Christmas 2024: A great year for gammon and British cheese

Wednesday, 15 January 2025

Grocery sales surpassed £13 billion this Christmas for the first time, with an upturn in grocery price inflation of 3.7%, the highest level since March 2024 (Kantar 4 w/e 29 December 2024).

As forecasted in our Christmas predictions article, 23 December proved to be the most popular grocery shopping day with sales 30% higher than any other day in 2024. Growth of premium own-label lines increased 14.6%, showing consumers are willing to pay a bit more for a treat, and online grocery spending reached a record £1.6bn, reaching 5.6m households this Christmas (Kantar 4w/e 29 December 2024).

Meat, fish and poultry (MFP)

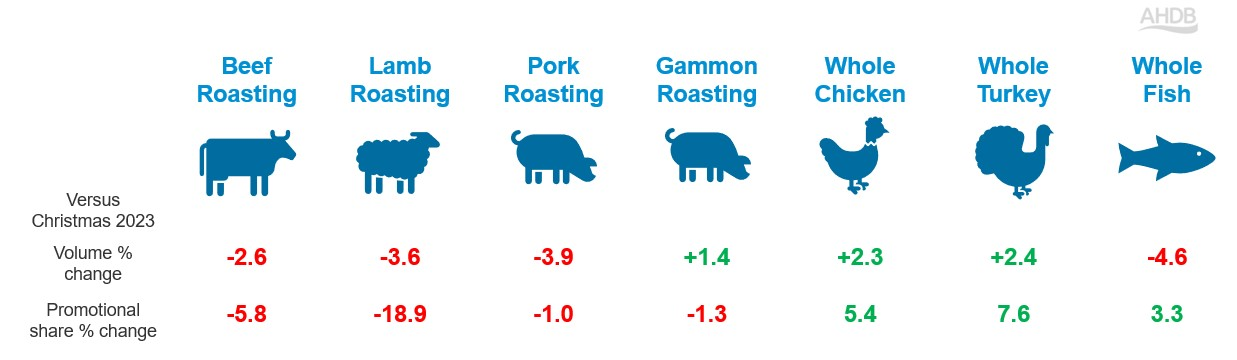

Total MFP volumes remained flat versus Christmas 2023 but remained at an elevated level of +2.0% versus Christmas 2022. Whole chicken and whole turkey fared well, with +2.3% and +2.4% year-on-year volume growth, boosted by an increase in promotions versus last Christmas. In contrast, beef, lamb and pork Christmas joints saw a decrease in promotions versus last Christmas, which contributed to a decline in volumes sold this year (Kantar 4 w/e 29 December 2024). The impact of promotions will be explained in more depth following further investigation.

Christmas 2024 meat volume and promotional share change

Source: Kantar 4 w/e 29 December 2024 | YoY volume change | YoY promotional share change

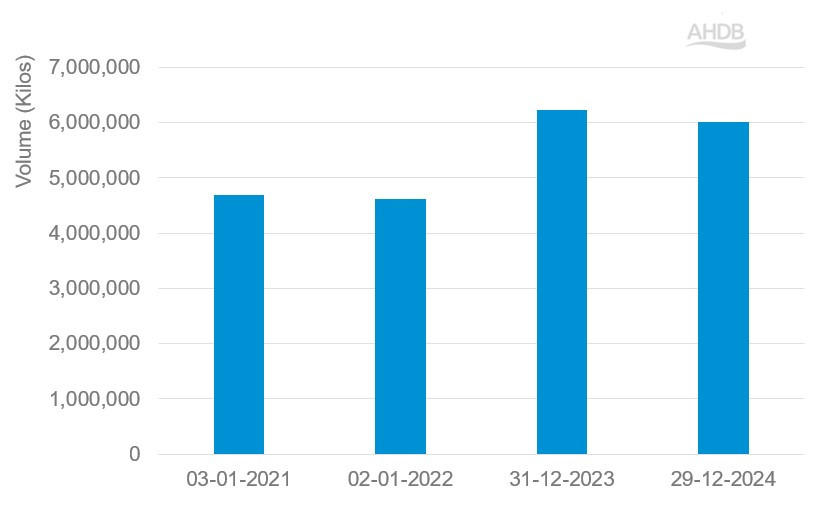

Despite the drop in promotion this Christmas, lamb roasting joints continued to show a stronger performance than we have seen in the past, echoing the good performance for lamb as a whole across 2024 (4.3% volume growth Kantar 52 w/e 29 December 2024). Check out our recent article on lamb: Consumers flocked back to lamb in 2024 | AHDB.

