- Home

- Prospects for UK agri-food exports: Europe – EU 27

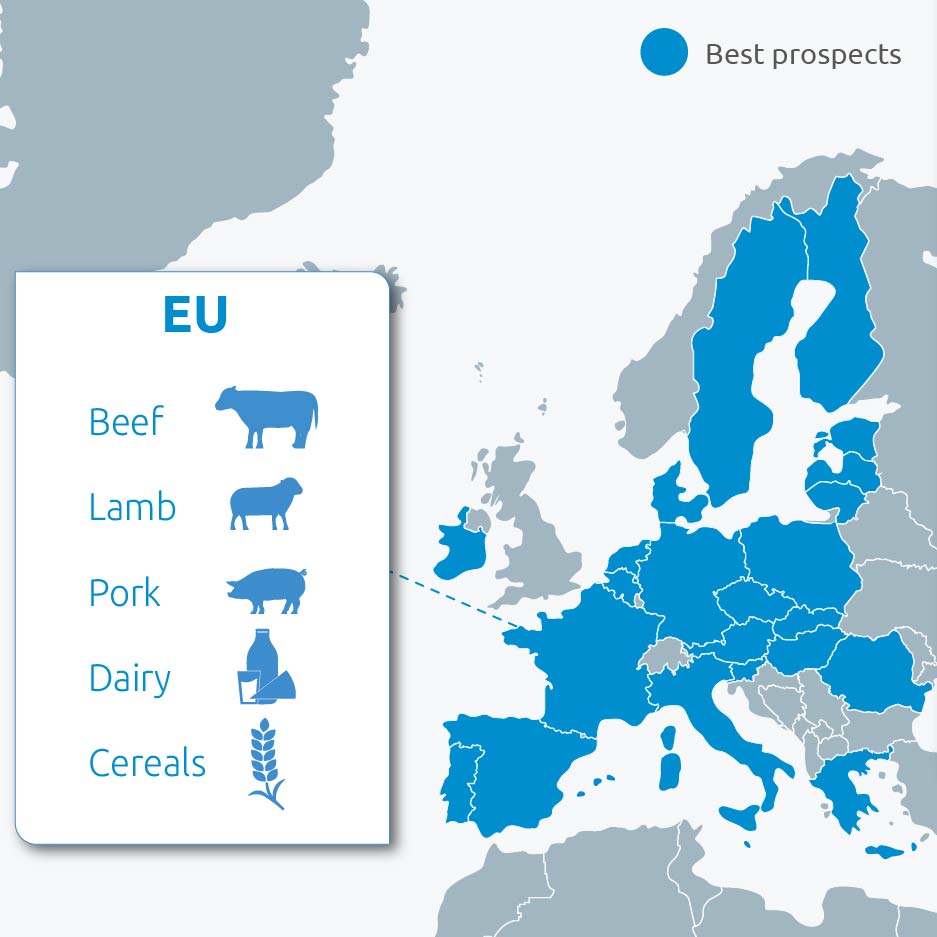

Prospects for UK agri-food exports: Europe – EU 27

Leaving the EU meant that the UK was independently able to negotiate Free Trade Agreements (FTAs) with other countries. Nevertheless, the EU remains the UK’s most important trading partner due to proximity and existing supply chains, markets and relationships.

This page was last updated in September 2025.

Summary of findings

In value terms, 83% of the UK’s red meat (fresh, frozen and offal) and dairy product exports were exported to the EU annually (2022–2024 average).

In volume terms, this is around three-quarters of these exports. This shows just how important Europe and the EU are to UK agri-food exports.

The UK–EU Trade and Cooperation Agreement enables the UK to export these products to the EU on a tariff-free basis (as was the case before EU-exit).

Since the UK left the EU, however, trade friction in the form of additional paperwork and border checks made a previously smooth operation more burdensome, time consuming, expensive and disproportionately disadvantageous to small-scale exporters.

The UK–EU trade summit in May 2025 paved the way to remove or reduce these barriers.

The EU, and Europe as a whole, is a developed and mature market. Little growth is forecast in consumption of red meat over the next decade. However, there are areas where the UK is well placed to take advantage:

- High-value, premium beef in markets such as France and Italy

- Lamb for growing halal markets in France, Germany and the Netherlands

- Niche markets in Northern Europe for premium lamb

Cheese consumption in Europe is forecast to grow out to 2033. UK cheese is well positioned to benefit from strong demand for Cheddar and regionally protected products such as Stilton, as well as in the speciality and added-value markets.

Forecasts and projections are helpful, but they are certainly not the most important elements in developing export strategies. For consumers, factors such as taste, quality and value for money remain critical when making purchase decisions.

Bringing attention to the high production standards, animal welfare credentials and the premium quality of British meat and dairy is essential for UK exporters, as well as addressing affordability concerns.

Despite little change in red meat consumption, the UK can grow its export share in Europe via a more tailored and strategic approach. Maintaining and building long-term, consistent relationships is key.

Emphasising what sets the product aside from those of competitors, telling the story behind the product and enhancing the reputation of the UK for buyers in Europe is also important.

Incorporating these aspects into the UK’s red meat and dairy export strategy has the potential to strengthen the UK’s close relationship with the EU and Europe.

While the UK is expanding its export potential around the globe, the close-to-home EU market is one that needs to remain high on the list of priorities.

Where do the opportunities lie?