Baking trends in 2024: To bake or to buy, that is the question

Monday, 17 February 2025

Fewer people were putting their aprons on and baking at home in 2024, with consumers prioritising the cost and convenience of buying prebaked goods instead of making their own from scratch.

However, this trend has not impacted sales of baking essentials like block butter and flour, due to the versatility of these products in different types of cooking.

Consumer confidence continued to improve, meaning that, for some, finances were less of a consideration, and as a result we saw an increase in eating out occasions. The cost-of-living crisis became a less prevalent issue for many consumers, as their household finances remained consistent towards the end of the year (AHDB/YouGov November 2024). Convenience is a current priority for many consumers, with cooking behaviours shifting to demonstrate this. Prep time for the average evening meal has reduced to 31 minutes, showing that people are wanting to spend less time cooking and have less time available for cooking (Kantar usage 52 w/e 1 September 2024). We can see that the need for convenience and the time pressures on consumers to prepare meals have impacted the home baking market.

Baking trends

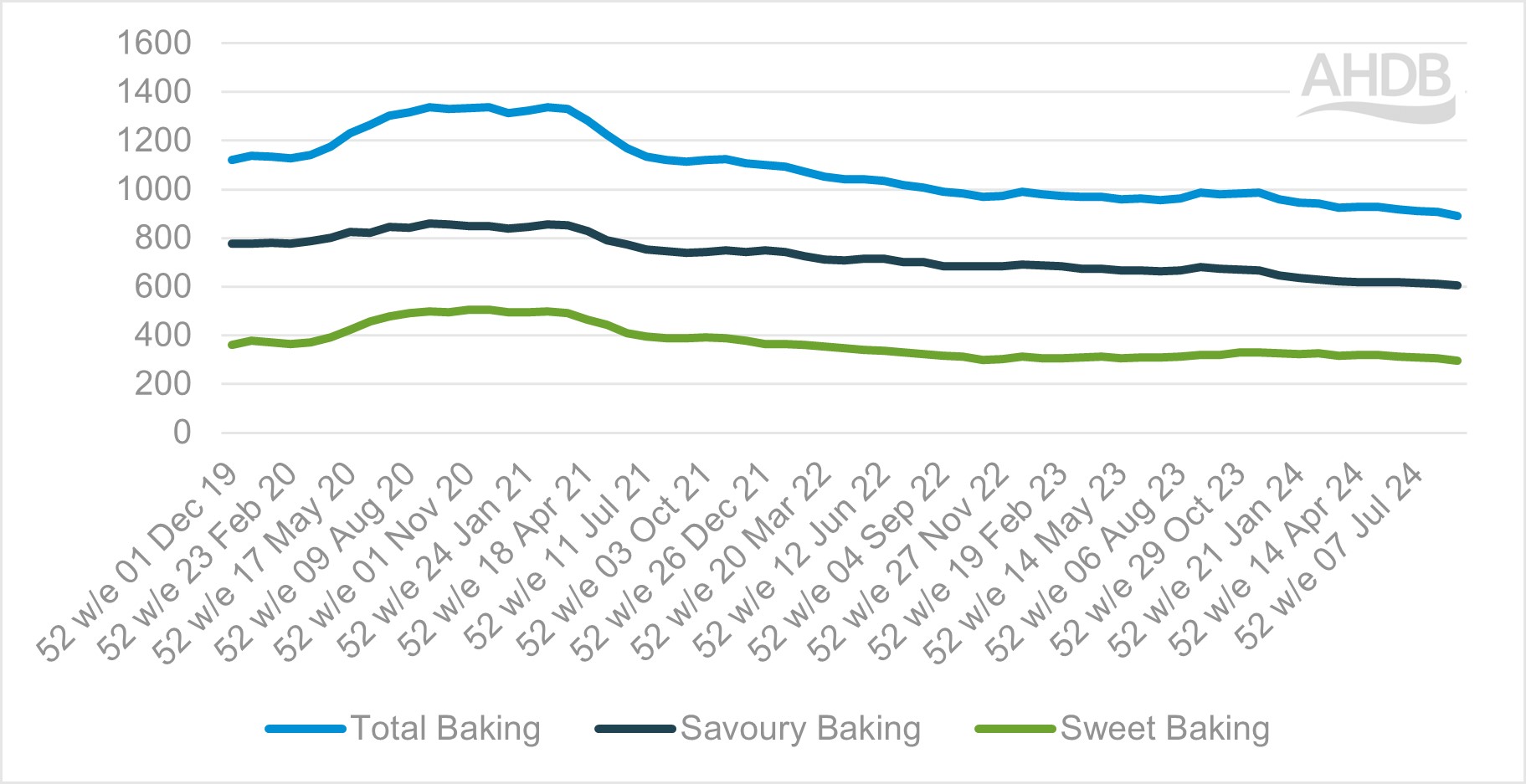

Home baking is in decline for both savoury and sweet baking. The decline comes from fewer people baking and those that are still baking doing it less frequently. However, those who are sweet baking are doing so more frequently than those savoury baking (Kantar usage 52 w/e 1 September 2024).

Total baking occasions

Source: Kantar usage 52 w/e 1 September 2024

When asked the question “How often have you baked at home?”, 11% of people surveyed baked at least once a week and 20% at least once a month, showing that some people are still baking frequently (AHDB/YouGov January 2025). Savoury bakes are more likely to be used at the evening meal, whereas sweet baking is more popular for a snacking occasion. Sweet baking is most common with retirees, while savoury baking is most common with the pre, young and middle family demographics. The biggest growth in sweet baking has been seen in the young family 0–4 demographic. This could be due to sweet baking being seen as a cheaper activity to do with children at home (Kantar usage 52 w/e 1 September 2024).

Within our YouGov Pulse research, consumers who haven’t baked in the last 6 months stated it is easier and quicker to buy ready-made baked goods, and they do not have the time to bake. This shows people like the convenience and value of shop-bought baked goods (AHDB/YouGov January 2025). Despite the overall decline, certain sweet bakes have seen growth; these include bread and butter pudding, flapjacks, brownies and sweet pies (Kantar usage 52 w/e 1 September 2024). Chocolate cake and lemon drizzle were reportedly the favourite cakes that people like to eat, closely followed by Victoria sponge and carrot/pumpkin cake (AHDB/YouGov January 2025).

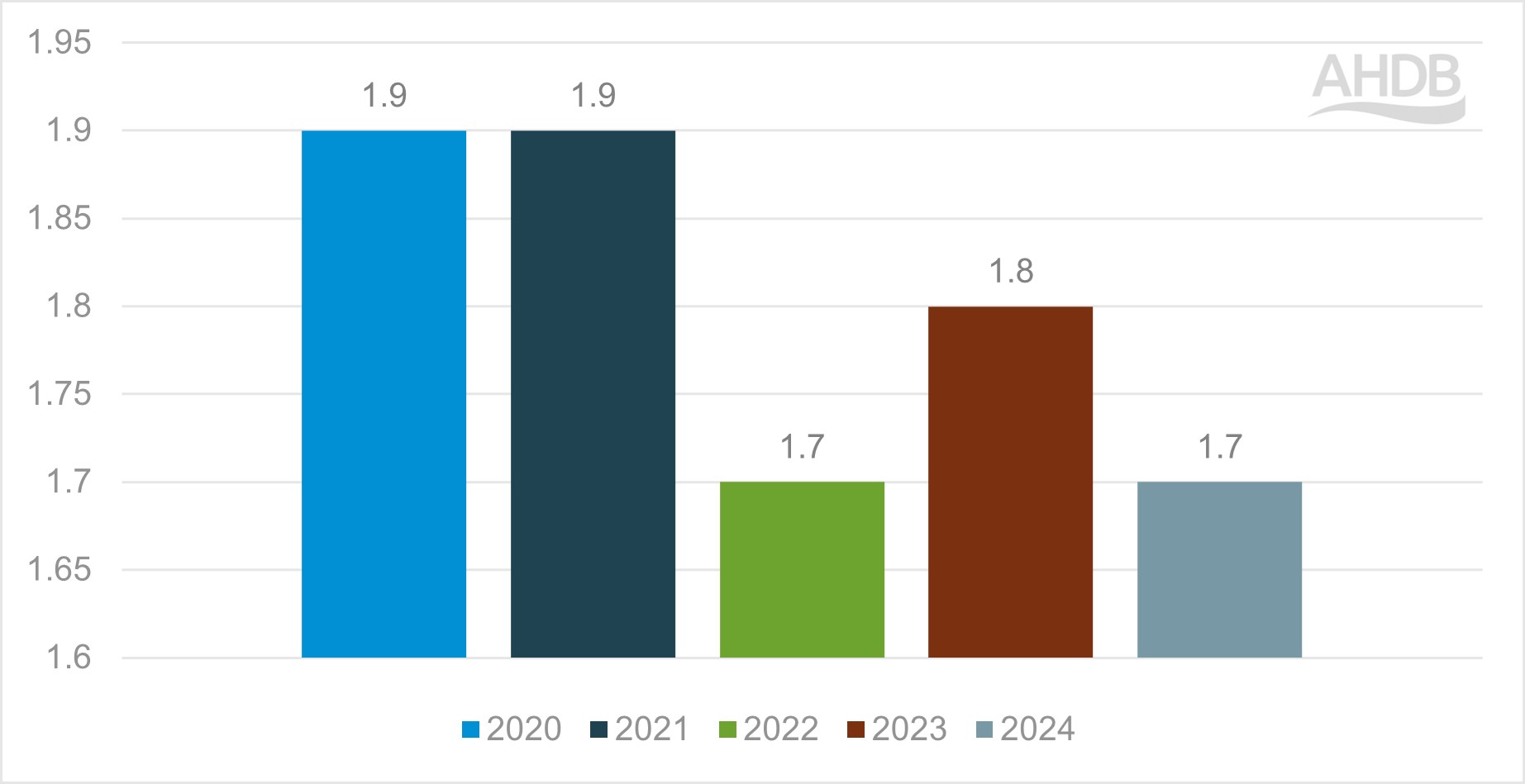

Dairy trends

There is a slow decline in total dairy consumption occasions, despite there being an increase in the number of people consuming dairy. The total decline is driven by a reduction in frequency of consumption (Kantar usage 52 w/e 1 September 2024). Block butter volume sales have increased by 6.5% (NIQ Panel on Demand Homescan, 52 w/e 28/12/24). More than 50% of baking occasions feature dairy; although smaller than the previous year, this is still higher than peak pandemic levels, showing that it is still an essential ingredient in baking (Kantar usage 52 w/e 1 September 2024).

Weekly frequency of dairy used in baking

Source: (Kantar usage 52 w/e 1 September 2024).

Health concerns are the top reason for why people are considering reducing their dairy intake. This is followed by animal welfare concerns (AHDB/YouGov November 2024). Therefore, look to encourage shoppers with healthy baking recipes including dairy and remind shoppers of the natural and taste credentials of cow’s dairy.

Flour trends

Flour spend was £33.7m, which has increased by 7% since the previous period (Kantar 12 w/e 29 December 24). However, consumption occasions of flour has decreased by 11% since 2023 (Kantar usage 52 w/e 1 September 2024). As consumers are now looking for convenience, this has led to less scratch cooking, which has resulted in the reduced use of flour. Another cause for this decline is the loss of engagement with flour (Kantar usage 52 w/e 1 September 2024). In total, 46% of baking occasions include flour, down from 49.1% in 2020 – again, proving it is an essential ingredient but consumers are seeking convenience over home baking (Kantar usage 52 w/e 1 September 2024). When asked “Which ingredients do you usually bake with?”, the majority of people said a type of flour such as plain or self-raising. The 45+ age category are more likely to use flour than the younger generation (under 34 age category) as they more frequently use bread or cake mixes when baking (AHDB/YouGov January 2025). Lunch time and evening meals are the most popular times to eat products made with flour, but in the last five years breakfast has been increasing due the popularity of pancakes and crepes (Kantar usage 52 w/e 1 September 2024).

Opportunities and recommendations

- Continue the momentum of growth in the young family demographic by encouraging at-home baking as a fun and cheap activity to do with children.

- Promote the benefits of the cost and taste of baking from scratch to demographics reducing the frequency of baking.

- There should be a focus on gaining consumers back and following trends by finding and sharing quick and convenient ways to use flour.

- Remind consumers of the benefits of increased taste and quality when baking with dairy products such as milk and butter.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.