- Home

- Lamb: modelling the impact of the UK’s accession to CPTPP

Lamb: modelling the impact of the UK’s accession to CPTPP

The impact of the UK accession to CPTPP was examined for lamb, looking at the changes expected after the deal comes into force. This aspect of the modelling work assumes all other factors, except succession, remain the same.

Key points for the lamb sector were:

- The model suggests that CPTPP lamb exports to the UK will increase by about 74 t (an increase of 37% in percentage terms on the baseline used within the model)

- The model suggests that UK lamb exports to CPTPP will increase by about 118 t (an increase of 26% in percentage terms on the baseline used within the model)

- The model predicts that changes to production and price will be relatively small (less than 1%)

For lamb, the chosen network consists of the UK, EU, USA, New Zealand and Australia, and the rest of the CPTPP. The EU is a significant exporter and importer of sheep meat and is currently the main market for UK exports. The USA is a major importer of sheep meat, and New Zealand and Australia are key lamb exporters. The main markets for New Zealand and Australia lamb exports are China and the USA, while New Zealand also sends a large volume lamb to the UK and EU, and Australia to Asian markets. The rest of CPTPP does not export huge volumes of lamb. However, Canada, Japan, Malaysia and Singapore import a large volume, mainly from New Zealand and Australia. A key consideration when interpreting the results is that the model cannot determine which of the nine countries within the rest of CPTPP node will be importing or exporting the lamb.

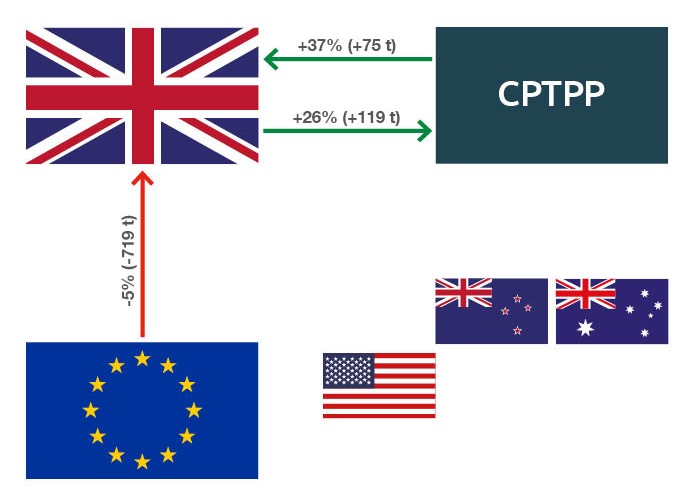

Figure 1 shows the changes in trade within the network. The model shows an increase of exports from the UK to CPTPP of about 26% (119 t) from the current 457 t.

The model also shows there will not be a significant increase in imports from CPTPP to the UK, only 75 t.

These changes are relatively insignificant. Demand for lamb imports is low in the CPTPP countries, and they only export a tiny amount of lamb compared to others in the network.

Figure 1. Modelling results impacts to lamb trade

Note: No connecting arrows indicates minimal change in trade levels.

The effect on the domestic marketplace is relatively small. There will be a 5% increase in lamb sold, mainly due to the increase in imports from New Zealand, as discussed in the NZ FTA impact report. Domestic production and farmgate price will see no change, but there will be a minor reduction in retail price. CPTPP countries will see a minor increase in domestic production and lamb sold in the domestic market.

Table 1. Detailed lamb results

| UK | The rest of CPTPP | |

|---|---|---|

|

Domestic production |

No change |

+0.11% (+136 t) |

|

Price paid to producers |

No change |

No change |

|

Total lamb sold in the domestic market (incl imports) |

+5% (16 Kt) |

+0.16% (+330 t) |

|

Retail price |

-2.03% |

-0.15% |

Considerations

There are a number of caveats to these results. Like other economic models, the trade network model is not a prediction or forecast and assumes all factors other than UK accession to CPTPP remain equal. This is unrealistic in a global economy but is an essential assumption for modelling due to the complexity of predicting future changes. What the network model can do, though, is examine specific ‘what if’ scenarios and this is something that AHDB will be analysing going forward.

Like other economic models, the trade network model treats all products in a category as homogenous. In reality, we know that there are varying levels of demand for different cuts of lamb in each market. The model treats all cuts as the same, and therefore the impact of carcase balance must be considered alongside the results. As such, our interpretation considers the modelling results within the context of the other analysis and findings.

The model does not take into account Sanitary and Phytosanitary (SPS) limitations such as Export Health Certificates (EHCs) and other trade barriers, such as the ban on hormone-treated beef entering the UK.

Read more about trade implications of Non-Tariff Measures (NTMs)