Lamb roasting volumes Christmas 2021–2024

Source: Kantar 4 w/e 3 January 2021 through to 29 December 2024 | Volume (kilograms)

For beef, although we see a decline in roasting joint volumes, total primary beef volumes grew 1.8% year-on-year, driven by good performance for beef mince (+5.0%), beef steak (+3.2%) and diced beef (+6.1%). Total processed beef also performed well with a 2.3% increase in volume year-on-year, driven by burgers (+9.4%) (Kantar 4 w/e 29 December 2024). These results suggest that beef offerings were key to consumer meal repertoires in the run-up to Christmas delivering on both enjoyment and value for money.

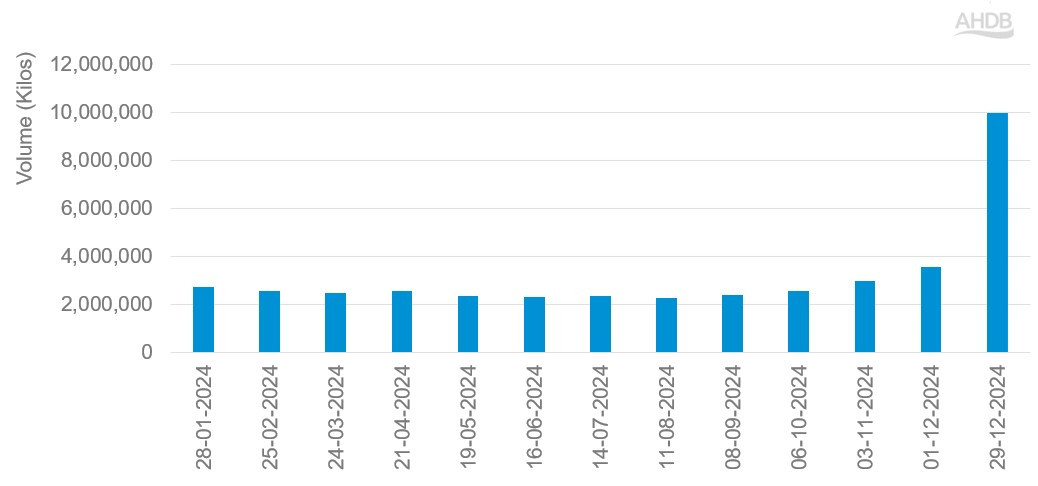

Within pig meat, gammon roasting joints are the star of the show, with a +1.4% volume increase year-on year (Kantar 4 w/e 29 December 2024). Volumes of gammon roasting joints sold during December represent 24.4% of all gammon roasting joint volumes sold during 2024, demonstrating the importance of this offering to the Christmas festivities.

