Beef retail demand continues to suffer as inflation soars

Wednesday, 17 September 2025

According to the Office for National Statistics (ONS) beef and veal inflation hit 24.9% in August 2025, driven by a constrained supply. AHDB and QMS jointly funded research with Worldpanel by Numerator UK to estimate the impact of further inflation rises on beef volumes. This article updates our insights following release of the latest data.

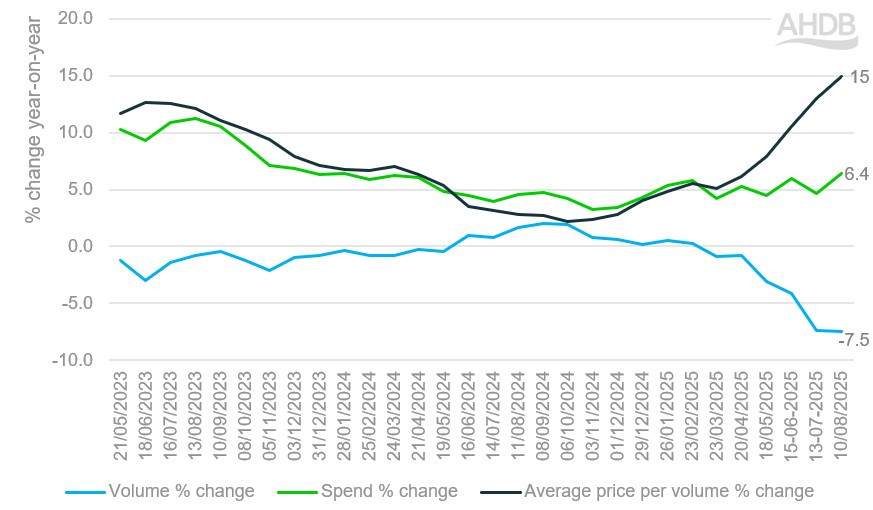

For total beef in retail, average price per volume has increased +15% year-on-year – the highest increase seen in the last two years. This has resulted in a -7.5% volume decline, equivalent to -9,460 tonnes (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

Figure 1. Tracking volume, spend and average price per volume % change year-on-year

Source: Worldpanel by Numerator UK, 12 w/e from 21 May 2023 to 10 August 2025

Alongside rising average prices, shares of volumes sold on promotion for total beef have declined -5.6% year-on-year, indicating that consumers have less opportunity to manage their spend through promotions. Some consumers are switching from mainstream stores to discounter stores to help manage their spend on beef, with discounters seeing a slower decline in total beef volumes (-5.4% year-on-year) (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

Frozen beef, which typically has a lower average price per kg than chilled beef, is showing a modest +0.1% volume growth, suggesting that consumers are starting to turn to frozen offerings to manage their spend. This is particularly evident for beef burgers, where frozen volumes have grown +8.8%, in contrast to chilled volumes which have declined -12.9% (average price per kg of £7.59 and £9.49 respectively) (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

Beef mince

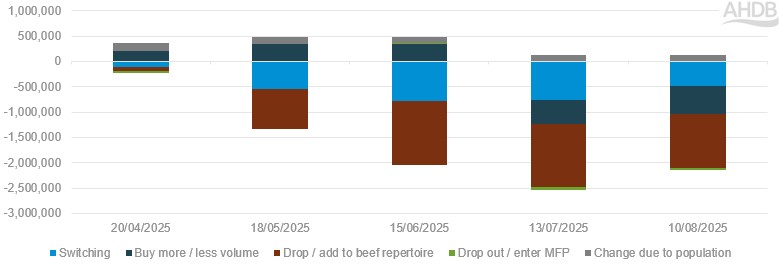

Focusing on mince, latest period data shows a 26.3% increase in average price per volume, with a corresponding -6.5% decline in volume (Worldpanel by Numerator UK, 12 w/e 10 August 2025). Trends over the past five months suggest that shopper behaviour has changed as inflation has increased. In May and June, beef mince was losing shoppers as they dropped it from their beef repertoire or switched to cheaper proteins.

In July and August, those beef mince shoppers that remained were also seen to buy less volume of beef mince (e.g. moving from 750 g or 1000 g packs to 500 g packs), attempting to stretch the volume further in their everyday meals.

