Cheesy dinners favoured by consumers

Monday, 29 April 2024

Consumers cut back on the volume of food purchased in 2023 due to rising prices and subsequently ate more meals in-home compared with 2019. How did this trend impact dairy consumption within the home?

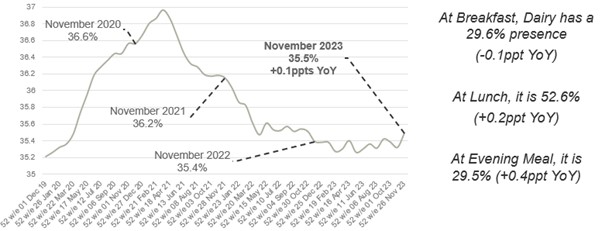

According to the Kantar Usage, in 2023 more than a third of our meals (35.5%) featured dairy as an ingredient, making it a popular choice amongst consumers (Kantar Usage 52 w/e 26th November 2023). Dairy within all meal occasions remained steady during 2023 and also across each category (butter, cheese, milk, cream and yoghurt) which is positive when taking into account the average price of cow’s dairy products rose by 8.1% year on year (YoY) (NIQ Homescan, Dairy, Total GB, 52 w/e 23 March 2024).

% of Breakfast/Lunch/Evening meal occasions featuring Dairy

Source: Kantar Usage, Total breakfast, lunch and evening meal occasions, 52 w/e rolling

Due to this rise in food prices, consumers are now more cost conscious and Kantar highlights that consumers are choosing their food more for taste (69.3% +2 percentage points on 2019, 52 w/e 26 November 2023) and are looking for meals that are easy to prepare.

Cow's dairy category trends versus year ago

| Value YoY% | Volume YoY% | Average price YoY% | |

| Total Dairy | 6.4% | -1.5% | 8.1% |

| Butter & Spreads | -1.9% | -3.6% | 1.7% |

| Cheese | 12.6% | 0.2% | 12.4% |

| Cream | 5.7% | 1.3% | 4.3% |

| Milk | 1.7% | -2.2% | 4.0% |

| Yoghurt & Fromage Frais | 12.3% | 2.7% | 9.3% |

Source: NIQ Homescan, Dairy, Total GB, 52 w/e 23 March 2024 versus year ago

As the table above highlights, cheese, yoghurt and fromage frais experienced the steepest price increases of all the dairy categories during the last year, and volume sales remained positive due to the strong sales of cheddar and more consumers buying yoghurt.

Lunches

According to Kantar, 87% of lunches are now had in the home due to the increase in hybrid working since Covid. Sandwiches remain the number one choice for lunches accounting for 35.1% of occasions, due to ease and speed of preparation. There has been a shift away from traditional ham sandwiches with butter (down 42 million) with consumers choosing tastier alternatives, such as those including bacon. Where consumers are looking for a change, butter’s presence further boosts their enjoyment, and a high-quality sandwich really merits butter.

Hot lunch options have also grown in popularity during 2023 (+3ppts on 2019, Kantar Usage, 52 w/e 24 December 2023). With ease of preparation and cost being key considerations, this has led to baked potatoes with butter (+12.9%) and cheese toasties (+6.6% YoY) increasing in popularity.

Evening meals

Dairy products feature in many popular evening meals enjoyed regularly within the UK. These range from Italian dishes with cheese to Indian dishes with yoghurt or cream, the list is endless. There lies a real opportunity for dairy as 11.5% of evening meals are Italian dishes (excluding pizza) and 33.9% of these occasions feature cheese as an ingredient. The dishes in growth during 2023 were those using cheese as a secondary ingredient, such as carbonaras, spaghetti bolognese and pasta bakes (up 25 million occasions YoY). Lasagne is another Italian dish in growth featuring both cheese and milk and is a firm favourite amongst families (up 4 million occasions YoY). Italian dishes with cheese are increasingly being chosen for being both filling and tasty whilst also being quick and easy to prepare. This growing trend provides a real opportunity for speciality cheese producers.

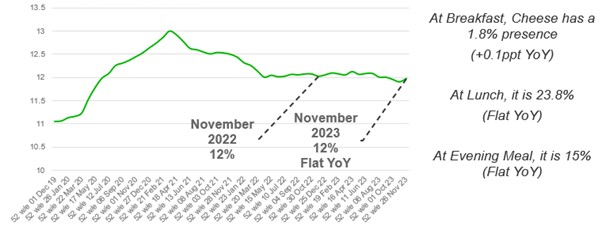

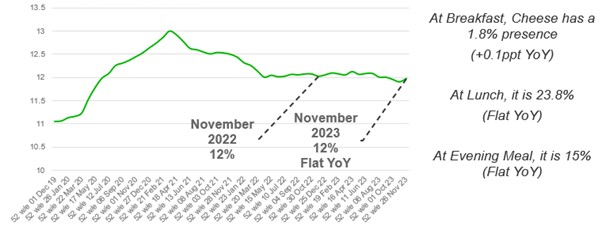

Cheese presence at mealtimes has dipped since reaching record peaks in 2020, providing further opportunities at evening meals

% of Breakfast/Lunch/Evening meal occasions featuring cheese

Source: Kantar Usage, Total breakfast, lunch and evening meal occasions, 52 w/e rolling

In addition, Indian meals account for 4.9% of evening meal occasions and are popular amongst families. Those dishes containing cream (+73.9% YoY) and yoghurt (+8.7% YoY) are showing significant growth whether as part of the main dish or as an accompaniment. This provides an opportunity for producers of plain yogurt and cream.

In-home consumers cooking and eating habits are evolving since Covid, with the transition towards more hybrid working and time at home and the cost-of-living crisis. One thing is for sure, regardless of cost, consumers today are searching for lunch and evening meals options that are tasty and easy to prepare.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: