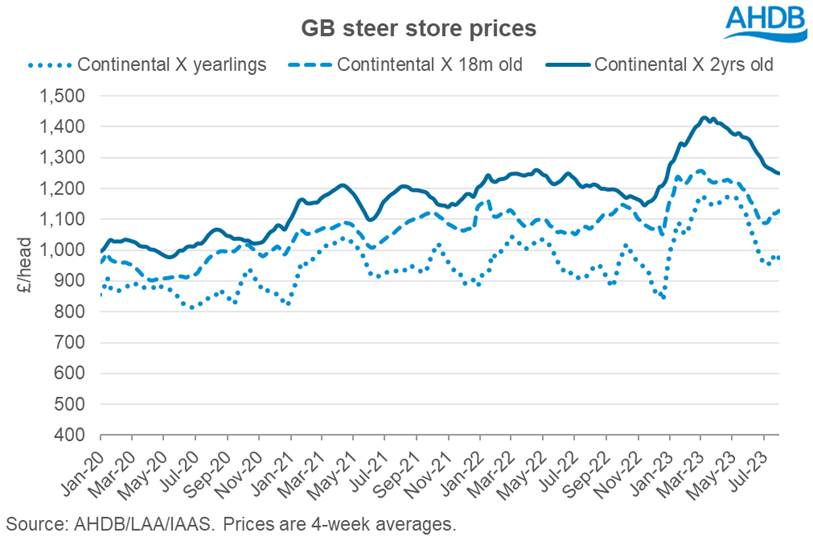

Indeed, our store cattle prices show that generally over the past few months, more apparent price declines have been recorded across younger cattle categories (12 months old) while older stores (18 months and over) have seen some price falls.

Looking more recently however, prices for 12-month and 18-month animals have seen support from the trade. Tricky weather keeping combines in the sheds in some parts of the country has potentially kept more demand in the store trade lately. In recent weeks, prices have stabilised and in some cases values have ticked upwards. Reports suggest that interest has grown with the grass, following recent flushes.

A forward view

Last week, we considered how market factors may influence the beef price going forward. How this, combined with the cost of inputs and availability of forage, affects finisher margins is a key consideration behind store cattle demand.

Grass growth

Grass growth figures from Forage for Knowledge show that growth is now well above average for the time of year in most regions of the country.

The monthly weather outlook is looking good for growing grass but not so good for cereal harvest, with unsettled weather on the forecast.

Keep up to date with the latest grass growth data and analysis

Grain price outlook

Grain prices have fallen since winter crops were sown and have been on a downward trajectory as exports out of the Black Sea region continued under the Black Sea Initiative.

Since this agreement ceased in July, global markets have felt support from this and from ongoing conflict in the region, which potentially threatens global supply availability.

All in all, global grain markets are well supplied on paper, especially maize. However, prices in the short-term will remain reactive to developments in the Black Sea, which is injecting volatile support into the market at present.

Events in the Black Sea region are constantly changing, so be sure to keep up to date with our latest grain market analysis here.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.