Figure 2. Beef mince: contribution to volume change (kg)

Source: Worldpanel by Numerator UK, 12 w/e 20 April 2025 to 10 August 2025

In August, the majority of switching from beef mince went into primary chicken, although there was also a rise in switching to pork mince, suggesting that consumers are prepared to use other minced proteins within mince-based meals (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

Economy-tier beef mince, although only 4.9% of total beef mince, is showing volume growth (+4%), suggesting that consumers are prepared to down trade tiers to help manage their spend (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

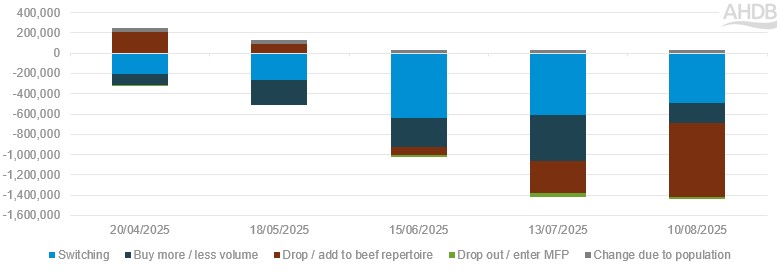

Beef steak

For beef steak, the latest period data shows a 23% increase in average price per volume (equating to an average price per volume of £21.49), with a corresponding -12.8% decline in volume (Worldpanel by Numerator UK, 12 w/e 10 August 2025).

As prices have risen, consumers have dropped steak from their beef repertoire, with switching also seen to a range of different proteins and cuts, including primary chicken, pork steaks and sliced cooked meat, or downtrading to beef burgers.

Figure 3. Beef steak: contribution to volume change (kg)

Source: Worldpanel by Numerator UK, 12 w/e 20 April 2025 to 10 August 2025

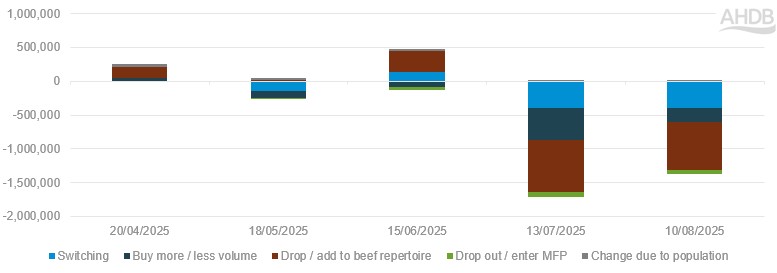

Beef roasting joints

For beef roasting joints, the latest period data shows a 15.6% increase in average price per volume, with a corresponding -25.7% decline in volume (Worldpanel by Numerator UK, 12 w/e 10 August 2025). As prices have risen, consumers have dropped roasting joints from their beef repertoire.

Switching behaviour is also seen, with consumers switching predominantly to primary chicken – either whole chickens or chicken breasts/wings/legs/thighs. This potentially suggests that some consumers retain the need for a roast meal utilising whole chickens, while other consumers are changing not only the protein they consume but the type of meals they are preparing.

Figure 4. Beef roasting joints: contribution to volume change (kg)

Source: Worldpanel by Numerator UK, 12 w/e 20 April 2025 to 10 August 2025

Recommendations

- Ensure there is sufficient breadth of choice in pack size and quality so that British beef remains accessible for all consumers

- Continue to celebrate the benefits of British beef as a trusted, high-welfare and sustainable choice for UK shoppers

- Focus messaging on the unique benefits of beef cuts that are not easily replaced by other proteins such as beef burgers and steaks. AHDB’s Let's Eat Balanced consumer campaign highlights the taste and nutritional benefits of British beef

- Deliver promotions on premium British beef cuts to help consumers trade up to more premium offerings, such as restaurant-quality dine-in deals. Make the most of seasonal events to promote seasonal cuts, e.g. beef roasting joints for Christmas

- Work to ensure robustness in domestic supplies as this will help to stabilise beef inflation for consumers and support demand across the range of beef cuts. This is an area where AHDB supports farmers to be more efficient, profitable and resilient through our work in areas such as genetic evaluations, animal health and welfare, and knowledge exchange. In addition, we support profitability across the whole supply chain through domestic marketing, export market development and the provision of evidence and insight in areas such as market intelligence

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: