Mixed picture for farm profitability in 2024

Tuesday, 24 June 2025

UK Total Income from Farming (TIFF) in 2024 increased by 26% year on year. However, there was not positive news for all sectors.

What is TIFF?

Total Income from Farming (TIFF) in the UK is explained by Defra as the income of those who own businesses within the agricultural industry, adjusted for inflation. The total UK number is total profit calculated by Defra, from all UK farming businesses by calendar year, measuring return for management, inputs, labour and capital invested. Government support payments are included too.

UK TIFF increased in 2024 but mixed picture

In 2024, UK TIFF was £7.7 billion 26.4% higher compared with 2023. The increase was mainly due to a decline in input values and increase in output values. However, the situation varies by sector

Livestock

Higher milk prices in 2024 were a key driver in total livestock output in 2024. The value of milk was £6,316 million in 2024, up 5.5% from 2023. The average UK farmgate price (excluding bonuses) in 2024 was 16% higher, year on year, compared with the previous five-year average. Tight global dairy supplies in 2024 supported prices in spring and summer 2024.

In 2024, beef output increased by 9.3%, year on year, to £4.1 billion. Prime cattle prices were the main drivers spurred by tight supplies and high demand. Overall GB prime cattle prices were 6% higher than the three-year rolling average in 2024.

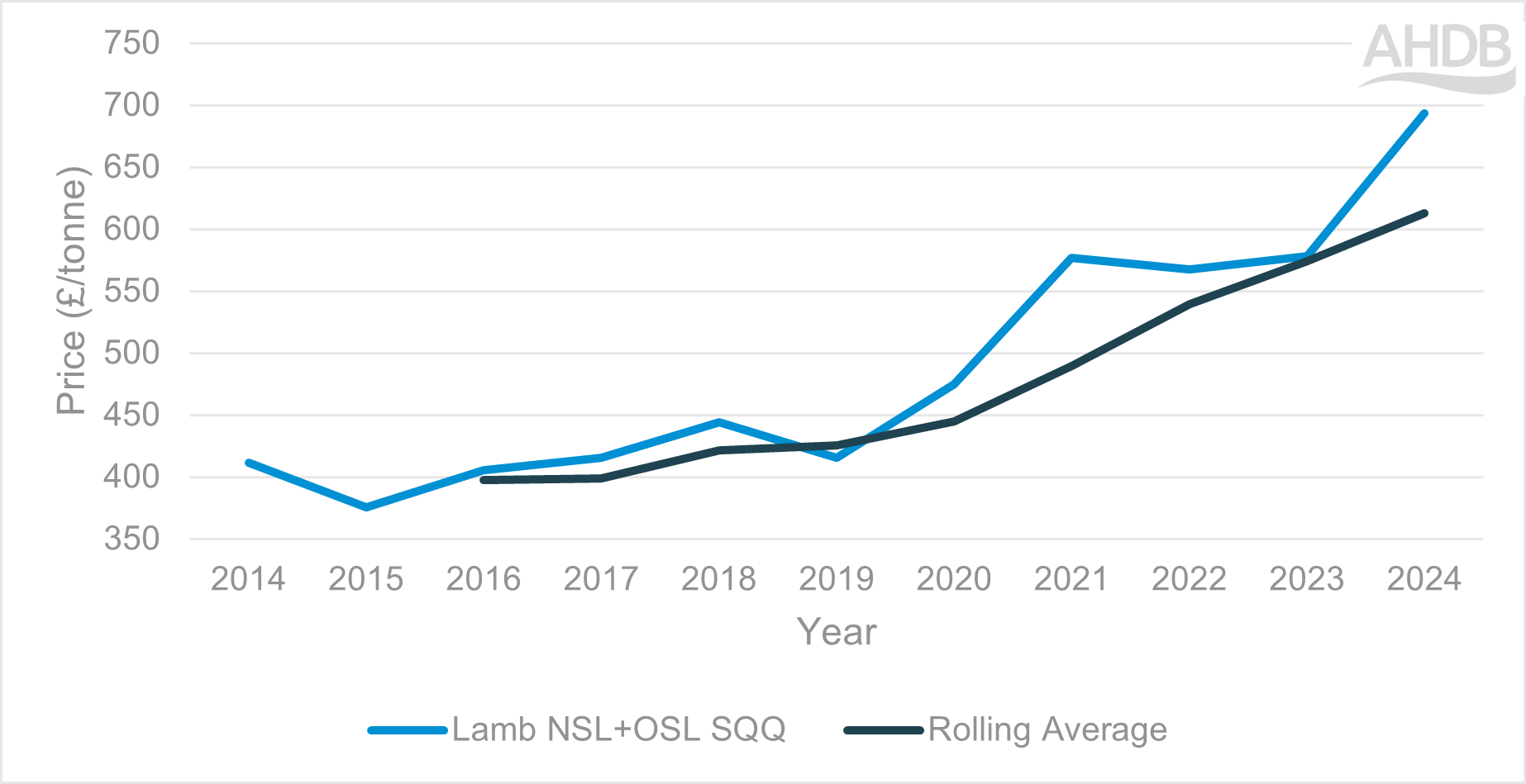

AHDB lamb prices (NSL + OSL SQQ) averaged 693.3 p/kg in 2024, compared with 578.1 p/kg in 2023, and were 13% higher than the three-year rolling average.

Output for pigs was lower in 2024 compared with 2023. The UK spec pig price (SPP) averaged 206.1 p/kg in 2024, 7.6 p/kg lower year on year, however, it was still 4% above the previous three-year rolling average.

Lamb price for the past 10 years with 3 year rolling average

NSL = New season lamb

OSL = Old season lamb

Animal feed

Feed prices continued to decrease in 2024 from the high prices seen in 2022 and 2023 as a result of the Russia-Ukraine conflict. The average feed wheat price was £180.68 per tonne which was 15% lower than the three-year rolling average. Although this was positive for livestock farmers in terms of reducing input costs, it was not favourable for arable farmers.

Cereals

2024 was a difficult year for arable farmers with decreased yields and quality issues due to particularly wet weather. The largest contribution to total crop output in 2024 was wheat with a value of £2,161 million.

Wheat had the sharpest value decline of 26.9%. Wheat production decreased by 20.3% to 11.1 million from 2023. This is the lowest production figure since 2020 due to a yield reduction of 10.4% and a decline of 11% in planted area.

Barley had a value decline of 14.1% which was £190 million less compared to 2023. Yields declined to 5.9 t/ha, but production increased by 1.8% to 7.1 million tonnes compared to 2023. Due to improved weather during the spring drilling season there was a rush for many to plant spring barley.

For many the low premium and quality issues in malting barley meant that much of the crop was sold as feed barley instead, with losses for the farmer.

Fertiliser

In 2024, the value of fertilisers fell by £617 million (-26.3%) to £1.7 billion. This is due to a fall in the cost of gas from record prices seen in 2022 and 2023. The average price of imported ammonium nitrate was £335, which was 30% down from the three-year rolling average. This decrease was positive news for both arable and livestock farmers however the wet weather meant that application was not always possible.

Looking Forward

In 2025 there was an accelerated cut to direct payments and the Spending Review announced further cuts for 2026 and 2027. This is a factor which is likely to impact future profitability., especially as applications have been paused for the Sustainable Farming Incentive (SFI).

The drier than average weather so far this year, is something which could have a considerable impact on farm profitability in 2025, as it could influence many different aspects of agriculture. There is the risk of low forage availability which would drive input prices higher. The arable sector may be impacted as the dry conditions would have put pressure on crop development resulting in lower yield potential.

Tensions in the Middle East is likely to increase volatility in global energy markets and its impact on Agri-commodity prices. Higher crude oil prices will inevitably affect diesel costs which is a key input in the arable sector especially with harvest approaching. Monitoring the market and planning purchases strategically will be important for cost management in the weeks and months ahead.