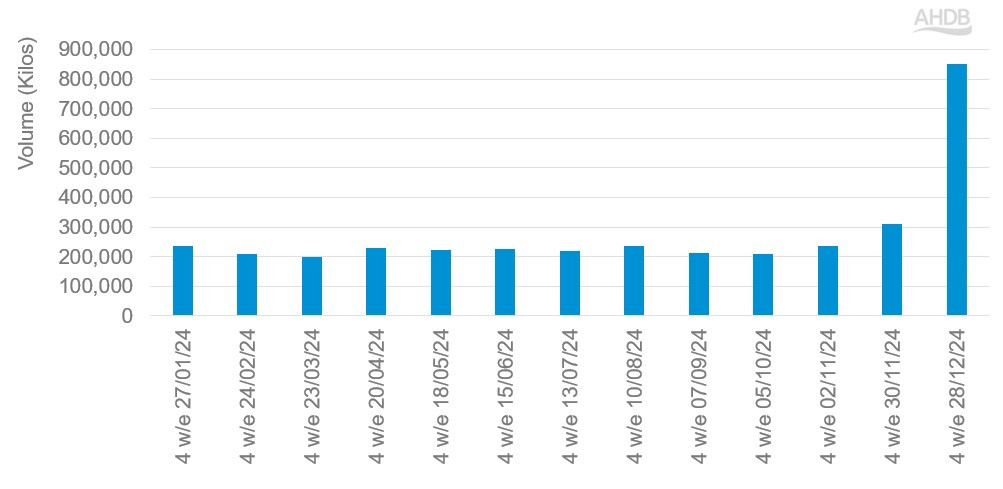

Gammon roasting volumes throughout 2024

Source: Kantar 4 w/e 28 January 2024 through to 29 December 2024 | Volume (kilograms)

Further data for beef, lamb and pork’s recent category performance can be found in our retail data dashboards.

*Previous years AHDB have looked at 2 w/e data for MFP Christmas Reviews but please note this year only 4 w/e data is available from Kantar.

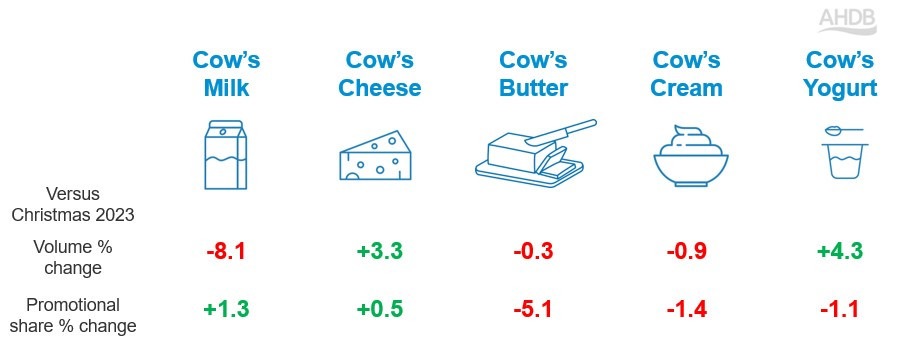

Dairy

Total dairy volumes declined 5.3% this Christmas versus last Christmas, with a mixed picture across offerings: a positive uplift is seen for volumes of cow’s cheese and yogurt, with volume declines year-on-year for cow’s milk, butter and cream (NIQ POD Homescan, Total GB, 2 w/e 28 December 2024).

Christmas 2024 dairy volume and promotional share change

Source: NIQ POD Homescan, Total GB 2 w/e 28 December 2024 | YoY volume change | YoY promotional share change

Within cow’s cheese, strong volume growth year-on-year was seen for Cheddar (+3.8%), speciality/continental cheese (+4.8%) and Stilton & British blue cheese (+15.0%) (NIQ POD Homescan, Total GB 2 w/e 28 December 2024), reflecting our predictions for cheese boards favouring brie, Cheddar and Stilton. Volumes of Stilton and British blue cheese sold during December represented 23.7% of total volumes for 2024, reinforcing the importance of this type of cheese to Christmas celebrations.

Stilton and British blue cheese volumes throughout 2024

Source: NIQ POD Homescan, Total GB, 4 w/e 27 January 2024 through to 28 December 2024 | Volume (kilograms)

Cream is a key accompaniment to many Christmas desserts, and we saw double cream volumes increase 2.6% year-on-year. Strong promotions on specific types of cream helped drive volume increases for clotted cream (+8.1%) and aerosol cream (8.2%); however a drop in promotions may have contributed to a 14.2% decline in volumes for single cream, hindering cream performance overall (NIQ POD Homescan, Total GB, 2 w/e 28 December 2024).

Further data for dairy’s recent category performance can be found in our dairy retail dashboard.

A full analysis of Christmas sales is underway and we will publish a full Christmas review in early February.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.