Are consumers deprioritising health?

Tuesday, 10 January 2023

Adjusting to life after the pandemic and the ongoing economic crisis is having a profound impact on society and how we behave.

We consistently see three core needs consumers prioritise when choosing food and drink, enjoyment, practicality, and health. Health remains a lower priority than the other core needs but remains an integral part of our everyday lives and is closely intertwined with practicality and enjoyment. Concern for ‘affordable healthy food’ has increased 9% percentage points year-on-year. Within healthy behaviours, eating a balanced diet is more likely to be prioritised by consumers and meat and dairy plays a key role in this, providing essential naturally occurring nutrients such as B12 and iron.

An update on health

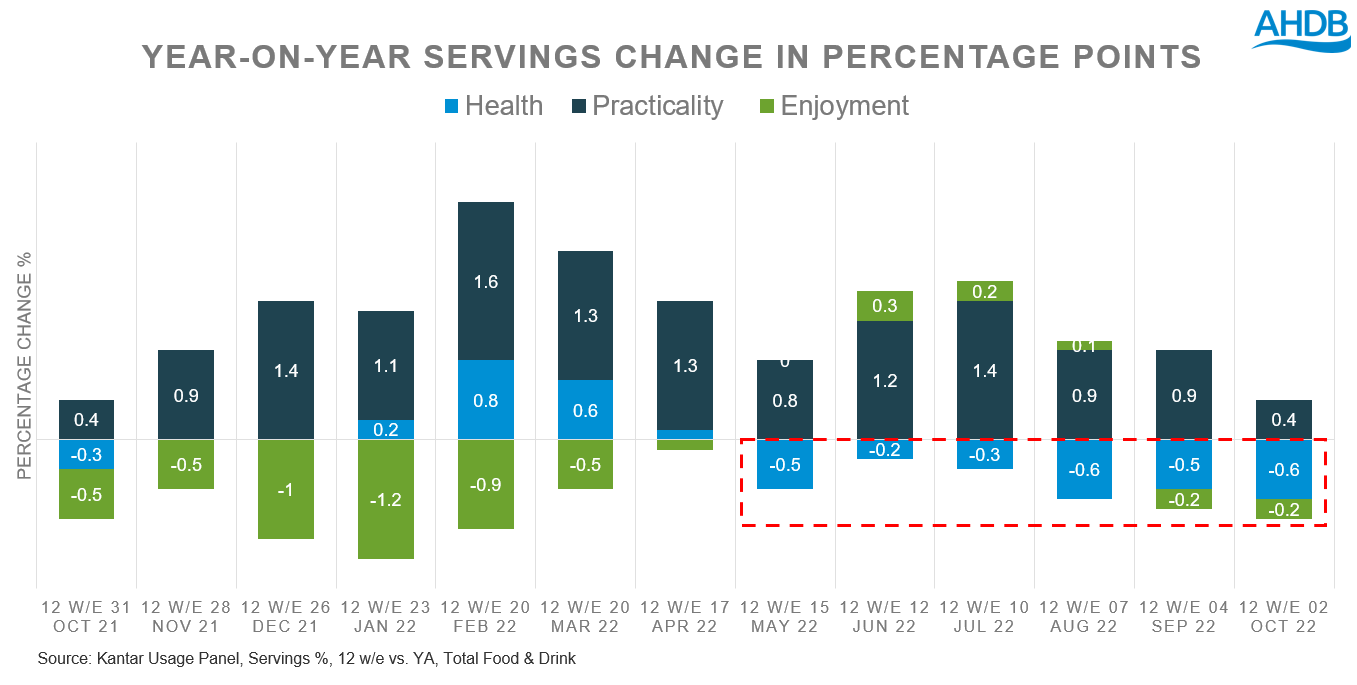

We now see six periods in a row where food chosen for health reasons has declined year-on-year (12 w/e Oct 22), indicating that health is being consistently deprioritised. For the 52 w/e October 22, 27.7% of food and non-alcoholic drinks were chosen with health reasons in mind – lower than other core needs such as enjoyment (78.6%) and practicality (55.3%) (Kantar, 52 w/e Oct 22).

Within the realm of health, it seems that positive health benefits are being prioritised by consumers, with added health benefits (fibre/vitamins), naturalness (less processed) and a balanced diet among the most important (Kantar Usage). Depending on cut and type, meat and dairy potentially have lots of synergies with these core needs that are worth highlighting to consumers.

However, positive health needs are also those which have driven the decline in health for the last six data periods, though managed health has dropped off too in the latest period - the first time in 2022. There is evidence of cost playing a part in our behaviour, for example, fresh vegetables are featuring less in meals, down 2.7% percentage points, but frozen and canned vegetables are increasingly selected as cheaper options, up 1.3% and 0.6% percentage points respectively. If we look at who is driving this decline, it is the less affluent groups indicating this is more out of necessity than choice (Kantar Usage).

Economic concerns take centre stage

There have been significant shifts in wider consumer concerns year-on-year with the cost of food and energy prices dominating people’s anxieties. However, concern for ‘affordable healthy food’ increased 9% percentage points year-on-year, with 47% of consumers now stating this as an area of concern (AHDB, Blue Marble 2022).

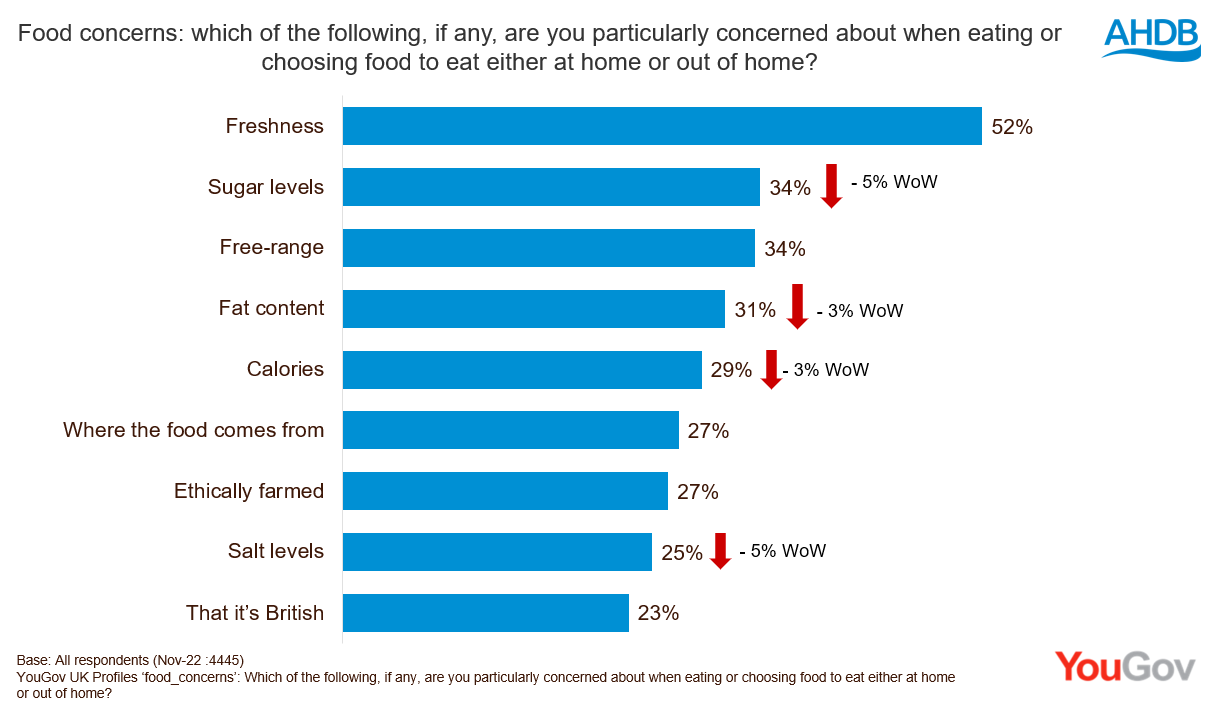

In our most recent AHDB/YouGov tracker (Nov 22), there’s a shift in consumer concerns related to health. Consumers are less pre-occupied with sugar levels, fat content, calories, and salt levels whilst other concerns remain stable wave on wave.

To manage the rising cost of food, many consumers are changing their behaviours which includes buying less meat and dairy. In AHDB’s annual Trust, Transparency & Traceability report, 30% of respondents indicated they would buy less meat and poultry, and 19% would buy less dairy to manage the rising cost of food. Conversely, 53% of consumers state that health is an important factor when they choose food (AHDB, Blue Marble 2022), demonstrating the importance of highlighting the nutritional density and value for money meat and dairy provides for consumers seeking to fulfil their health needs without breaking their budget. Retailers should look to highlight where meat and dairy can offer low-cost access to quality nutrition.

. The difficult economic climate means that many people are trying to find a new lifestyle balance, and this can often work against healthy eating habits. With over half of consumers stating that health is an important factor when they buy food, opportunities still exist for meat and dairy. As we now move into a period where health is being consistently deprioritised by consumers, it’s important to push specific health messaging.

Alongside this, meat and dairy can also target those seeking the core shopper demand - enjoyment. During difficult times, people generally look for that mood-boost when they shop which can also work against healthy eating habits. Low earners are more likely to prioritise more indulgent self-care activities over health focussed ones, so this could be especially effective amongst these consumers. Meat and dairy occupy a niche position where they can fulfil both health and enjoyment needs.

Embracing wider health need trends

In recent years health has come to encapsulate a wider meaning with more consumers embracing the World Health Organisation’s definition of health “as a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity". Consumers are increasingly adopting a new awareness of health and wellbeing and are increasingly exploring areas such as mindfulness, physical performance, appearance, getting enough sleep, and self-care. A range of actions and behaviours can feed into these lifestyle principles with food and drink playing a central role. The emerging spaces can serve as a valuable opportunity for meat and dairy.

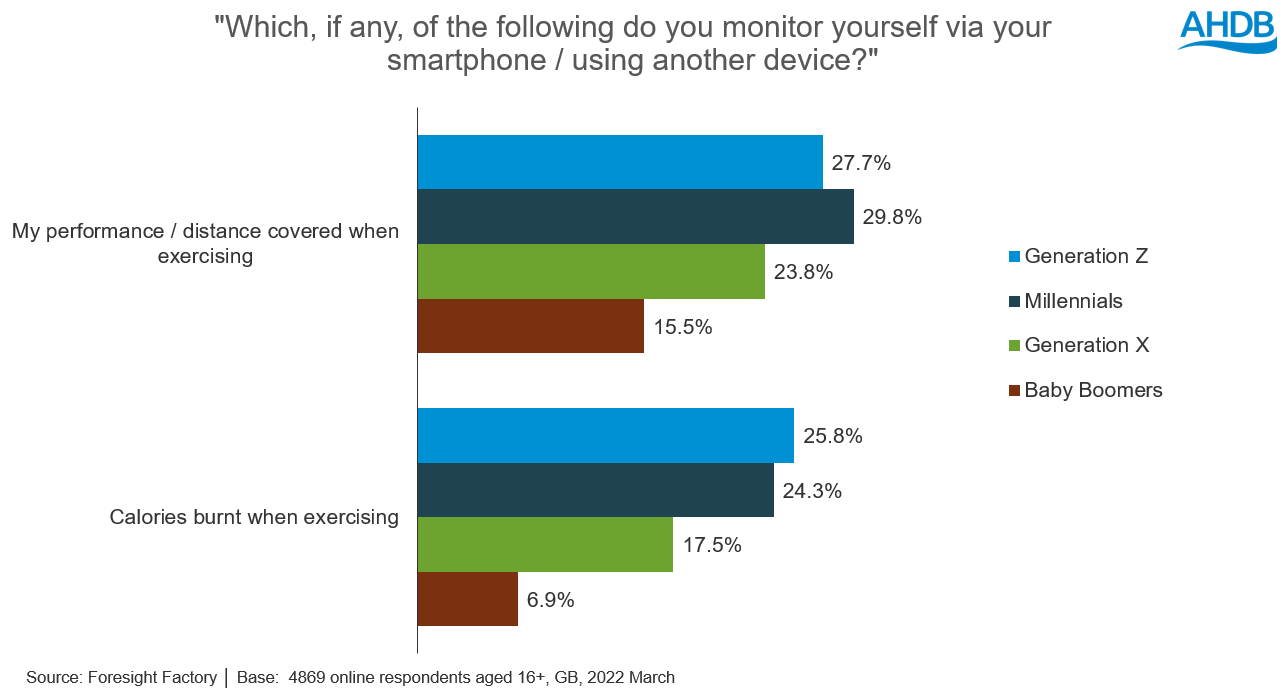

Monitoring our progress using tracking tools in the pursuit of optimal physical performance and wellbeing is growing at a large rate year-on-year. The most popular measures monitored are physical performance or distance covered and calories burnt when exercising, with consumers looking for support alongside their workouts and personal fitness goals. Helping consumers to be more precise with the nutritional value of food consumption, linked to their personal needs and goals can help increase the value of meat and dairy in providing a balanced diet (Foresight Factory).

Health testing and tracking services also help support personalised data-driven health priorities. As a result, health benefits which are scientifically supported are increasingly important, with 28% of consumers stating they actively look for scientifically proven health benefits when shopping for food and drink. This increases to 39% for Gen Z and 41% for Millennials. With this new level of insight at consumers fingertips, it’s important that meat and dairy meet this demand, particularly among those who are now looking for the optimum combination of macro-nutrients (protein, fats, carbs) as well as micro-nutrients (vitamins and minerals) (Foresight Factory).

Key takeouts for the year ahead:

- Highlight where meat and dairy offer low-cost access to quality nutrition.

- Demonstrate health credentials alongside enjoyment.

- Embrace wider consumer health trends to maximise engagement.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.