An update on post-Brexit trade deals

Monday, 28 September 2020

Brexit has once again come to the fore in the media, with various developments transpiring that are increasing the tension and intensity of trade negotiations in the EU. Last year, we carried out analysis on how the UK government were progressing on securing other free trade agreements (FTAs) around the world, and examined some of the nuances of these agreements. These continuity deals with various countries around the world make up a relatively small, but not insignificant amount of UK agri-export trade, in this article we take a look at how these continuity deals have developed in the last 12 months and how the release of the new UK Global Tariff (UKGT) has affected these developments.

Trade with Non-EU countries

Back in October 2019 – leading up to the Brexit deadline – the UK government had 15 agreements signed or in place to continue after the UK left the EU, which would have come into effect in the event of a no deal scenario. However, a withdrawal agreement between the two parties was eventually agreed, and the UK formally left EU membership on 31 January 2020. However, the UK entered into a ‘transition phase’ in which the UK retains a number of EU benefits, such as remaining aligned to the single market and customs union, as well as having access to all the EU FTAs in force. Since October the Government has secured a number of additional continuity deals, with 21 agreements (covering 50 countries) having been signed to date (14th September 2020).

* Countries part of the customs Unions with the EU. The UK’s future trading relationship with these countries will be influenced by the agreement the UK reaches with the EU.

What is the value of EU-FTAs to UK agriculture?

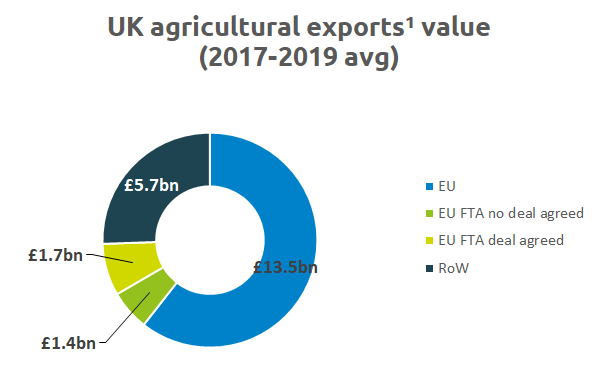

For total Agri-products[1] exports, in value terms, 61% of exports are shipped to the European Union. Of the exports to the rest of the world, around £3bn goes to countries that the EU has an existing trade agreement in place with, accounting for around 14% of total UK agri-exports.

The agreements that the government have managed to secure, contribute to around 56% of the total value of UK exports to countries that the EU has a FTA with. Crucially, 2 of the top 3 countries that receive the most product from the UK through EU-FTAs have yet to sign trade deals; Singapore and Canada. It is important to note that regardless of whether the UK leaves the EU with or without a deal, it will be trading as an independent partner, and so any country it has not signed a continuity agreement with, will be trading on WTO terms.

Why Japan and Canada have come back to the table

The original UK external tariff published back in March 2019, and dubbed the ‘No-deal Brexit tariff’, liberalised a number of key tariff lines, and 87% of Canadian goods would’ve had tariff-free access to the UK market. In some instances, better access was afforded to Canadian exporters than was contained in the EU-Canada FTA (CETA). This gave Canada little incentive to sign a continuity deal. However, the UK Global Tariff was released in May this year, and by and large is a carbon copy of the EU common external tariff. This iteration of the UKs external tariff schedule is more protectionist, and gives added incentive for various countries to enter into negotiations. Indeed Canada has recently resumed negotiations with the UK in order to try and secure a free trade deal.

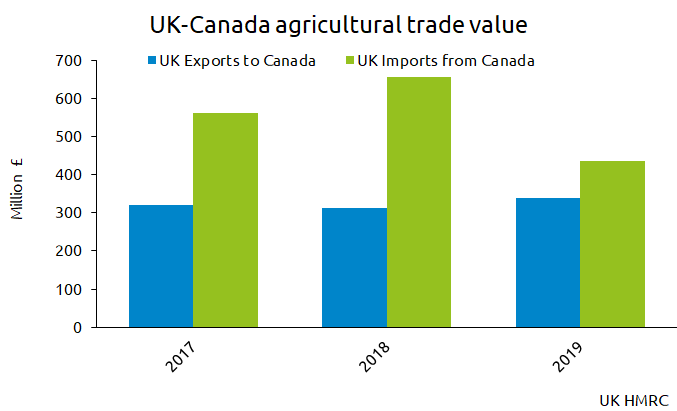

Both countries will be keen to secure a deal. UK agri-exports to Canada grew significantly in 2019, in part due to the signing of CETA in 2017. Through CETA, Canada liberalised 91% of food and drink products from day one, as well as increasing tariff free quotas of cheese and removing significant barriers for wine and spirit exports. Although agricultural exports to Canada did fall slightly between 2017-2018, in 2019 exports were up 8% totalling £340 million. Despite the singing of CETA, Canadian agri-exports to UK, and to the wider European Union have fallen since CETA entered into force. Canadian exporters have been finding it hard to profitably meet the contrasting regulatory requirements of both the EU, and the USA[2], their main customer – particularly in the pork and beef sectors. Canada will likely be keen to capitalise on any agreement they can reach with the high value market of the UK.

Japan: A done deal?

Meanwhile, negotiations with Japan have progressed somewhat since we last carried out this analysis. A formal announcement made on 11th September, reported that the UK-Japan Comprehensive Economic Partnership Agreement was agreed in principle by the two countries. . The full text of the deal has yet to be released, so the exact detail of concessions is currently unknown. However, the deal is likely to be largely similar to the Japan-EU deal, given the timeframe that negotiations have taken place in. UK exports to Japan continue to grow year on year, totalling £317 million in 2019. Japan granted the UK with access to beef and lamb at the beginning of 2019, after a two-decade long ban. As part of the EU-Japan deal, tariffs on beef are set to be cut from 38.5% to 9% over 15 years. Other key concessions in the EU-Japan deal is improved access for pork, processed pork, cheese and alcoholic beverages, all key opportunities for UK exporters in the future. AHDB are due to carry out additional, more detailed analysis on the UK-Japan trade deal in the coming days and weeks.

The final deadline

The UK formally left the EU on 31st January 2020. After this the UK entered a transition period which ends on 31st December 2021. During this time the UK still has to navigate departing the single market and customs union, an arguably more arduous and complex process than the original Withdrawal Agreement. The upcoming deadline of 31 December 2020 has the potential to have a far more profound effect on agriculture. Although the UK government have continued to sign continuity deals, these still represent a small share of total UK agricultural exports, with some key partners still yet to sign. As it stands, if the UK departs from the Customs Union and Single Market without a trade deal, the UK will be trading with the EU, and a number of other key partners on WTO rules which, as we’ve previously explored, has a number of implications for agriculture.

[1] Agri-products covers HS Chapters 1-24 less fish as per the WTO agreement on agriculture. Additional codes haven’t been included due to data availability.

[2] Financial Times: Canada’s farmers struggle to reap gains from EU free trade deal.

Topics:

Sectors:

Tags: